The penalties, CRA’s process, and how to bounce back without losing sleep.

Let’s be honest — nobody plans to file a late tax return.

Maybe you were swamped with clients. Maybe your bookkeeping was behind. Or perhaps the tax season just slipped past you.

Now it’s after the original filing deadline, and you’re asking:

“Am I in serious trouble with the CRA?”

Take a deep breath. You’re not the first business owner to miss a filing obligation — and you won’t be the last. What matters is what you do next.

This guide breaks it down in plain English:

- What happens when you file late vs pay late in Canada

- How the CRA calculates penalties and interest

- When the CRA might take enforcement action

- What steps do I take now to reduce penalties and stress

- Special programs for late or incorrect tax returns

Late-Filing Penalties vs. Late Payment Penalties

In Canada, there are two corporate tax deadlines to consider:

- Corporate tax payment deadline (3 months after your year-end)

- Corporate tax filing deadline (6 months after your year-end)

Missing either has its consequences—but they’re different.

Late Payment Penalties

Even if you file your corporation income tax return on time, failing to pay your taxes on time triggers interest.

CRA charges compound daily interest on the unpaid balance.

The prescribed interest rate is set quarterly and typically ranges between 7–10% annually.

Key point: Unlike late-filing penalties, there’s no cap on interest—it keeps compounding until the full balance is paid.

Example: If you owe $10,000 and delay payment by 90 days with a 9% interest rate:

- Daily interest: 0.0247%

- Interest: 0.0247% × 90 × $10,000 ≈ $222

Late-Filing Penalties

If you owe a balance of tax and file late, the CRA charges a late-filing penalty:

- 5% of your unpaid balance, plus

- 1% per full additional month late, up to a maximum penalty of 12 months

That adds up to a potential 17% applicable base penalty rate for first-time late filers.

Example: If you owe $10,000 and file 3 months late:

- 5% of $10,000 = $500 (base penalty)

- 1% × 3 months = $300

- Total penalty: $800

And that’s before additional interest charges or late penalties…

Interest Charges on Late Taxes (Updated Quarterly)

The CRA charges compound daily interest on:

- Unpaid taxes

- Late-filing penalties

- Previous tax debt

As of Q2 2025, the prescribed interest rate is 8% per annum.

How Interest Accumulates:

- Calculated and compounded daily

- No penalty-free program or maximum limit

Example: Delay payment by 90 days at 8%:

- Daily interest = 0.0219%

- 90-day penalty interest: $197.10

Repeat Offender - Penalties Double

If you’ve had late tax returns before, the CRA increases your penalty for failure to file.

You’re considered a repeat offender if:

- You were assessed a late-filing penalty in the past 3 years

- You received a legal warning letter (formal demand) for this year

In that case:

- 10% base penalty, plus

- 2% per full or partial month late, up to 20 months

Over time, you could face excessive penalties of up to 50%.

Will the CRA Come After You?

Short answer: Yes — eventually. CRA uses automation to detect:

- Late returns for incorporated businesses

- Missing GST/HST remittance on time

- Unfiled payroll remittances

If flagged, the CRA may:

- Issue a substitute return (usually overestimated)

- Freeze your account with financial institutions

- Garnish income and benefit payments

- File liens

Important: Filing (even late) and contacting CRA is better than silence.

