Over the years, we've worked with countless Canadian business owners who were leaving money on the table—often without realizing it. They thought they had a handle on their deductions, but they were missing out on key savings that could’ve made a real difference.

The truth is, tax write-offs can be complex, and staying on top of what you can (and can’t) claim takes more than guesswork. That’s why I created this Ultimate Guide to Business Deductions in Canada—to help entrepreneurs like you maximize every legitimate deduction and keep more of what you’ve worked so hard to earn.

Whether you’re curious about vehicle expenses, home office claims, or overlooked deductions like professional development or business meals, this guide gives you the knowledge to file with confidence and save big.

What Qualifies as a Business Tax Deduction in Canada?

.png?width=2240&height=1260&name=Profit%20and%20Loss%20(1).png)

To get deductions right, you first need to know what the CRA actually considers deductible. Here’s a straightforward rundown of what qualifies.

Definition of a Deductible Expense

In simple terms, a deductible expense is any reasonable cost directly related to earning business income. “Reasonable” and “directly related” are keywords here. The goal is for the CRA to tax you on what you actually made as a business, minus your true business-related expenses.

Key Deduction Categories

- Operating Expenses – These are the day-to-day costs of running your business, from rent to office supplies. Think of them as the “keep the lights on” expenses.

- Capital Expenses – These are long-term investments, like equipment or machinery. Instead of writing them off in one go, you spread the deduction over time with something called Capital Cost Allowance (CCA).

- Partially Deductible Expenses – Some expenses, like meals and entertainment, only get partial deductions because they have both business and personal benefits.

Documentation Is King

The CRA doesn’t just want to see numbers—they want proof. The larger the deduction, the more likely they are to dig into your claim. That means every significant deduction needs a paper trail of accurate records, receipts, logs, and invoices. Keep them organized, and if you’re claiming something big, make sure it’s bulletproof.

For tips on streamlining your record-keeping, check out our Ultimate Accounting System Guide—we cover receipt tracking methods that’ll save you time and headaches.

The Ultimate List of Deductions for Canadian Business Owners

It’s one thing to know the basics of deductions; it’s another to spot all those smaller, often-overlooked ones that can add up fast. Missing these can mean leaving money on the table, so here’s a rundown of expenses that are easily forgotten but fully within your rights to claim.

