Whether you run a seasonal business or you are saying goodbye to a team member for good - they likely want to start leveraging their Employment Insurance.

For that (and compliance reasons) the government requires business owners to issue an ROE.

Here's the full guide on when to issue one, how to issue one, and how to put ROEs on autopilot for the future.

What is an ROE?

First of all what is an ROE? A Record of Employment (ROE) is a form employers in Canada must fill out when an employee’s pay stops or changes a lot. It’s the main document that lets workers apply for Employment Insurance (EI) through Service Canada.

Think of the ROE as a snapshot of the employee’s job history. It shows:

- How much money they earned (insurable earnings)

- How many hours they worked (insurable hours)

- The reason they stopped working (quit, layoff, illness, etc.

If these numbers are wrong, your employee’s EI claim could get delayed - and you could be on the hook for penalties

When Should You Issue an ROE?

An employer has to issue an ROE when there’s a break in someone’s work or pay. This is called an interruption of earnings.

This usually happens when:

- The employee doesn’t work for seven days in a row, or

- Their pay drops by 40% or more because of things like illness, injury, maternity leave, or other reasons.

Common times you’ll issue an ROE include:

- When someone quits, retires, or is laid off

- When there’s not enough work (shortage of work)

- When someone goes on maternity or parental leave

- If the person is sick or injured

- When seasonal work ends

Even real estate agents, contract workers, and people paid on commission need ROEs, though the way their pay is calculated is a little different.

How to Issue an ROE

There are two ways to issue an ROE:

