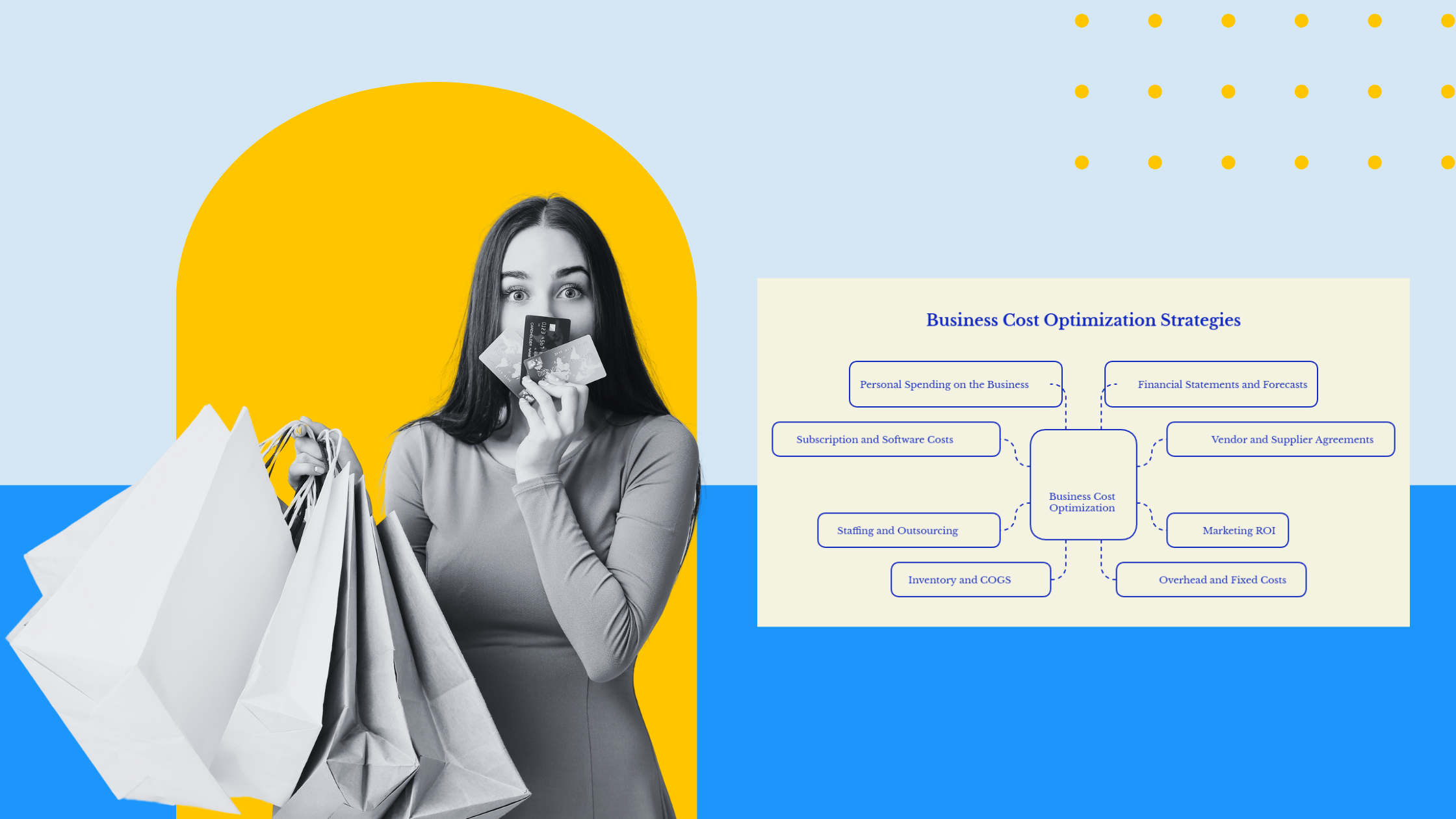

With rising costs, uncertain market conditions, and leaner margins, every dollar in your business needs a purpose. That’s where a Lean Spending Strategy becomes a key component of your financial foundation.