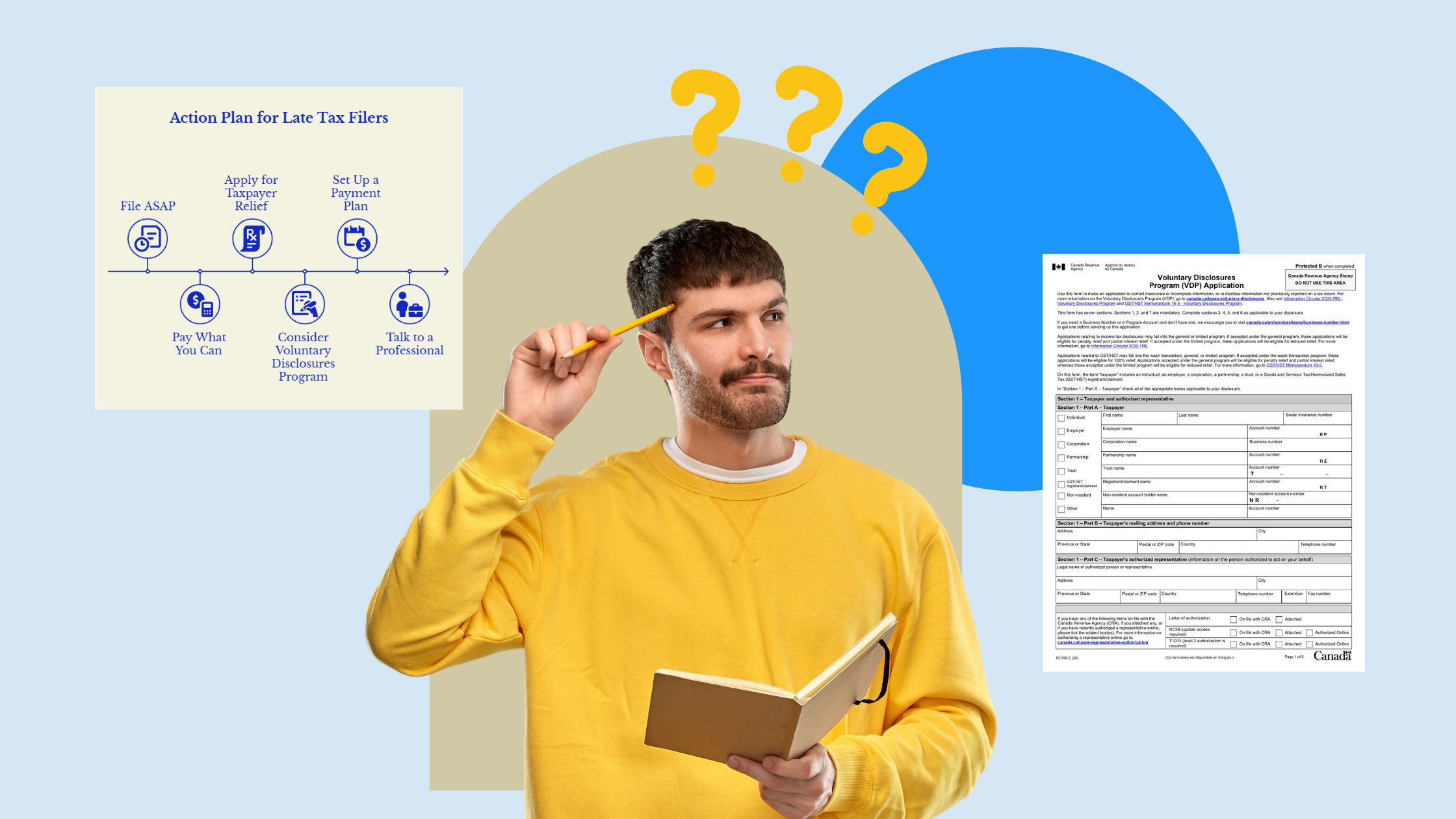

What To Do If You’re Already Late

%20-%20visual%20selection%20(1).png)

Step-by-step action plan:

- File ASAP — Even If You Can’t Pay

- Stops the late file penalty from growing

- Reduces future penalties

- Pay What You Can

- Interest is based on the unpaid portion

- Even partial payments lower interest

- Apply for Taxpayer Relief

- If your delay involved illness, natural disaster, or hardship

- May waive additional penalties

- Consider the Voluntary Disclosures Program (VDP)

- Ideal for unfiled tax returns or incorrect tax returns

- Helps avoid penalty charges and prosecution

- Set Up a Payment Plan

- CRA offers installment agreements based on your income

- Communication avoids collection notices or legal action

- Talk to a Professional (Like Us)

- Get tax advice and help with CRA communication

- We offer advice on taxes, filings, and programs like penalty abatement

Key Deadlines to Keep in Mind

- Individuals: April 30, 2025

- Self-employed people: File by June 16, pay by April 30

- Revenu Québec filers: Pay by May 31

- Corporations: Based on your tax year balance

- GST/HST filers: File by June 15, pay by April 30

The Good News: It’s Fixable

Thousands in Canada file late tax returns and bounce back. What matters most is timely action.

At Mesa CPA, we help:

- File complete returns and correct incomplete returns

- Minimize tax penalties and future penalties

- Navigate tax relief and amnesty programs

- Stay compliant for your future return

Whether it’s a personal income tax return, corporation return, or joint return, our experts can help. From balancing your credit card balance to understanding federal income tax return rules or avoiding failure-to-pay penalties, we guide you with clarity.

Need help? Get professional advice today. It’s never too late to fix a late tax return file.

.png)