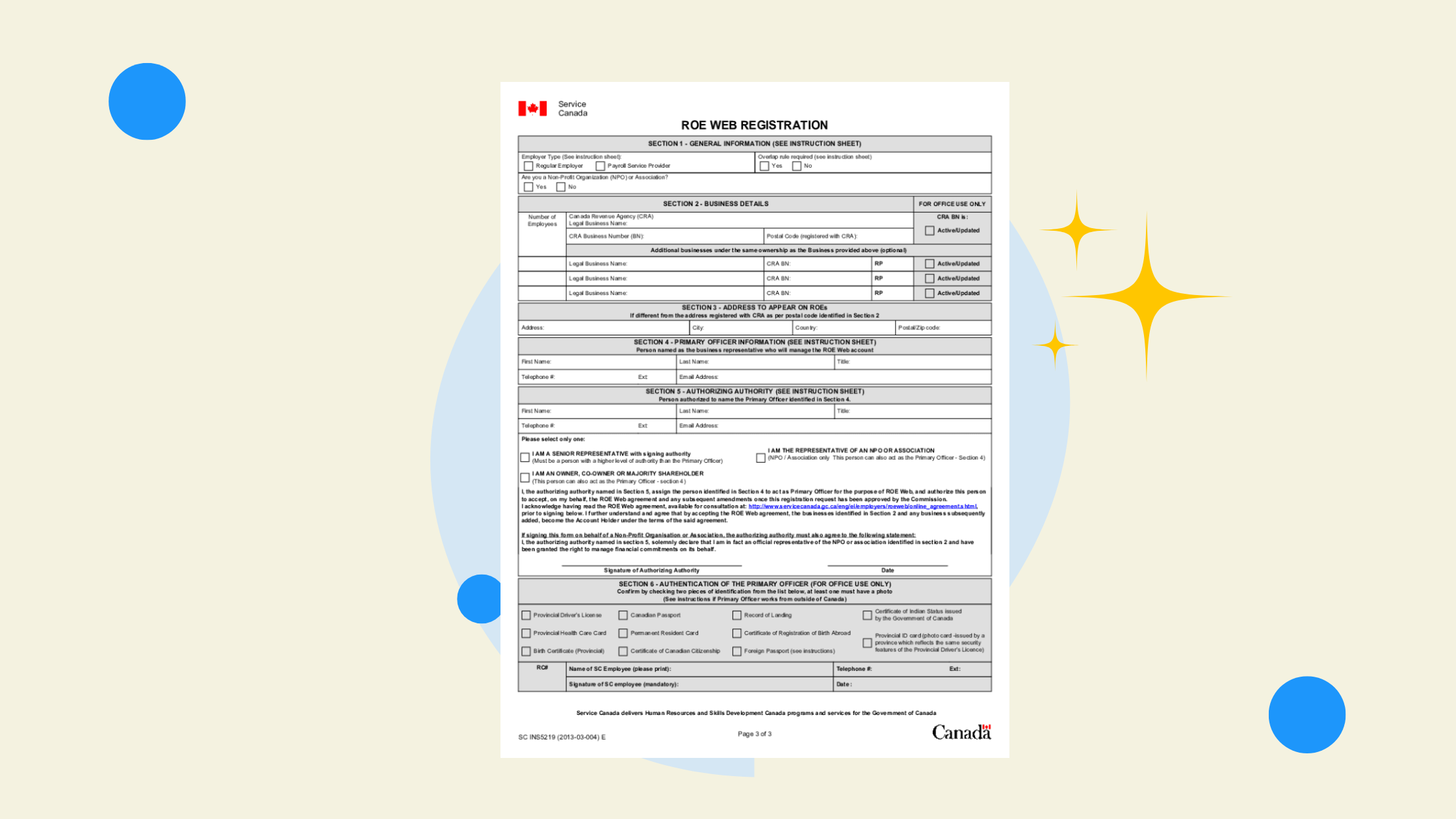

- Electronic ROEs – Done online through Service Canada’s ROE Web (this is the fastest and easiest way).

- Paper ROEs – Printed and given to the employee, who must then send it to Service Canada.

Steps for Filling Out an ROE

Filling out a Record of Employment can feel overwhelming the first time, especially if you’re not sure what terms like insurable hours or insurable earnings mean. But once you break it down step by step, it becomes much simpler.

Here’s how to do it right:

1. Check the basics

Start with the simple stuff. Double-check the employee’s:

- Social Insurance Number (SIN)

- Full legal name

- Address and contact information

Any mistakes here can slow down their Employment Insurance (EI) claim

2. Look at payroll records

This is where most employers get tripped up. You’ll need to know:

- Hours per week or per day the employee normally worked

- Insurable hours – these are the hours that count towards EI. For most employees, all regular hours are insurable. Exceptions might apply for self-employed people or very specific industries.

- Insurable earnings – this includes the money employees earn that EI contributions are based on (like wages, salary, overtime, vacation pay, and statutory holiday pay). Things like tips or expense reimbursements don’t usually count.

If you’re not sure what’s “insurable” and what isn’t, payroll software like Wagepoint can help. It automatically tracks insurable hours and insurable earnings for you, so you don’t have to calculate them by hand. That way, when it’s time to file an ROE, the numbers are already there and accurate.

3. Fill in the key blocks

The ROE is broken into blocks. Here's a block by block breakdown in plain english of what you need to fill out:

| Block Number | Purpose and What to Include |

|---|---|

| Block 1: Serial Number | Unique identifier pre-printed on paper ROEs; automatically generated for electronic ROEs. Keep records of these numbers for 6 years. |

| Block 2: Serial Number of Amended ROE | Complete only if amending a previous ROE; enter the original ROE’s serial number. |

| Block 3: Employer’s Payroll Reference Number(optional) | Employer's internal identifier for the employee, for payroll tracking. |

| Block 4: Employer's Name and Address | Official company name and mailing address, matching CRA remittance forms. |

| Block 5: CRA Business Number (Payroll Account Number) | The full 15-character CRA payroll account number used to remit EI premiums. |

| Block 6: Pay Period Type | The employee’s pay cycle (weekly, biweekly, semi-monthly, monthly, or 13 pay periods a year). Special rules apply for irregular or commission pay (weekly type used). |

| Block 7: Employer’s Postal Code | Postal code for the employer’s address. |

| Block 8: Employee’s Social Insurance Number (SIN) | The employee’s 9-digit SIN. Ensure it’s accurate to avoid processing delays. |