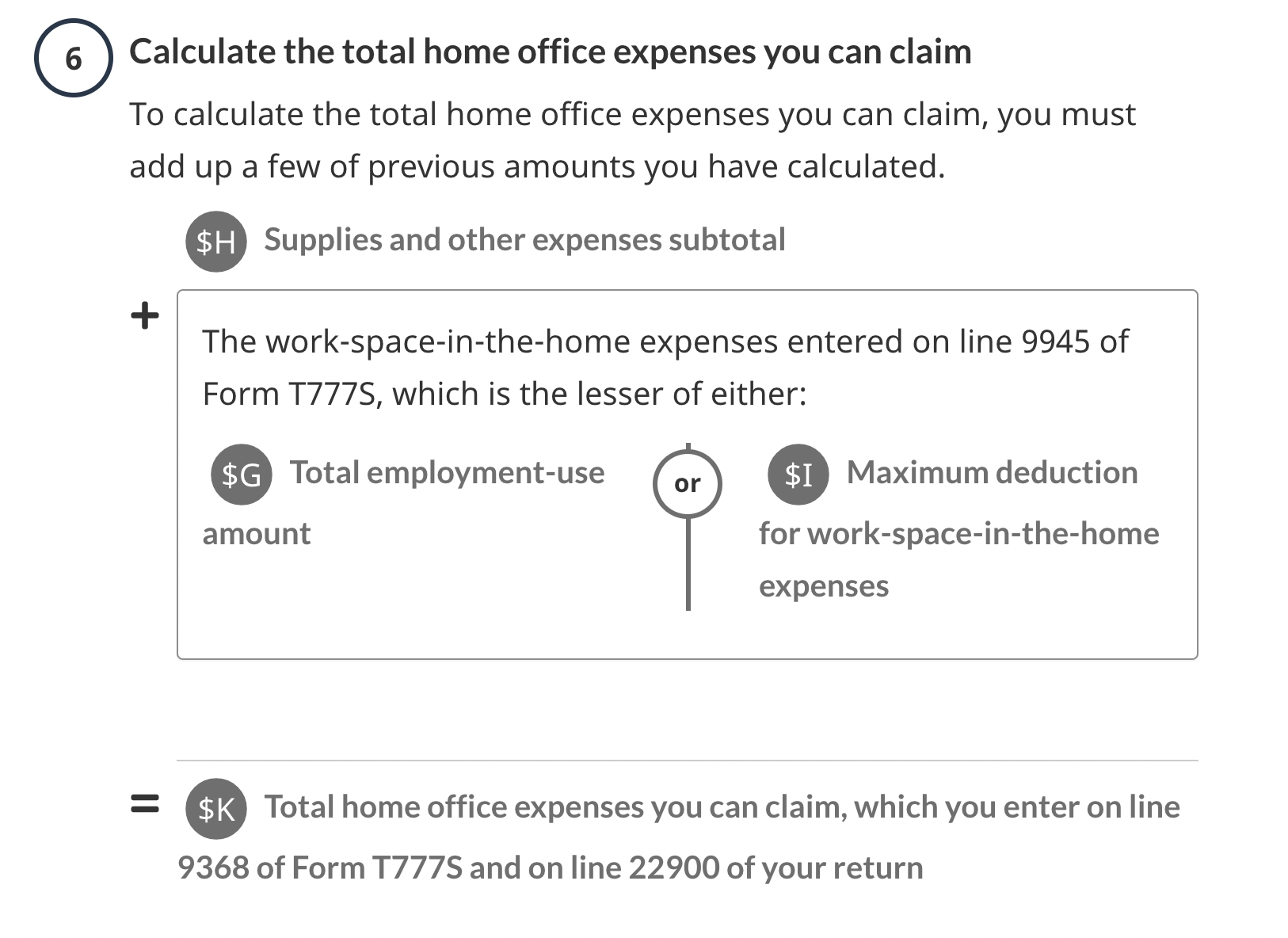

Home Office Expenses

If you run any part of your business from home, you can deduct a portion of your home expenses. This includes:

- Utilities (electricity, heat, water)

- Rent or mortgage interest

- Property taxes

- Insurance (related to your home)

- Maintenance and repairs

Calculation Tip: Measure your workspace and divide it by the total home space to find the percentage. Multiply your home expenses by this percentage to get your deduction.

Internet and Cell Phone Bills

The business portion of your internet and cell phone bills is deductible. If you use your phone and internet for both personal and business purposes, the CRA expects you to track how much time or data goes toward business use.

- Internet usage (proportion of business use)

- Cell phone usage (business call percentage or data usage)

Best Practice: Track your business vs. personal usage with apps that log phone and internet time, such as RescueTime or Moment, for a clear breakdown.

Mileage and Vehicle Expenses

Motor vehicle expenses can be a big deduction if you’re using your car for business purposes. You can deduct:

- Fuel and gas

- Maintenance and repairs

- Insurance

- Depreciation or lease payments on the vehicle used for business

Tech Tip: Use a mileage-tracking app like QuickBooks to automatically log trips. These apps make it easy to categorize each trip as business or personal and create detailed records, which are invaluable for CRA audits.

![]()

Bank Charges and Credit Card Fees

Any fees related to business accounts or credit cards are deductible. This includes:

- Monthly maintenance fees on business accounts

- Transaction fees on business bank accounts

- Interest on business credit card balances

Pro Tip: Use separate business accounts and cards to keep expenses clear for tax purposes, and consider using apps like Dext to categorize and track receipts easily.

Professional Development and Training

If you’re taking courses, seminars, or workshops to improve skills directly related to your business, those expenses are deductible. Don’t forget travel costs if you’re attending out-of-town training.

