A GST/HST return is a tax report filed with the Canada Revenue Agency (CRA) that summarizes how much Goods and Services Tax (GST) or Harmonized Sales Tax (HST) your business collected and paid. It helps determine whether you owe tax to the CRA or are eligible for a refund.

If you’re a small business owner in Canada, understanding how to file this return is one of the simplest ways to stay compliant, avoid penalties, and keep your cash flow predictable. Here’s what it involves and how Mesa CPA helps you stay on top of it.

1. What Is GST/HST

The Goods and Services Tax (GST) is a federal sales tax of 5% applied to most goods and services in Canada. In some provinces, it’s combined with the Provincial Sales Tax (PST) to form the Harmonized Sales Tax (HST).

HST rate by province:

British Columbia: 5%

Ontario: 13%

New Brunswick: 15%

Prince Edward Island: 15%

Types of sales tax across Canada:

- GST only (e.g., Alberta)

- HST (combined)

- Separate GST + PST (e.g., BC, Saskatchewan, Manitoba)

- Québec Sales Tax (QST, administered by Revenu Québec)

In short, GST/HST is the tax your business collects from customers, then sends to the CRA.

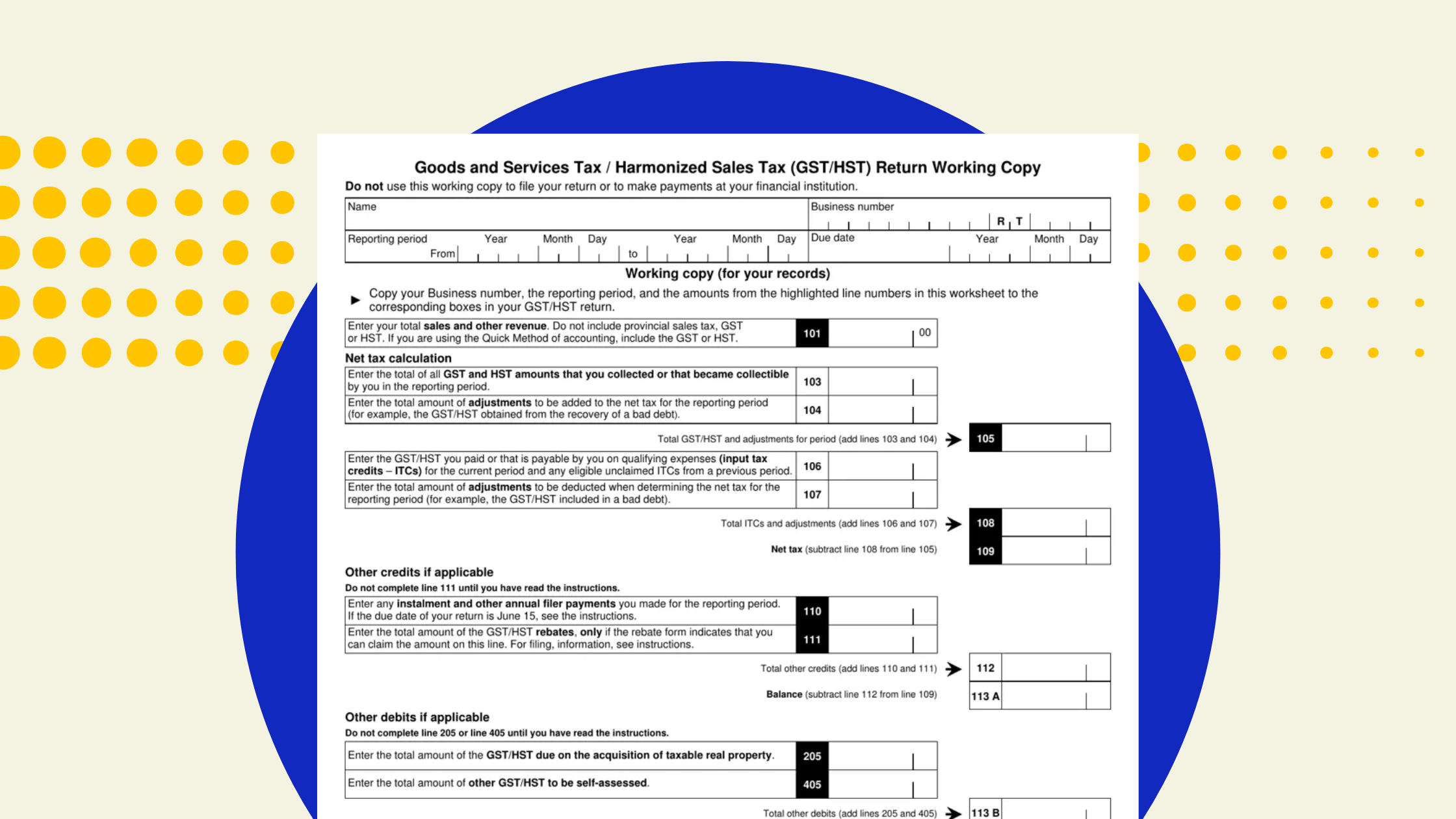

2. What Is a GST/HST Return

A GST/HST return summarizes:

