Gross Margin Benchmarks by Industry – Where Do You Stand?

Discover how to improve your gross margin and ensure your hard work translates into profitability. Learn industry benchmarks and...

OUR BLOG

Add a little bit of spice to your inbox.

May 22, 2025

Discover how to improve your gross margin and ensure your hard work translates into profitability. Learn industry benchmarks and...

May 22, 2025

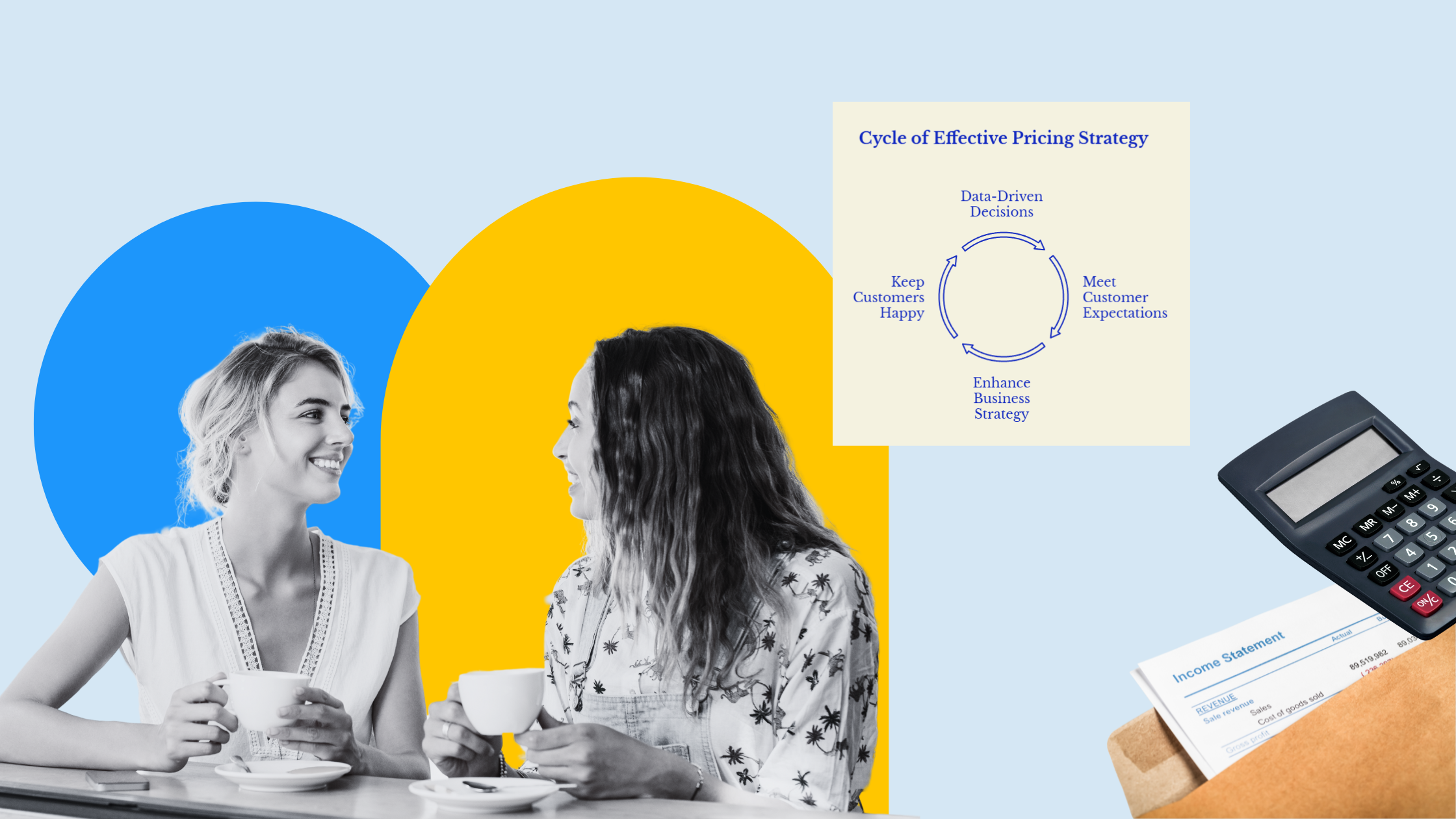

Learn how to develop a pricing strategy based on your Profit and Loss (P&L) statement to boost profitability and make informed...

