Mark spent 35 years building his contracting business from the ground up. No investors. No safety net. Just long hours, tough decisions, and a loyal customer base he personally earned. Like many business owners, he assumed selling the business would take care of his retirement.

But when the time came, reality hit hard:

- The offer was much lower than expected

- He had a few savings outside the business

- There was no backup plan

If this is a fear for you, you’re not alone.

Many Canadian small business owners reach retirement age only to realize their exit plan isn’t strong enough to support the life they imagined. That’s why it’s critical to work backwards—from your retirement lifestyle, to the money you’ll need, to the steps you should take now in your retirement planning process.

1. What Does Retirement Look Like for You?

Before thinking about contributions and investments, ask yourself:

- Do I want to travel every year?

- Will I keep working part-time?

- Do I want to help my kids or grandkids financially?

Once you define your lifestyle expenses and retirement goals, you can estimate what it’ll cost.

General Rule:

You’ll need 25× your annual expenses to retire comfortably.

If you want $80,000 per year, aim for a $2 million retirement nest egg (after tax).

2. Don't Rely on the Business Sale Alone

The sale of your company should be one source of income in retirement—not the entire retirement plan.

Other Sources of Retirement Income:

- CPP and OAS – Government pensions providing basic support

- RRSPs and TFSAs – Tax-advantaged retirement savings options

- Real estate, mutual funds, or private company shares

- Employer-sponsored retirement plans or past employment pensions

Think of your income in retirement like a table. The more legs it has, the more stable it is.

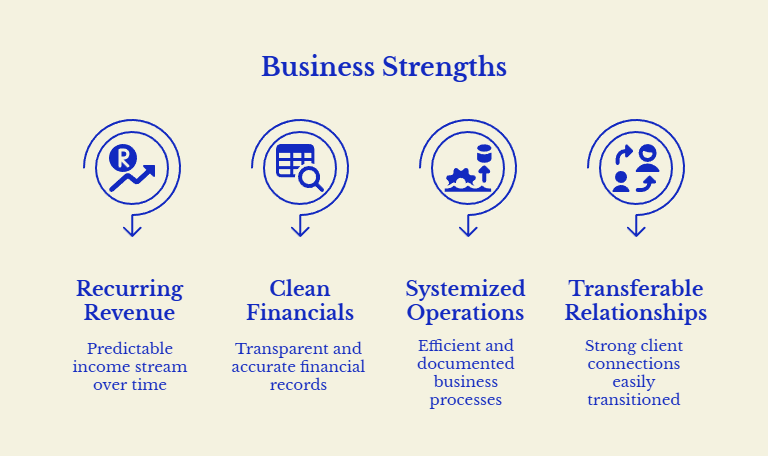

3. Is Your Business Sellable?

Here’s a tough question: Would you buy your business today?

Buyers look at:

- Recurring revenue and business profit

- Clean financial structures

- Systemized business operations

- Transferable client relationships

💡 TIP: Start improving sellability 3–5 years before your target retirement age. A smooth transfer begins with early preparation.

4. Use the Lifetime Capital Gains Exemption (LCGE)

If you’re selling shares in a qualifying Canadian corporation, you may be eligible to exempt up to $1 million in capital gains from tax.

But—there are strict qualification rules. A proactive approach and advice from a tax advisor can help you take full advantage of this powerful tool.

👩💼 Talk to your professional advisor at least 2 years before your expected sale.

5. Understand the Tax Impact of Your Sale

There’s a big difference between:

- Selling shares – may qualify for LCGE, often simpler

- Selling business assets - can trigger more capital gains tax and tax liabilities

Your business structure (sole proprietorship, partnership, Canadian-controlled private corporation) also affects your taxable income and estate taxes.

6. Build Your Exit Plan Early

Wishing for a buyer isn’t a strategy. Business transfer requires:

- A timeline to gradually step back

- Clear financial goals and a contribution plan

- A documented succession planning strategy

- Pre-sale tax planning and legal structures

Have you identified who could take over your family business—family, employees, or external buyers?

What Are Your Other Options?

Selling isn’t the only way to retire. There are several options for business owners who want to remain connected while drawing a steady stream of income:

- Employee Share Ownership Plans (ESOPs) to gradually transition ownership

- Retaining dividend-paying shares and stepping back as an advisor

These strategies allow you to continue benefiting from your business while ensuring a stable income stream.

Business Owner Retirement Checklist

The best time to start is today. Here’s your starter checklist for a secure retirement:

- Define your retirement lifestyle and timeline

- Know your business’s realistic value and business rate

- Max out RRSP and TFSA contributions within annual contribution limits

- Get a tax-efficient succession plan in place

- Schedule a meeting with your financial advisor or tax advisor

🔁 Final Thoughts: Your Legacy Deserves a Plan

You didn’t build your business overnight, and your exit won’t be overnight either. Retirement is about more than a sale—it’s about income sources, preserving your lifestyle, and protecting your wealth.

Whether through RRSPs, non-registered investment accounts, or estate freezes, planning ensures your business capital and growth serve your future. Use valuable tools like employer-matching programs, family trusts, and online services to develop a comprehensive retirement plan.

Peace of mind starts with a number. Let’s work backwards from there—and secure the successful retirement plan you deserve.

.png)

.png)