Running a business is a rollercoaster ride. The right financial safety net can mean the difference between confidently navigating unexpected expenses and facing serious setbacks. But how much money should your business keep in reserve? 🤔

1. Know Your Operating Expenses 📊💵

Understanding your monthly living expenses is the first step to building an emergency savings fund.

📝 Identify Fixed & Variable Costs: List monthly costs like rent, payroll, utilities, and discretionary expenses.

📆 Build a Buffer: Aim for savings that cover at least 3-6 months of operating expenses. A 6-month emergency fund is ideal for businesses with variable income streams or unpredictable cash flows.

Pro tip: Set up automatic transfers to a high-yield savings account to ensure consistent savings regularly.

💡 Example:

Sarah owns a mid-sized marketing agency. Her monthly expenses include:

- Rent: $5,000

- Salaries: $25,000

- Utilities & Subscriptions: $2,000

.png?width=1026&height=278&name=The%20Golden%20Rule%20of%20Business%20Savings_%20How%20Much%20Is%20Enough_%20-%20visual%20selection%20(1).png)

Her total monthly operating expenses are $32,000. To build a safety net for 3 months, Sarah needs at least $96,000 set aside.

2. Account for Industry Variability 📉📈

🌦️ Prepare for Seasonal Shifts: If your business faces seasonal income shocks, you'll need a larger cash cushion to handle off-peak months.

🛠️ Consider High Overhead Costs: Industries with substantial fixed costs (like equipment leases or specialized staff salaries) require deeper reserves. Consider a cash buffer that includes funds for emergency repairs, unplanned travel expenses, or other unforeseen expenses.

💡 Example:

Tom runs a landscaping company that thrives in spring and summer but slows down in winter. During peak months, revenue is $60,000/month, but in winter, it drops to $10,000.

To sustain his business during slow months, Tom sets aside additional reserves to cover salaries, equipment maintenance, and other overhead costs.

3. Prepare for Emergencies 🚨💳

Emergencies can strike anytime, from sudden equipment breakdowns to an economic crisis.

🛡️ Expect the Unexpected: Whether it’s a health emergency, costly repair, or economic downturn, planning for unexpected events helps prevent reliance on high-interest loans.

💼 Avoid Costly Debt: A well-funded emergency savings account can help you steer clear of payday loans, credit card debt, and personal loans during financial emergencies.

💡 Example:

Emily runs a bakery. One day, her commercial oven breaks down, and repairs cost $8,000. Thanks to her safety net, Emily can cover the cost immediately without taking out a high-interest loan or disrupting cash flow.

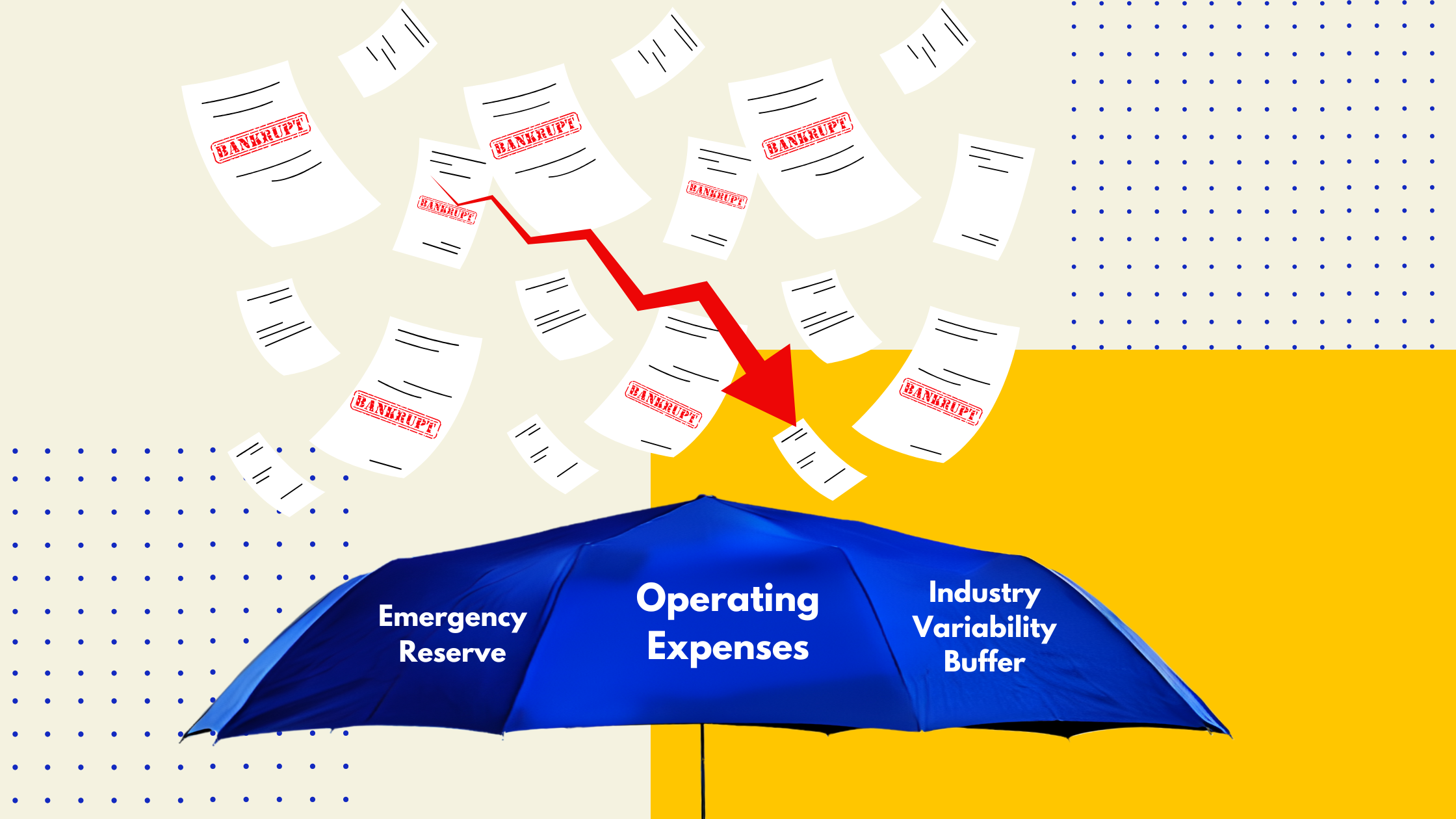

Safety Net Fund Formula 🧠📊

Your ideal safety net fund should include:

Safety Net = (3-6 months Operating Expenses) + (Industry Variability Buffer) + (Emergency Reserve)

- Operating Expenses: Covers essential monthly costs.

- Industry Variability Buffer: Accounts for seasonal fluctuations and high overhead.

- Emergency Reserve: Funds set aside for sudden expenses like unexpected car repairs or medical emergencies.

Pro tip: Use an emergency fund calculator to refine your savings goals based on your current budget and financial objectives.

💡 Example:

If your safety net goal is $120,000 and you’ve used $24,000:

- $24,000 ÷ 12 = $2,000 per month

By saving $2,000 monthly, your safety net will be replenished in one year. If cash flow allows, increase your monthly contributions to rebuild faster.

A disciplined approach ensures your safety net is always ready for the next rainy day.

Key Takeaway: Build a Smart Safety Net 🛡️💼

A financial safety net isn’t just a backup plan—it’s a strategic foundation for long-term resilience and growth. Start with a starter emergency fund, then work toward a 6-month emergency fund to ensure you’re prepared for the unexpected.

👉 Want to master your cash reserve strategy? Book a meeting here.

.png)