Home office deductions are a golden opportunity for Canadian business owners working from home to save on taxes. Whether you’re a freelancer, consultant, or small business owner, understanding how to claim these deductions can reduce your tax burden. However, maximizing these savings requires knowing the eligibility criteria, calculating expenses accurately, and keeping solid records to satisfy the Canada Revenue Agency (CRA).

In this guide, we’ll break down the essentials of home office deductions so you have everything you need to get a home office deduction this year.

By the end you'll walk away with:

- What home office expenses you can deduct

- How to calculate your deductions to ensure you are maximizing them

- What you need to get the deduction

Who Qualifies for the Home Office Deduction?

Eligibility Requirements

To claim a home office deduction, your workspace must meet one of these conditions:

- Primary Place of Business: Your home office is where you conduct most of your business activities.

- Regular and Exclusive Use: The space is used exclusively and consistently for earning business income or meeting clients.

Common Scenarios

- Freelancers and consultants conducting business primarily from home.

- Small business owners running operations from a dedicated home office.

What Expenses Can You Deduct for Your Home Office?

Now that you know you qualify - let's get into what home office expenses can you actually deduct. This fall into two categories:

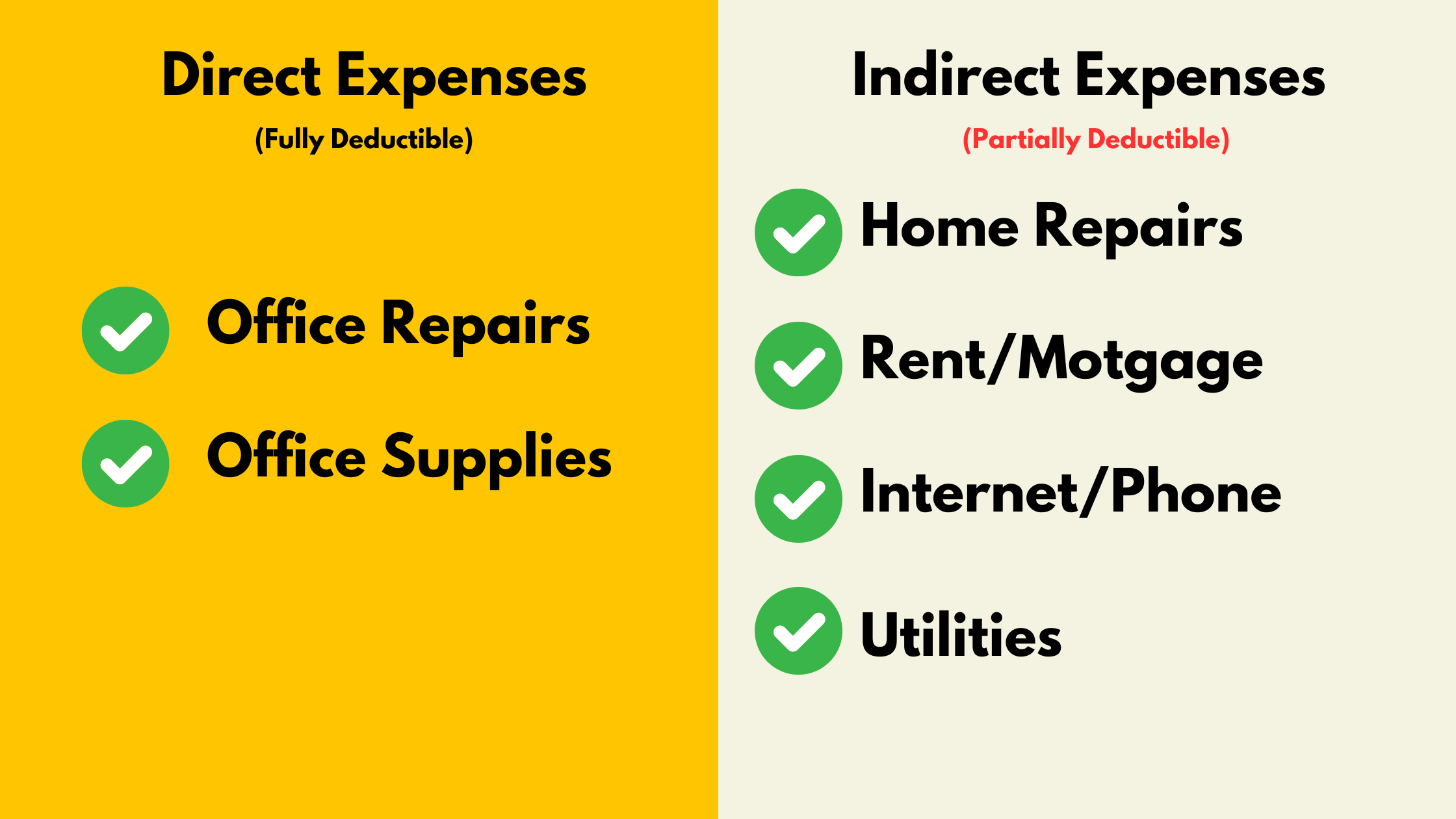

Direct vs. Indirect Expenses

- Direct Expenses: Costs tied directly to the office, like repainting or repairs, are fully deductible.

- Indirect Expenses: Shared costs like utilities are partially deductible based on your business-use percentage.

Deductible Home Office Expenses

Direct Expense:

- Maintenance and Repairs: Office-specific repairs are fully deductible

- Minor Office Improvements: Paint, shelving, or ergonomic furniture for the office.

- Office Supplies: Paper, printer ink, and other small items used solely for business.

Indirect Expenses:

- Utilities: A portion of electricity, water, heating, and cooling costs.

- Rent or Mortgage Interest:

- Rent: Tenants can deduct a portion based on business use.

- Mortgage Interest: Available only for self-employed business owners. Principal payments are not deductible.

- Property Taxes and Home Insurance: Deductible for self-employed individuals proportionate to business use. Employees cannot deduct insurance.