| Block 9: Employee’s Name and Address | The employee’s full legal name and mailing address. |

| Block 10: First Day Worked | The first day the employee worked and was paid insurable earnings for the current period of employment or since the last ROE issued. |

| Block 11: Last Day for Which Paid | The last day the employee received insurable earnings, including paid leave (e.g., vacation, sick leave). This can differ from the last actual day worked. |

| Block 12: Final Pay Period Ending Date | The end date of the final pay period covering the last day paid. |

| Block 13: Occupation (optional) | Employee’s job title or occupation. |

| Block 14: Expected Date of Recall (optional) | If the employee is expected to return, enter the expected date; if unknown, check “Unknown”; if not returning, check “Not returning.” |

| Block 15A: Total Insurable Hours | Total number of insurable hours the employee worked during the employment period reported on this ROE. Includes statutory holiday hours if insurable. |

| Block 15B: Total Insurable Earnings | Total insurable earnings received by the employee during the period, including wages, salary, overtime, vacation pay, and statutory holiday pay. |

| Block 15C: Insurable Earnings by Pay Period | Breakdown of insurable earnings for each pay period during the period of employment; required for electronic ROEs and recommended for paper ROEs to support EI benefit calculations. |

| Block 16: Reason for Issuing this ROE | Select the appropriate code explaining why the ROE is issued (e.g., shortage of work, quit, illness, retirement, layoff). This is crucial for EI processing. |

| Block 17: Separation Payments | Report any separation payments made or payable including vacation pay on termination, severance, bonuses, or retirement leave credits. |

| Block 18: Comments | Use this block for notes or explanations about unusual situations, irregular hours, lump-sum payments, or other relevant details. |

| Block 19: Paid Leave or Wage Loss Payments | Report any payments related to sick leave, maternity, parental, compassionate care or wage loss indemnity plans. |

| Block 20: Language | Language in which the ROE is completed (English or French). |

| Block 21: Employer’s Phone Number | Contact phone number of the issuer. |

| Block 22: Certification | Employer’s signature certifying the accuracy of the ROE. |

Again, if you use payroll software, these numbers can often be pulled straight from your system without much extra work.

4. Submit the ROE

Finally, you need to send the ROE. There are two options:

- Electronic ROE (eROE): The easiest way, done online through Service Canada’s ROE Web. Payroll software like Wagepoint connects directly to ROE Web, so you can submit in just a few clicks.

- Paper ROE: You fill out a paper form and give it to the employee. They’re then responsible for sending it to Service Canada.

For most employers, electronic is faster, easier, and less likely to have errors.

FAQs

1. How long do employers have to issue an ROE in Ontario?

In Ontario (and across Canada), you must issue the ROE within five calendar days of the employee’s last day of work or the day you find out about the interruption of earnings.

2. Can I fix an ROE after I send it?

Yes. If you made a mistake (like the wrong number of hours or earnings), you can send an amended ROE.

3. Do commission workers and real estate agents get ROEs?

Yes. Even though their pay is different, they still get ROEs. Their average earnings are worked out using a special formula.

4. What if an employer doesn’t issue an ROE?

If you don’t issue an ROE, the employee might not be able to get their EI benefits. Service Canada or the Revenue Agency could also fine you.

5. Do I include statutory holiday pay on the ROE?

Yes. Payments like vacation pay, statutory holiday pay, or retirement leave credits all need to be reported in the ROE.

6. What’s Block 15C for?

It’s where you show the employee’s earnings for each pay period. This helps Service Canada figure out the person’s EI benefits.

Conclusion

The Record of Employment (ROE) is one of the most important forms for employees in Canada. It connects their work history to their Employment Insurance claim.

Employers should know when to issue it, how to fill it out, and where to submit it. Whether you’re dealing with full-time staff, contract workers, or real estate agents, making sure the ROE is done right keeps everything smooth for both your team and your company.

.png)