- Registration fees for business-relevant courses or seminars

- Training material costs (books, online resources)

- Travel and lodging costs for out-of-town training events

Software and Subscriptions

Subscriptions and software that directly support your business operations are fully deductible. This includes:

- Accounting software (e.g., QuickBooks)

- Design or project management software (e.g., Canva, CRM tools)

- Essential business apps and subscriptions

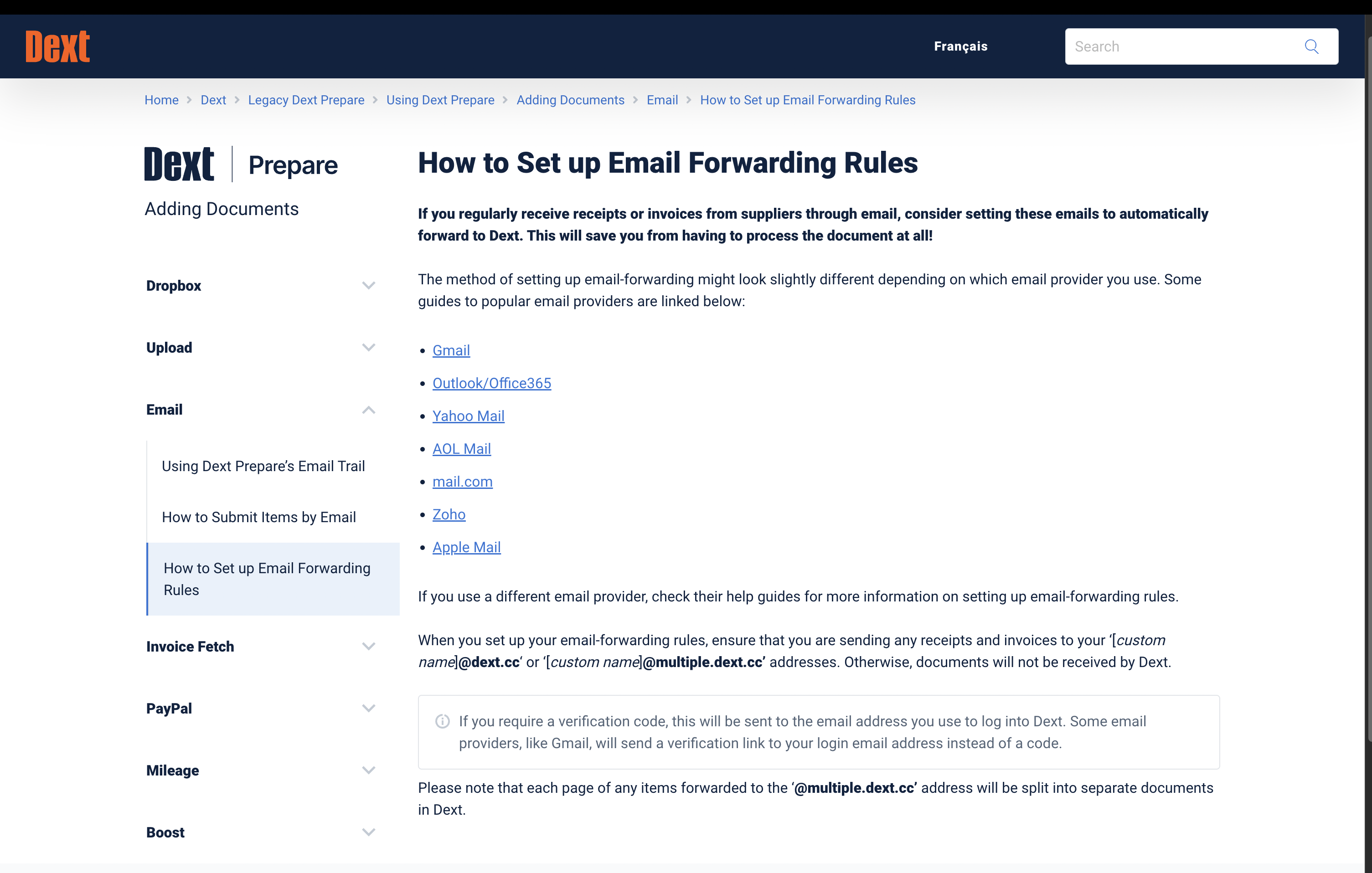

Good to Know: Store digital copies of purchase invoices or subscription confirmations by forwarding the receipts to Dext