May 22, 2025

Retirement planning tips for business owners: define your goals, diversify income sources, improve business sellability,...

May 22, 2025

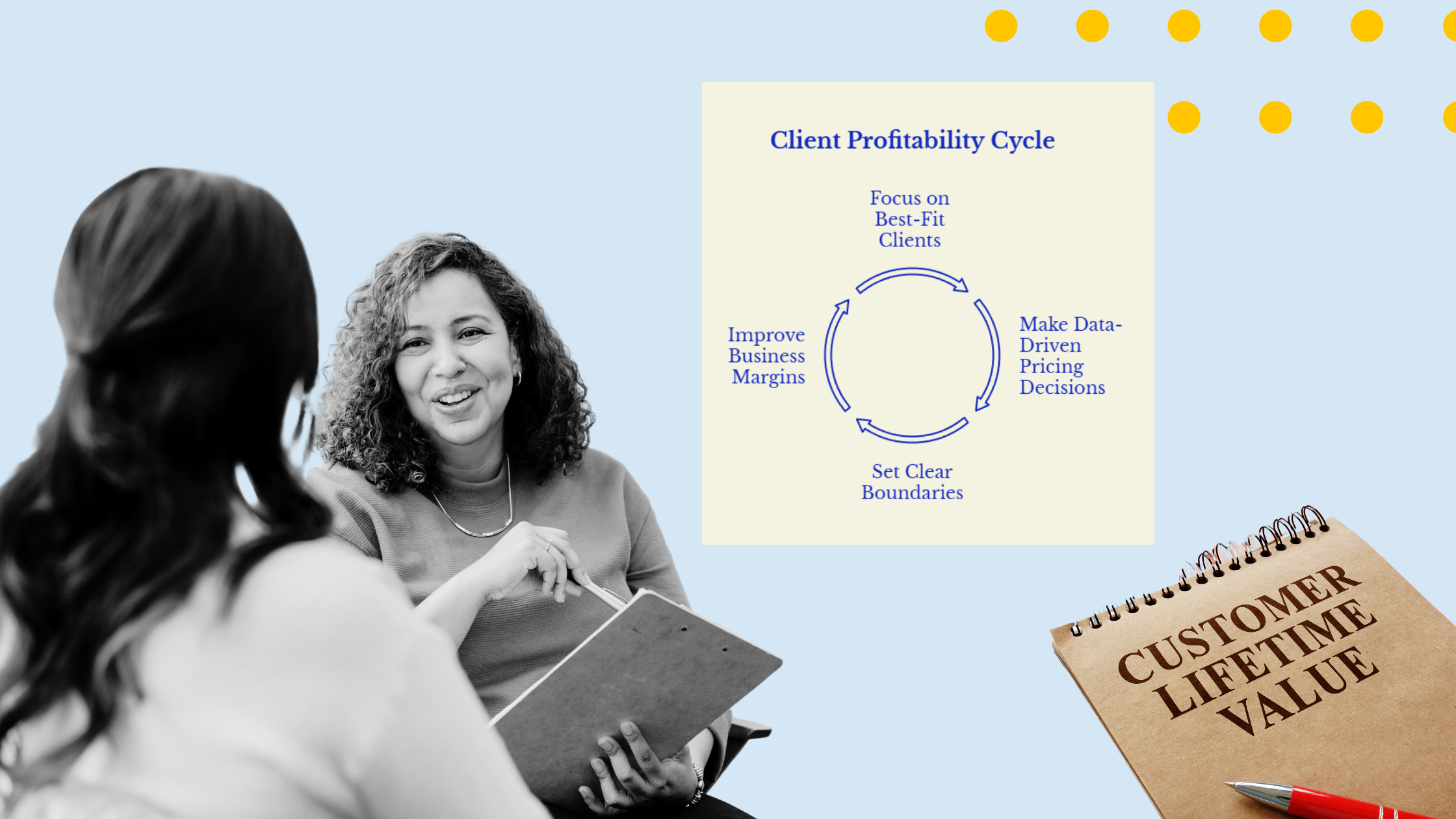

Identify profitable clients and streamline your business operations by tracking customer-level profitability. Make informed...