A Lean Spending Strategy is a cost optimization and capital efficiency approach that helps Canadian businesses eliminate waste, align expenses with business objectives, and support sustainable growth. This strategy empowers business owners to direct financial resources toward effective cash flow management and business growth.

At Mesa, we've supported dozens of Canadian entrepreneurs in enhancing their financial performance by implementing one simple tactic: reviewing business spending every 3-6 months.

Here’s a detailed plan to help you do the same, ensuring your payments, subscriptions, and overhead costs are always optimized.

1. Subscription and Software Costs

Why it matters: Bad costs from hidden or underused tools drain resources.

What to audit:

- Business credit card and bank statements for recurring payments

- QuickBooks or an income statement sorted by supplier to identify major expenses

- Team usage for underutilized licenses

Action:

- Cancel or downgrade non-essential tools

- Consolidate overlapping platforms (e.g., Zoom vs. Teams)

- Set reminders before automatic transfers and renewals

2. Vendor and Supplier Agreements

Why it matters: Outdated agreements can inflate operational costs.

What to audit:

- Market trends and competitor pricing

- Service performance and delivery timelines

- Contract renewal dates and payment terms

Action:

- Renegotiate for better rates or loyalty discounts

- Consider switching vendors for improved value

- Set calendar alerts before renewals

3. Marketing ROI

Why it matters: Without actionable metrics, you can’t gauge ROI or customer development methodology.

What to audit:

- Ad performance via metrics like CPL, CAC, ROAS

- Link marketing expenses to sales growth and customer feedback

Action:

- Cut underperforming campaigns

- Double down on high-performing channels

- Align spend with market share goals

4. Staffing and Outsourcing

Why it matters: Labor is a major cost center.

What to audit:

- Contractor hours and deliverables

- Automation opportunities using Zapier, Asana

- Realignment of roles with the client base needs

- Action:

- Streamline responsibilities and automate low-value tasks

- Implement performance-based contracts

5. Inventory and COGS

Why it matters: Overstock and supplier cost creep hurt cash flow.

What to audit:

- Inventory turnover and aging stock

- Recent supplier price changes

- Waste and spoilage

- Action:

- Liquidate slow inventory

- Improve forecasting and renegotiate COGS

6. Overhead and Fixed Costs

Why it matters: These are often overlooked during financial planning for small businesses.

What to audit:

- Rent, utilities, and insurance cost trends

- Business space utilization

Action:

- Shop for better rates

- Right-size your space

- Adjust insurance to match your business model

7. Personal Spending on the Business

Why it matters: Mixing personal experiences and business finances creates financial literacy risks.

What to audit:

- Owner draws, reimbursements, and non-business charges

- Documentation for tax planning

Action:

- Separate business/personal purchases

- Digitize receipts with tools like Dext

- Schedule mid-year tax reviews

8. Financial Statements and Forecasts

Why it matters: They are essential for making data-driven decisions.

What to audit:

- Budget vs. actuals in financial statements

- KPIs like gross margin, equity ratio, and current ratio

- Cash flow projections and seasonal fluctuations

Action:

- Spot overspending early

- Adjust forecasts and spending plans

- Review with a CPA quarterly

.png)

Build a Routine

Set a biannual reminder to audit your spending. Do monthly budget reviews, analyze key performance indicators, and have regular meetings with your bookkeeper. Include cash flow forecasts and check for unexpected expenses or disruptions.

How a CPA Can Help

- Offer market insights and benchmarking

- Suggest cost reduction strategies

- Identify financial shocks and offer peace of mind

Avoid These Common Mistakes

- Ignoring minor recurring charges

- Letting contracts auto-renew

- Only auditing during tax season

- Failing to connect spending with business strategy

Six-Month Audit Checklist

- Subscriptions and software

- Vendor/supplier contracts

- Marketing performance

- Staffing and outsourcing

- Inventory and COGS

- Overhead and operational costs

- Personal/business expenses

- Financial metrics and forecasts

A successful business strategy hinges on financial flexibility, a strong foundation, and informed decisions. Reviewing your business spending every few months gives you clarity, control, and the tools for sustainable success.

.png)