If you're already using Dext - here's their documentation on how to do so

Bad Debts

If you’re in a business with accounts receivable, you can write off unrecoverable debts as an expense—just be sure to show that you’ve made reasonable efforts to collect.

Reminder: This deduction applies mainly to businesses with outstanding invoices. Keep documentation showing attempts to recover the debt (emails, letters, etc.).

Advertising and Marketing Costs

Cost of advertising an marketing is fully deductible and cover a wide range of promotional activities, but if you’re advertising with foreign media or platforms, watch out for restrictions. Here’s what you can typically deduct:

- Social media and online ads targeting Canadian markets (e.g., Facebook, Google Ads for Canadian audiences)

- Website hosting and design costs

- Local sponsorships

- Printed marketing materials (business cards, brochures, flyers)

Watch Out: If you’re advertising through foreign media or targeting an international audience, CRA regulations can limit what you can deduct. For instance, only 50% of advertising costs with foreign print media or broadcast outlets may be deductible, especially if the ad isn’t targeting Canadian audiences specifically. For digital platforms, make sure the audience is primarily Canadian to claim the full deduction.

Pro Tip: Consider using digital tools like Google Analytics or Facebook Ads Manager to track and document your ad spend. They help show where your audience is located, which can strengthen your deduction claim if audited.

Legal and Professional Fees

If you hire professionals to support your business, their fees are deductible as long as they’re directly related to business operations. These may include:

- Accounting and tax preparation fees

- Legal fees for contracts and compliance

- Consulting costs for business strategy or compliance

Employee and Contractor Gifts

You can deduct non-cash gifts for employees, such as holiday gifts or rewards, with limits set by the CRA:

- Up to $500 per employee, per year, for non-cash gifts

- Gift cards are allowed if they’re for specific stores, not cash equivalents

Insurance Premiums

Business-specific insurance is deductible. This includes:

- Liability insurance

- Property insurance for business locations or equipment

Note: Personal insurance doesn’t qualify unless it’s required as part of a business loan.

Interest on Business Loans and Financing Fees

Interest on loans or credit lines used exclusively for business purposes is deductible. This includes:

- Interest on business-specific loans

- Financing fees associated with business credit lines or financing agreements

Health and Dental Insurance Premiums for Employees

Premiums paid for employee health and dental insurance plans are deductible. If you’re self-employed, consider setting up a Health Spending Account (HSA) to gain tax advantages on healthcare costs.

Travel Expenses

Travel expenses for client meetings, conferences, or training can be deducted, including:

- Transportation (flights, trains, car rentals)

- Accommodations (hotel stays)

- Meals (50% deductible when traveling for business purposes)

Tech Tip: Use Dext for organizing travel expenses. Store your tickets, receipts, and even help you create a note detailing the business purpose of each trip.

Capital Cost Allowance (CCA)

For major assets like vehicles, office furniture, and machinery, you can claim depreciation over time using Capital Cost Allowance (CCA). Keep an asset register with the date of purchase and depreciation rate.

Partially Deductible and Non-Deductible Expenses

Not everything can be written off as a business expense, and some items are only partially deductible. Knowing the difference keeps you from claiming items that could raise red flags with the CRA. Here’s what to watch out for so you stay compliant and avoid surprises.

