For small business owners, getting paid quickly and securely is a top priority. But with so many payment processing providers available, how do you choose the right one? The wrong choice can lead to high credit card processing fees, integration headaches, and cash flow delays, while the right one can streamline operations, boost customer satisfaction, and even save you money.

Whether you own a retail store, run an e-commerce shop, or provide professional services, selecting the best business payment processor is crucial to your success. In this guide, we’ll explore the top online payment processors, breaking down their pricing structure, setup fees, and features so you can make an informed decision.

Factors to Consider When Choosing a Payment Processor

Before diving into specific payment processing companies, here are key factors to evaluate:

- Transaction Fees & Pricing Models: Look at per-transaction costs, monthly plans, and any hidden processing fees, including interchange fees.

- Ease of Integration: Ensure seamless integration with your accounting software (e.g., QuickBooks Online) and e-commerce platforms.

- Variety of Payment Methods: Accept credit card payments, debit card payments, mobile wallets like Google Pay, and alternative payment methods.

- Customer Service Quality: Reliable customer support can save you time and frustration, especially when handling credit card fraud issues.

- Security Measures: Look for fraud protection, PCI compliance fees, and Address Verification Service (AVS) tools.

Top Payment Processors for Small Businesses

1. Square

Square is a great option for brick-and-mortar businesses and e-commerce payments, offering a free payment terminal and mobile card reader.

.png?width=610&height=153&name=image%20(7).png)

✅ Best for: Retail & service businesses needing in-person and online sales support

💰 Fees: 2.65% per in-person sale, 2.9% + 30¢ per online credit card processing transaction

🔹 Pros: No monthly plan required, free credit card readers, easy setup

🔹 Cons: Higher processing fees for manually entered transactions

2. Stripe

Stripe is ideal for online checkout and subscription plans, providing robust API integrations for custom payment processing solutions.

.png?width=491&height=295&name=image%20(8).png)

✅ Best for: E-commerce & subscription-based businesses

💰 Fees: 2.9% + 30¢ per credit card transaction

🔹 Pros: Strong API, supports recurring payments, variety of payment methods

🔹 Cons: No built-in payment terminal, complex setup for non-technical users

3. PayPal

PayPal is a widely recognized payment processing provider, making it a solid choice for international payments and freelancers.

.png?width=461&height=258&name=image%20(9).png)

✅ Best for: Freelancers & international customers

💰 Fees: 2.9% + 30¢ per transaction (higher for international payment methods)

🔹 Pros: Globally recognized, no one-time fees for setup, excellent service

🔹 Cons: High credit card processing system fees for currency conversion

4. QuickBooks Payments

QuickBooks Payments is an ideal solution for businesses using QuickBooks for financial service management and bank payments.

.png?width=323&height=323&name=image%20(10).png)

✅ Best for: Businesses already using QuickBooks accounting tools

💰 Fees: 2.9% + 25¢ per credit card payment, lower rates for ACH transactions

🔹 Pros: Seamless integration, automatic transaction type reconciliation

🔹Cons: Monthly plan required for some features

5. Helcim

Helcim is a merchant account provider offering transparent interchange plus pricing with no long-term contract terms.

.png?width=398&height=261&name=image%20(11).png)

✅ Best for: High-volume businesses looking for lower processing fees

💰 Fees: Starts at 1.92% + 8¢ per credit card transaction

🔹 Pros: No setup fees, volume discounts, a wide range of payment processing tools

🔹 Cons: Requires business verification before setup

How to Choose the Right Payment Processor for Your Business

Choosing the right merchant services provider depends on several key factors:

- Business Model: Are you handling online sales, in-person payments, or a combination of both? Select a payment processing provider that aligns with your needs.

- Average Transaction Size & Sales Volume: High-volume businesses benefit from interchange plus or tiered pricing structures to reduce cents per transaction costs.

- Integration with Business Systems: Ensure compatibility with your existing software, such as QuickBooks Payments, FreshBooks Payments, or other business payment platforms.

- Preferred Payment Methods: Accept a wide variety of payment methods, including major credit cards (Visa, Mastercard, American Express) and electronic payments.

- Cost Savings: Analyze processing fees, interchange rates, and additional features to find the most cost-effective solution for your needs.