May 22, 2025

Discover when it makes sense to transition from monthly to weekly bookkeeping to stay ahead of your business finances and avoid...

May 15, 2025

Learn about the updated Lifetime Capital Gains Exemption (LCGE) and its significant tax benefits for Canadian business owners.

May 15, 2025

Declutter your Chart of Accounts to simplify financial statements, improve tax compliance, and reduce accounting errors. Learn how...

May 15, 2025

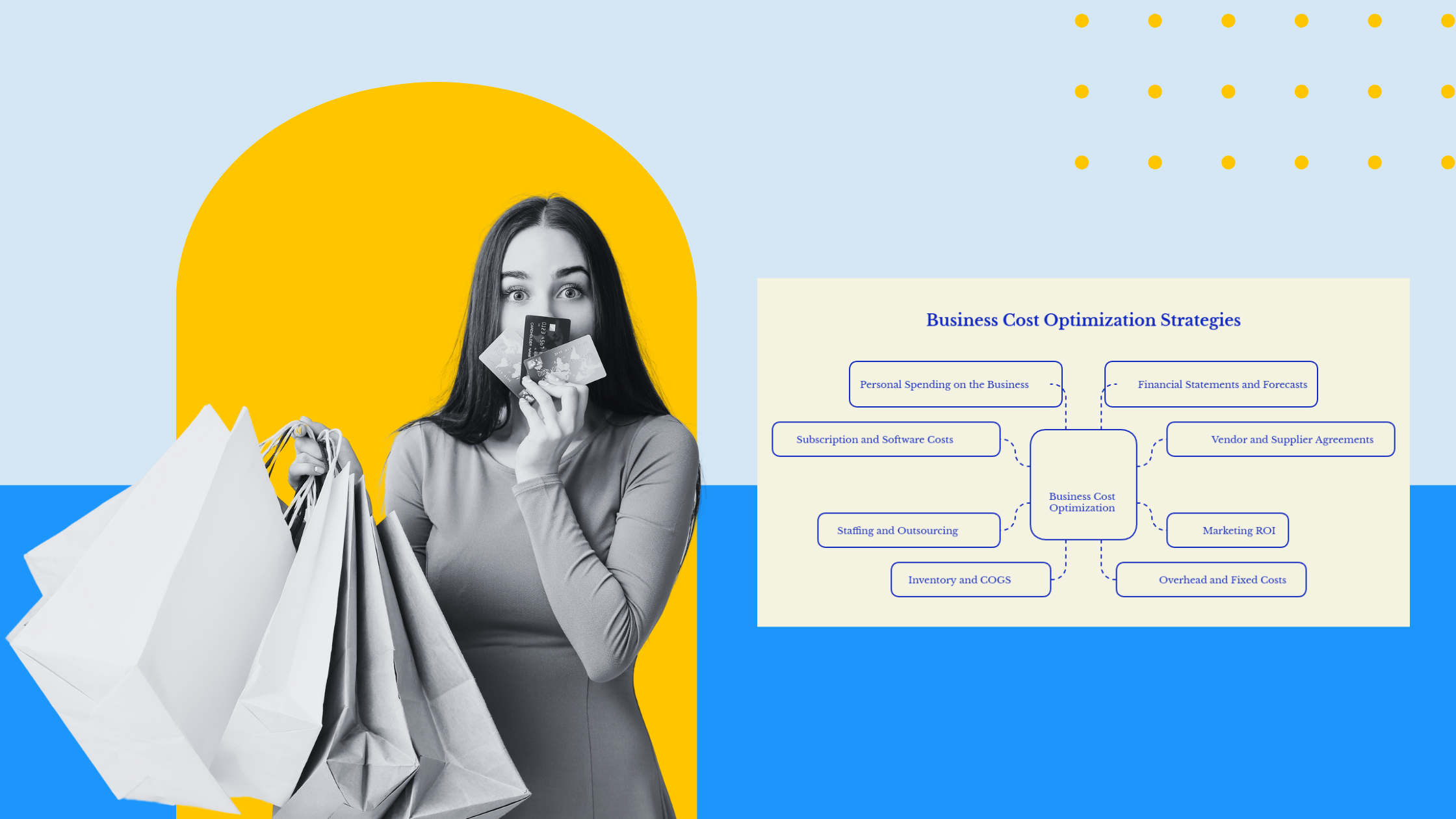

Discover how to optimize your business expenses with a Lean Spending Strategy. Learn what to audit every 6 months to ensure...