- Maintenance and Repairs: General home repairs are deductible by percentage.

- Internet and Phone Expenses: Claim the business-use portion of internet and phone bills.

- Home Security: Deduct the business-use portion of security systems.

Calculating the Home Office Tax Deduction - Step by Step

.png?width=2240&height=1260&name=Software%20(1).png)

With the broad overview covered heres the Step by Step breakdown of how to actually calculate the amount you can deduct

- Calculate your Total Direct Expenses Based on the List Above

- Calculate your Total Indirect Expenses.

- This should be the total for your home

- Example: your entire rent + your entire internet bill = $3090

- Measure Your Workspace

- Use a tape measure to calculate the length and width of your home office area. Multiply these to determine the total square footage of the space.

- Example: If your office is 10 feet by 15 feet, the total square footage is 10×15=150 square feet

- Measure Your Home’s Total Finished Area

- Measure the total finished area of your home. This includes all livable areas, excluding unfinished basements, garages, or storage spaces unless they’re used for business.

- Calculate the Business-Use Percentage

- Divide the square footage of your workspace by the total square footage of your home, then multiply by 100 to express it as a percentage.

- Example: (150 sqft office / 1200 sqft home) * 100 = 12.5% Business Use Percentage

- Multiply your Business-Use Percentage with you Total Indirect Expenses

- Example: $390 (Total Indirect Expense) * 12.5% (Business Use Percentage) = $386.25 (Indirect Deductible Expense)

- Add your Indirect Deductible Expense to your Total Direct Expenses (i.e. step 1 + step 6)

✅ Documentation Checklist

Even if you've calculated your expenses accurately you never know when you get reviewed by the Canada Revenue Agency. To make sure you get your tax savings - and keep them, make sure you have the following items:

- Photos of your workspace

- Receipts from your providers (internet, supplies, repairs, etc.)

- Proof of mortgage or rent costs

- T2200 Form - If you're an employee (read below)

Employee vs. Self-Employed Deductions

Whether you’re self-employed or an employee working from home, the rules for claiming home office deductions can vary. These differences affect not only what you can deduct but also the documentation required to substantiate your claims.

