Managing bill payments shouldn't be manual in 2025. Yet, for many business owners, keeping up with vendor payments, tracking invoice details, and avoiding costly entry errors is a daily battle. If you’re constantly dealing with late fees, or losing valuable time on manual data entry, it’s time for a change.

Accounts payable automation software is a game changer for Canadian businesses. It eliminates repetitive tasks, reduces human error, and ensures your vendors are paid on time—without the stress. Whether you handle domestic transactions, international transactions, or both, the right payable solution streamlines financial workflows and enhances business growth.

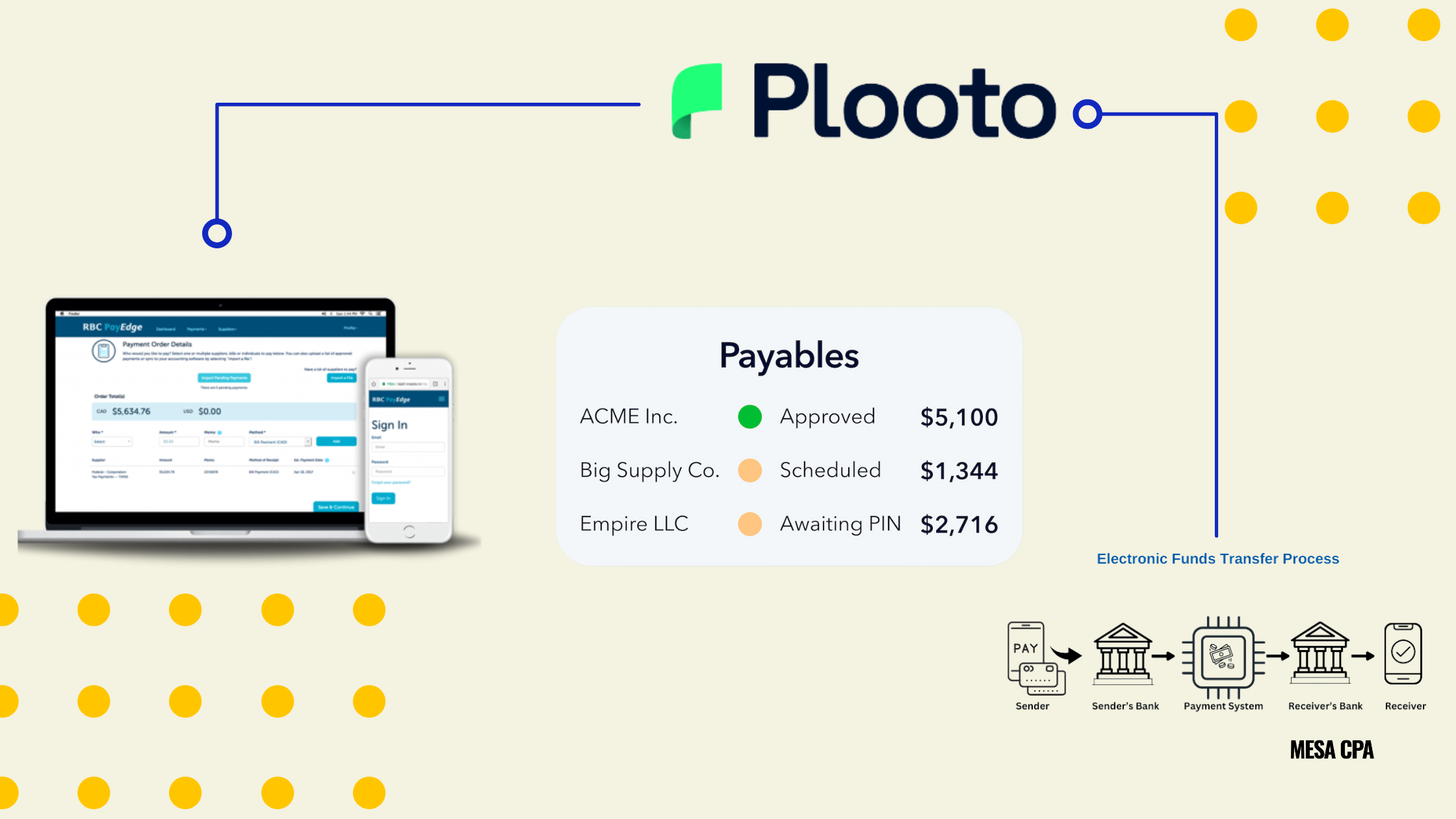

This guide breaks down the three best accounts payable automation solutions for 2025: Plooto, Electronic Funds Transfers (EFTs), and PayEdge. Whether you need a fully automated system, a cost-effective money transfer method, or a scalable payable automation software, these tools will help you take control of your finances and grow your business without drowning in paperwork.