- The total GST/HST you collected from sales

- The GST/HST you paid on eligible business purchases (known as Input Tax Credits, or ITCs)

Formula:

GST/HST Collected – ITCs Claimed = Amount to Remit (or Refund)

Businesses can file using two main methods:

- Regular Method: Track and claim all ITCs based on detailed records.

- Quick Method: Remit a fixed percentage of your sales instead of claiming ITCs individually — often ideal for small service-based businesses.

Mesa helps you determine which method gives you the best net tax outcome.

3. Who Needs to File a GST/HST Return

You must file if:

- Your business earns $30,000 or more in four consecutive quarters

- You sell taxable goods or services in Canada

- You operate a taxi, rideshare, or delivery service (mandatory registration)

If you’re under $30,000, you’re considered a small supplier, but you can still register voluntarily to claim ITCs or prepare for growth.

To register, you’ll need a Business Number (BN) and can apply through Business Registration Online on the CRA website or by mail via Canada Post.

Mesa insight: Waiting too long to register can mean missing refundable credits. Mesa CPA ensures your registration, filing frequency, and method are set up correctly from the start.

4. Reporting Periods and Filing Frequency

Your reporting period—how often you must file—depends on your annual revenue:

| Annual Revenue | Reporting Period | Example |

| $1,500,000 or less | Annual (option for quarterly/monthly) | Small consultancy |

| $1,500,000 – $6,000,000 | Quarterly | Medium-sized business |

| Over $6,000,000 | Monthly | Large corporation |

Choosing a shorter period helps with cash flow and avoids surprises. Mesa adjusts your bookkeeping to match your CRA schedule so filings remain seamless.

5. How to File a GST/HST Return (Step-by-Step)

Step 1: Gather Your Records

Collect:

- Sales invoices and receipts showing GST/HST collected

- Expense receipts showing GST/HST paid

- Reports from accounting software (QuickBooks, Xero, Wave)

Step 2: Calculate the Tax

Perform your tax rate calculation:

- Identify your HST rate based on province

- Total your tax collected from customers

- Subtract your ITCs from eligible business expenses

Step 3: File the Return

You can file through:

- CRA My Business Account

- Certified accounting software

- Paper return (mail via Canada Post) — slower but accepted

Step 4: Pay or Claim Refund

Pay electronically through CRA or your bank, or claim your refund directly to your business account.

Step 5: Keep Records

Keep documentation for at least six years for CRA or Revenu Québec reviews.

Mesa clients get ready-to-file summaries each month, making GST/HST compliance simple and stress-free.

6. Common Scenarios and Mistakes

If You File Late

CRA charges 1% of your balance owing plus interest — compounded daily until paid.

If You Made No Sales

You must still file a “nil” return to stay compliant.

If You Sell Exempt Services

Certain services (e.g., financial, educational, or medical) are GST/HST-exempt but still affect your filing obligations.

Québec Businesses

If you operate in Québec, you may need to file both GST/HST and QST returns through Revenu Québec.

7. GST/HST Credits and Adjustments

If your business expenses exceed your taxable sales, you may receive a GST/HST credit or refund. This often applies to startups or businesses with large upfront costs.

Mesa ensures these credits are correctly applied and reconciled — preventing lost refunds and unnecessary audits.

8. How Mesa CPA Simplifies GST/HST Filing

Mesa CPA combines compliance and automation to make GST/HST filing effortless:

- Setup and register your Business Number (BN)

- Configure your accounting system for accurate GST/HST tracking

- Recommend the Quick Method or Regular Method based on your business model

- File returns with the Canada Revenue Agency and Revenu Québec

- Monitor your reporting periods, payments, and refunds

9. Key Takeaways

- GST/HST is a federal sales tax you collect and remit to the CRA.

- Filing accurately and on time helps avoid penalties and interest.

- Choose between the quick method or regular method depending on your setup.

- Register using your Business Number through Business Registration Online.

- Claim eligible GST/HST credits and stay audit-ready with Mesa CPA.

Ready to Simplify Your GST/HST Filing?

Let’s make your next return the easiest one yet.

👉 Book a consultation with Mesa CPA and get your business tax-ready today.

.png)