May 08, 2025

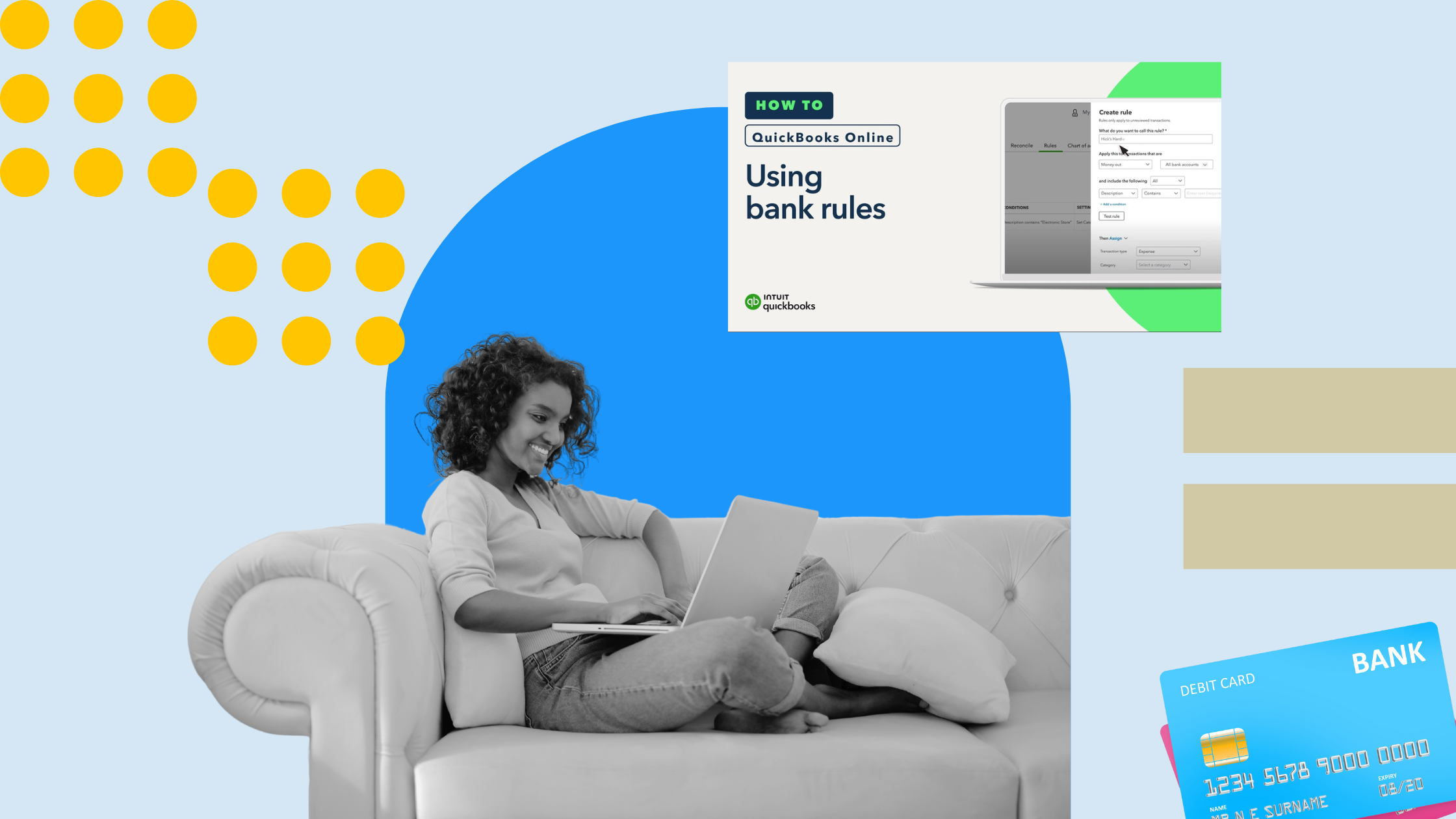

Learn how to set up QuickBooks Online (QBO) Bank Rules to automate transaction categorization and save time on bookkeeping tasks.

