Do you know which of your clients are making you money… and which ones are quietly draining your profits?

If you’re unsure, you’re not alone. Most small business owners don’t track customer-level profitability closely—and that’s a problem. Because without knowing which clients are unprofitable, you can't make informed decisions to improve your profit margin. It's like trying to plug a leak without knowing where the water's coming from.

Why Customer-Level Profitability Matters

Not all revenue is good revenue. A client might be paying you consistently, but if they’re consuming excessive time, requiring unique support, or pulling you away from high-value customers, they could be draining your business's operational costs.

Conducting a Customer Profitability Analysis allows businesses to:

- Focus on profitable customer segments

- Make strategic decisions with data-driven insights

- Allocate resources efficiently

- Improve overall business profitability without increasing workload

You Can Rightsize Unprofitable Customers

Customer profitability metrics highlight low-value customers who might be costing more than they contribute. Once identified, you can adjust:

- Raise prices to reflect true customer costs

- Streamline service delivery using automation or delegation

- Reallocate resources away from unprofitable customers

This approach helps business owners make smarter, profit-focused decisions.

Attract More Profitable Customers

Redirect time and marketing efforts toward acquiring high-value and profitable customer segments. Use data from your best clients as benchmarks:

- What are their customer demographics?

- What is their average revenue, customer lifetime value, and billable rate?

- How do they impact long-term profitability?

These insights support more effective marketing strategies and customer relationship management.

Retain Valuable Customers

Customer loyalty and satisfaction are crucial to long-term revenue. Businesses can:

- Prioritize high-impact content and improved services for loyal customers.

- Enhance customer experiences to boost retention.

- Offer targeted loyalty programs to increase customer lifetime value.

How to Measure Customer-Level Profitability in QuickBooks

Step 1: Track Revenue and Expenses by Individual Customer

Use accurate, real-time data for clean financial statements. Tag every income and direct cost to each customer.

Step 2: Run Profit and Loss by Customer Report

Compare revenue per customer against direct expenses, overhead costs, and indirect costs. Use the customer profitability formula: Customer Profitability = Customer Revenue - (Direct Expenses + Allocated Overhead Costs)

Evaluate against your target profit margin. If below expectations, consider:

- Increasing prices

- Reducing service costs

- Exiting low-margin projects

Shared Resources and Overhead

Use time tracking & expense tools to estimate the cost per customer service:

- Track hours per client project

- Calculate the total cost per resource

- Measure customer profit over time

Set limits for support hours and adjust pricing or expectations accordingly.

Frequency of Analysis

- Recurring clients: Review quarterly

- Projects: Evaluate at major milestones

TL;DR: If You Don’t Know Which Clients Are Costing You Money, You Can’t Improve Your Margins

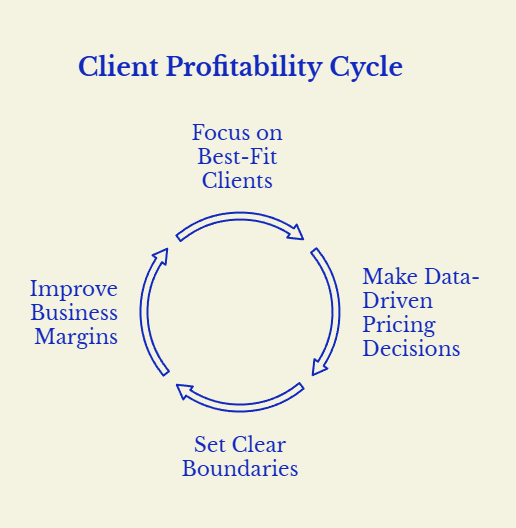

Customer-level profitability is one of the most powerful tools small business owners overlook. Once you start tracking it, you’ll have the clarity to:

- Raise the right prices

- Streamline the right processes

- Attract and retain the right clients

.png)

At Mesa, we help eCommerce businesses and service-based businesses leverage real-time insights and business intelligence tools to optimize customer profitability. If you're ready to make smarter decisions and grow sustainably, let’s talk.

Understanding your customer portfolio and segmenting customers based on profitability ensures you invest marketing dollars, sales efforts, and service offerings where they matter most. Use this knowledge to improve your business model and achieve long-term business success.

%20(1).png)

.png)