Self-Employed Business Owners

If you’re self-employed, you generally have more freedom to claim home office expenses because your workspace directly supports your income-earning activities.

- What You Need:

- Defined Workspace: You must have a designated area in your home used exclusively and regularly for your business.

- Accurate Records: Maintain detailed records of your expenses, including receipts, invoices, and a calculation of your business-use percentage.

- Proof of Income: Your home office claims must align with your business activities and income. For instance, claiming a large portion of your home as office space might trigger a CRA review if your business income doesn’t justify it.

- What You Don’t Qualify For:

- If you own your home, you can only claim mortgage interest—not principal payments.

- Expenses related to personal-use areas of the home cannot be deducted.

Employees Working from Home

As an employee, the scope of your deductions is narrower because the CRA assumes most home-related costs are covered by your salary or employer.

- What You Need:

- T2200 Form: Your employer must provide this form, certifying that you’re required to maintain a workspace at home as part of your job.

- Workspace Validation: The space must be used regularly for work and meet CRA guidelines.

- Expense Documentation: Keep records of your eligible expenses (e.g., utilities or rent) and how you calculated your claim.

- What You Don’t Qualify For:

- Employees cannot claim costs like home insurance or property taxes, as these are considered the employer’s responsibility.

- You cannot claim mortgage interest if you own your home.

Plan Strategically to Maximize Your Deductions

Claiming home office deductions can lead to real tax savings, but success depends on record keeping and knowing what actually qualifies. Track your expenses, calculate your business-use percentage accurately, and you'll be set.

For more deductions, check out our ultimate guide here.

FAQs

Q1: What qualifies as a home office for tax deductions?

A home office must be:

- Your principal place of business, or

- A space used regularly and exclusively for business purposes (e.g., meeting clients, completing work tasks).

Q2: Can I claim home office deductions if I work part-time from home?

Yes, but only for the portion of time and space used for business. Document your usage carefully to calculate the correct business-use percentage.

Q3: What’s the difference between direct and indirect expenses?

- Direct expenses are tied specifically to your home office, like painting or repairing the workspace. These are fully deductible.

- Indirect expenses cover shared costs (e.g., utilities, rent) and are deductible based on your calculated business-use percentage.

Q4: How do I calculate the business-use percentage of my home?

Use the square footage method:

- Measure your home office area and total finished home area.

- Divide the office space by the total space.

- Multiply by 100 for the percentage.

Example: If your office is 150 sq ft and your home is 1,000 sq ft, your business-use percentage is 15%.

Q5: Do employees and self-employed individuals follow the same rules?

No. Self-employed individuals have more deduction options (e.g., mortgage interest, property taxes). Employees are limited to costs like utilities and rent, and require a T2200 form from their employer to claim detailed deductions.

Q6: What’s the CRA simplified flat-rate method?

Introduced during the COVID-19 pandemic, the simplified method method allows employees to claim a fixed amount ($2 per day, up to a maximum of $500 annually) without requiring detailed calculations or a T2200 form. It’s not available to self-employed individuals.

Q7: What happens if my home office doubles as a personal space?

If the space serves both business and personal purposes, calculate a reduced business-use percentage based on the proportion of time it’s used for work. Keep records showing how and when the space is used.

Q8: Are there any expenses I can’t claim?

Yes, some non-deductible costs include:

- Mortgage principal payments.

- Furniture or equipment not used exclusively for business.

- Improvements to non-office areas of the home.

Q9: Will claiming home office deductions affect the sale of my home?

For self-employed individuals, claiming deductions might impact the principal residence exemption, potentially resulting in taxable capital gains. Employees do not face this issue as they can’t claim ownership-related costs.

Q10: How should I track my home office expenses?

- Maintain detailed records of all receipts, invoices, and utility bills.

- Use accounting software like QuickBooks to track expenses and calculate the business-use percentage.

- Regularly review your records to ensure you’re capturing all eligible costs.

Q11: What should I do if the CRA audits my home office deductions?

- Provide detailed records, including receipts, invoices, and proof of workspace use.

- Be prepared to show calculations for your business-use percentage.

- Consult a tax professional if you need assistance during the review process.

.png)

.png)