May 07, 2025

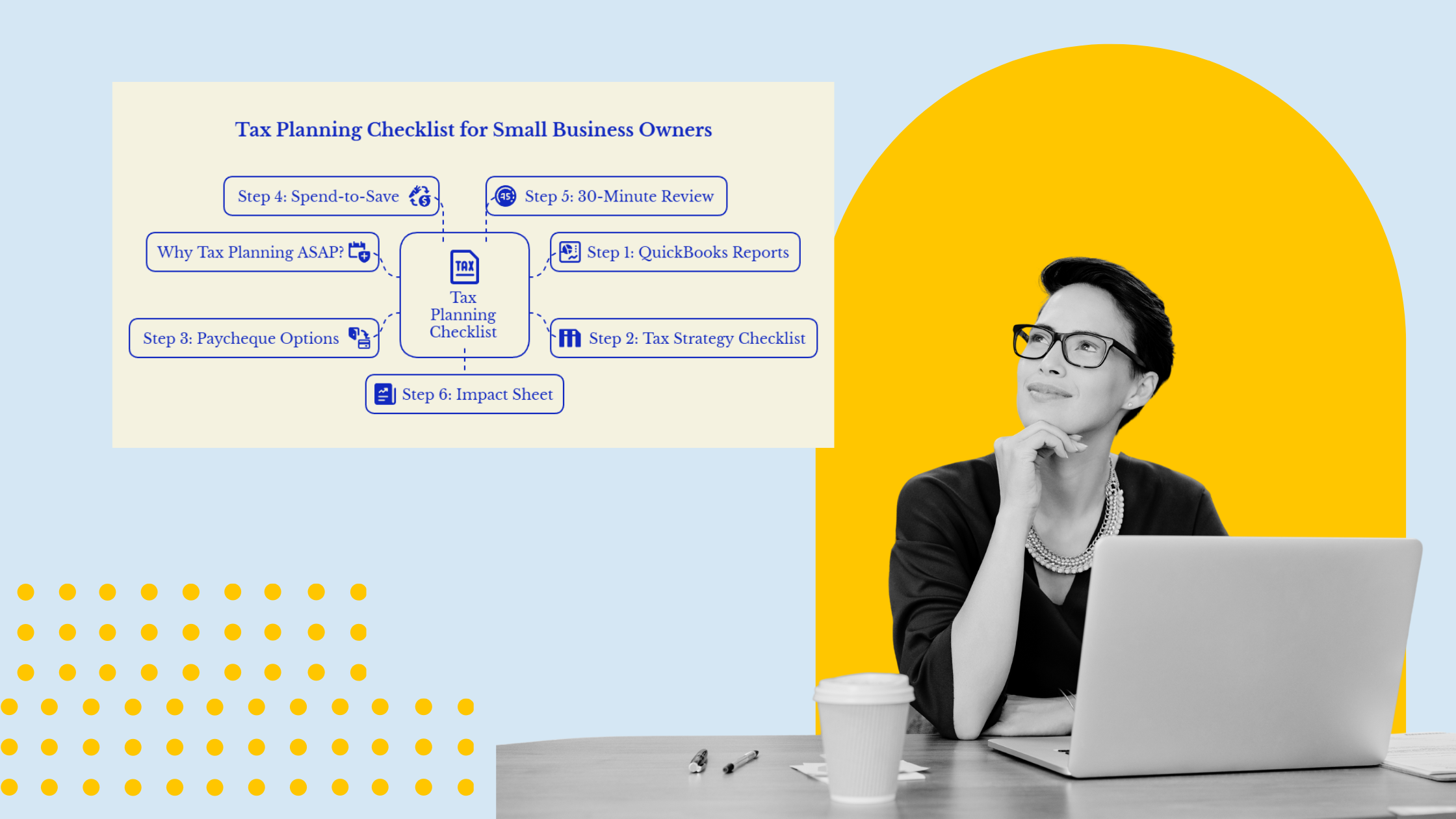

Tax Planning Checklist for Small Business Owners: Discover strategies to save on taxes and fuel growth with this comprehensive...