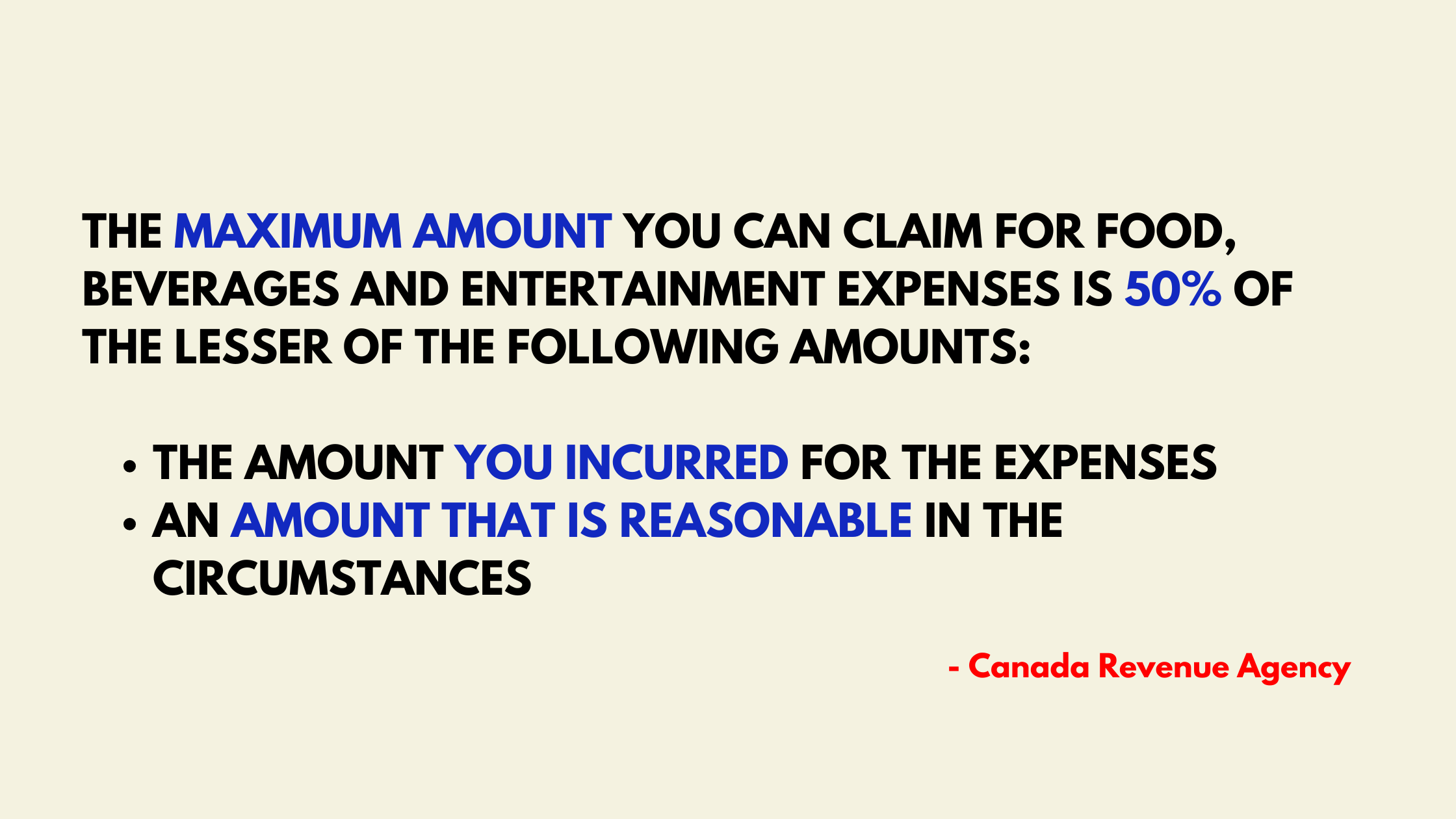

Meals and Entertainment (50% Rule)

While meals and entertainment expenses are deductible when related to business activities, only 50% of these costs can be claimed in most cases. Think of this as the CRA's way of ensuring you aren't getting deductions of personal purposes. This rule applies to meals with clients, business lunches, and even certain events you attend for business purposes.