The Real Cost of Manual Accounts Payable

Many businesses still rely on outdated, manual payable processes, which lead to:

- Time-Consuming Manual Tasks – Entering invoice details and processing payments manually interrupt your day's hours.

- Expensive Entry Errors – A single mistyped number can mean overpaying, missing payments, or duplicate transactions.

- Delayed Vendor Payments & Lost Discounts – Slow processing damages vendor relationships and costs you early payment discounts.

- Poor Cash Flow Management – Without a centralized system, tracking payments and forecasting cash flow becomes a nightmare.

Accounts payable automation fixes these problems—saving you time, improving accuracy, and giving you full control over your financial processes. Here’s how Plooto, EFTs, and PayEdge can help.

1. Plooto: The All-in-One Accounts Payable & Receivable Software

Best for: Business owners who want a fully automated AP and AR system.

Plooto is a powerful end-to-end account payable and receivable software designed for small and medium-sized businesses. It simplifies invoice processing, invoice matching, and payment date options, so you can automate payments and get paid faster.

Why Business Owners Love Plooto:

- Automated Workflows & Custom Approvals – Eliminate manual approvals with customizable automation.

- Seamless Accounting Tools Integration – Syncs with QuickBooks Online, Xero, and NetSuite for automatic reconciliation.

- Multiple Payment Options – Pay vendors via EFTs, checks, corporate card, or credit card payments.

- CRA Payments Made Easy – Automates tax remittances to the Canada Revenue Agency.

- Stronger Cash Flow Management – Get full visibility into accounts payable and receivable workflows.

With Plooto, businesses reduce manual entry, minimize errors, and gain better control over their financial operations.

2. Electronic Funds Transfers (EFTs): The Cost-Effective Digital Business Banking Solution

Best for: Businesses looking for a simple, digital way to transfer funds.

EFTs are one of Canada's most widely used digital business banking methods, offering a secure and efficient way to pay vendors.

Why Business Owners Love EFTs:

- Faster Payments – Transfers are processed within 2-4 business days.

- Lower Costs – Cheaper than checks or wire transfers.

- Increased Security – No risk of lost or stolen checks.

If your business already has structured payable processes and you just need a reliable, low-cost digital payment method, EFTs are a great option.

3. PayEdge: The Flexible & Scalable Payable Automation Software

Best for: Businesses managing multiple vendors with diverse payment preferences.

PayEdge is a robust payable solution that provides flexibility for companies handling multiple payments at scale.

Why Business Owners Love PayEdge:

- Multiple Payment Methods – Choose from EFTs, credit cards, or virtual cards.

- Batch Payments – Pay multiple vendors in one click, saving hours of work.

- Accounting Firm Integrations – Syncs with QuickBooks Online, Xero, and more.

- Vendor Management – Store supplier details and payment preferences.

If your business has a high volume of vendor payments or works with various suppliers, PayEdge can streamline your workflow and reduce manual intervention.

Which Payable Software Is Right for You?

Use Plooto if you:

✔ Need complete payable automation software.

✔ Want to automate invoice approvals and custom approval workflows.

✔ Handle frequent international transactions and domestic transactions.

✔ Need an all-in-one system that syncs with QuickBooks Online or Xero.

✔ Want to automate CRA tax payments?

Use EFTs if you:

✔ Prefer a low-cost, secure way to pay vendors.

✔ Already have structured payable processes and just need a digital payment method.

✔ Want to eliminate paper checks and lower transaction fees?

✔ Need a simple payment solution that integrates with accounting tools.

Use PayEdge if you:

✔ Work with multiple suppliers who prefer different payment methods.

✔ Process batch payments regularly and want to save time.

✔ Need an accounts payable automation tool that integrates with QuickBooks Online and other accounting firms.

✔ Want to manage supplier payment preferences easily?

By choosing the right tech stack—or a combination of these tools—you can eliminate bottlenecks, improve efficiency, and ensure your business runs smoothly.

Final Thoughts: It’s Time to Automate

The days of manually tracking invoices and writing checks are over. If you want to eliminate payment headaches, reduce errors, and take control of your cash flow, accounts payable automation is the way forward. With tools like Plooto, EFTs, and PayEdge, you can optimize payable processes, improve cash flow management, and scale your business without getting bogged down by manual tasks.

For businesses banking with RBC Royal Bank of Canada, HSBC Bank Canada, or other financial institutions, integrating a reliable payable solution with online banking tools like RBC Mobile Banking, RBC Express, or HSBC Bank Canada Online can enhance efficiency. Whether you deal with foreign currencies, exchange rates, or money movement across international markets, automation helps streamline operations and ensures financial stability.

Stay ahead of the curve by leveraging payable automation software to simplify your financial workflows. The future of business payments is digital—make sure your company is ready for it.

Accounts payable automation software is a game changer for Canadian businesses, generating revenue of between $500K and $5M.

.png)