Summary

Selecting the right payment processing solutions is essential for maximizing revenue and minimizing transaction fees. Whether you need a robust in-store payment terminal, an online credit card processing gateway, or seamless integration with accounting software, there’s a payment service provider tailored to your needs.

Square, Stripe, PayPal, QuickBooks Payments, and Helcim all offer unique gateway features, so consider their pros and cons before making a decision. By choosing the right payment processing company, you can improve your checkout flow, enhance customer engagement software interactions, and set your small business up for long-term success!

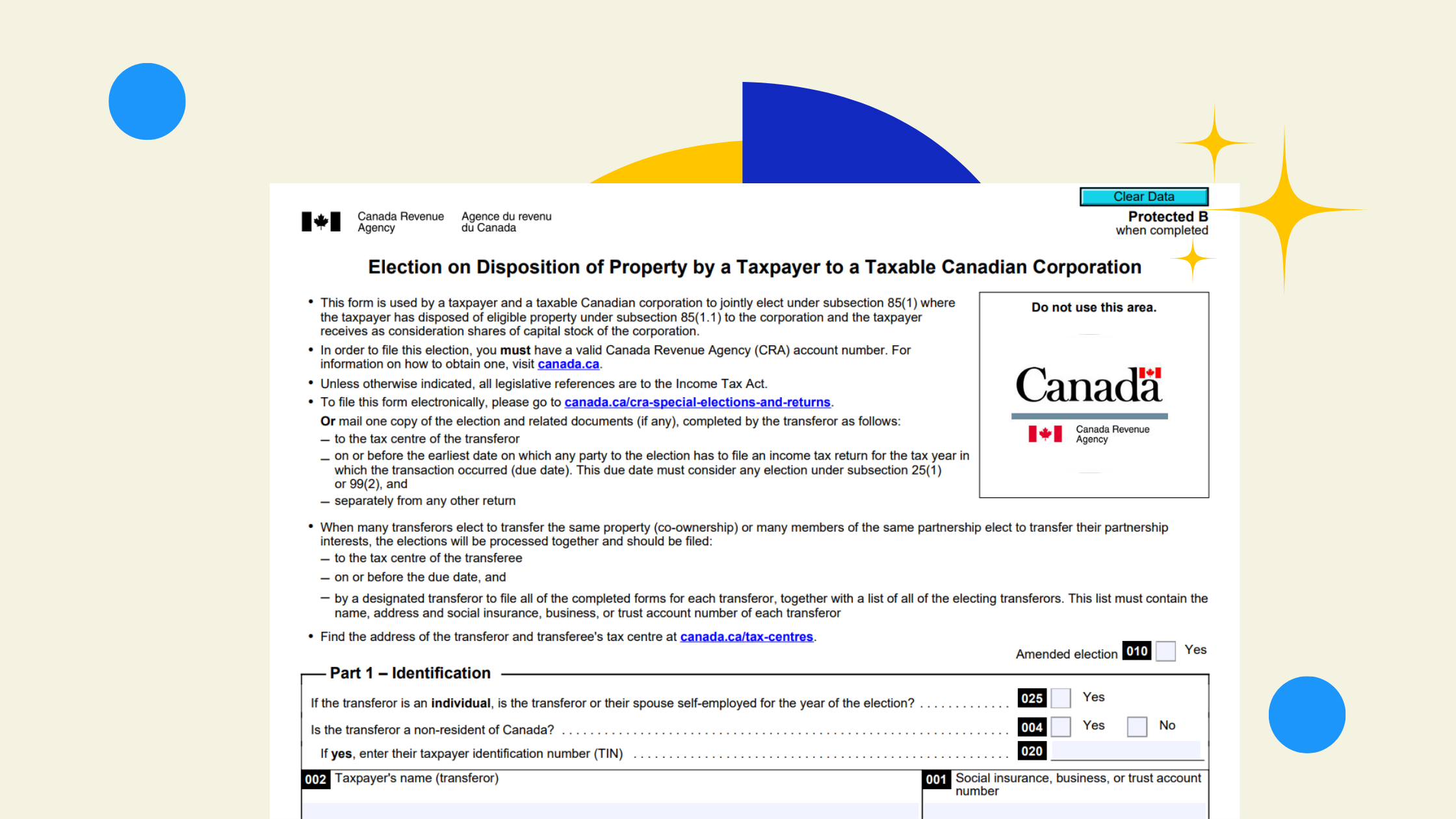

.png)