- Partially deductible items include:

-

- Client meals and business lunches

- Event tickets and entry fees for business-related entertainment

- Staff meals for regular work purposes (note: holiday parties have different rules)

Exceptions: Certain employee events, such as an office party for the holidays, may be fully deductible within CRA limits. Meals at remote worksites may also qualify for full deduction. If in doubt, consult the CRA’s guidelines on allowable meals.

Non-Deductible Interest and Penalties

Certain interest expenses and penalties don’t qualify as business deductions. The CRA is clear: personal loan interest, fines, penalties, and interest on unpaid taxes are off-limits, even if you’re running a business.

- Non-deductible items include:

-

- Personal loan interest (e.g., a mortgage or car loan unrelated to business)

- Late fees, fines, and penalties, including traffic tickets

- Interest on overdue tax payments

Note: If you’re unsure, remember that interest is deductible only when it’s tied directly to business financing or assets.

Club Memberships and Recreational Fees

The CRA generally doesn’t allow deductions for club memberships or recreational activities. This rule includes clubs like golf courses, gyms, and athletic memberships, even if you use them for networking purposes.

Exception: If the club membership is a specific condition for your business operations, you may be able to claim it. But this is rare, and the CRA tends to be strict here.

Tips for Maximizing Deductions

Knowing what’s deductible is half the battle—keeping records and tracking expenses correctly is the other. Here are some strategies to help you maximize your deductions while staying CRA-compliant. These tips will save time, reduce stress, and make sure you’re ready in case of an audit.

Maintain Separate Accounts

It’s easy to mix personal and business finances when you’re running the show, but keeping them separate is a game-changer. Not only does it make tracking expenses easier, but it also simplifies things if the CRA ever comes calling.

- Open a dedicated business bank account: This helps you track income and expenses separately and gives you a clear view of your financials at a glance.

- Use a business-specific credit card: With a separate credit card for business purchases, you avoid the headache of sorting through personal expenses come tax time.

Use Digital Tools for Expense Tracking

.png?width=2240&height=1260&name=Ultimate%20Guide%20Blog%20Banner%20(1).png)

Old-school paper receipts have their place, but digital tools can make your record-keeping faster and more reliable. Plus, with some tech-savvy tools, you can automate much of the work, so you never miss a deduction.

- Receipt-tracking apps: Use apps like Dext to scan and store receipts digitally. These apps let you organize expenses by category and keep all your records easily accessible.

- Mileage-tracking apps: Use QuickBooks to automatically track and categorize your mileage. These tools keep an accurate log, saving you time and adding an extra layer of verification if the CRA questions your business travel deductions.

Keep your Documentation Audit-Ready

The CRA expects thorough documentation to back up deductions, especially on larger claims. Make sure you’re prepared with an audit-ready approach to your record-keeping.

- Keep detailed records of all business expenses: Store both digital and paper copies of receipts, invoices, and logs. Remember, the CRA can go back up to six years in an audit, so plan accordingly.

- Record the “who, what, when, where, and why”: For each expense, note the details (e.g., client meeting, business purpose). This information gives clarity and legitimacy to each deduction.

- Regularly review and organize: Take a few minutes each month to check that your expenses are accurately recorded. This habit makes it much easier to prepare your year-end financials without scrambling.

The Bottom Line

Deductions aren’t just about reducing your tax bill; they’re about understanding your financial picture and planning for growth. With a clear handle on which expenses are deductible, partially deductible, or off-limits, you can make strategic decisions that keep you both compliant and profitable. Plus, with organized records and dedicated tracking systems, you’ll be ready for tax season and prepared in case of an audit.

If you’d like more personalized advice, or need help setting up your accounting system for maximum efficiency, reach out to us at Mesa. We’re here to make sure you capture every eligible deduction while staying on the CRA’s good side.

.png)