What is a section 85 rollover?

Learn how Section 85 rollover allows Canadian business owners to transfer assets to a corporation without immediate tax...

OUR BLOG

Add a little bit of spice to your inbox.

December 29, 2025

Learn how Section 85 rollover allows Canadian business owners to transfer assets to a corporation without immediate tax...

-1.png)

December 26, 2025

Learn the risks of putting your car in the company, from tax to insurance considerations, and discover when it makes sense for...

.png)

December 19, 2025

Learn how dividend income is taxed in Canada, including differences between eligible and noneligible dividends, and how to...

December 08, 2025

Understanding CRA GST/HST notices, common errors, and how to respond effectively. Learn compliance tips and how Mesa CPA can help...

December 05, 2025

Discover the risks of mixing personal and business expenses and learn how to keep your financial records clean to avoid CRA audits...

November 17, 2025

Learn how dividend income is taxed in Canada, when it can be tax-free, and optimize your salary-dividend mix for financial...

November 14, 2025

Learn how to file and pay your T2 corporate tax return on time, avoid penalties, and ensure compliance with the CRA using secure...

.png)

November 12, 2025

Learn about GST/HST registration numbers, who needs to register, and how to register with the Canada Revenue Agency to ensure tax...

.png)

November 10, 2025

Learn about the Canada Revenue Agency Business Number, its importance, how to register, and common mistakes to avoid for a...

October 29, 2025

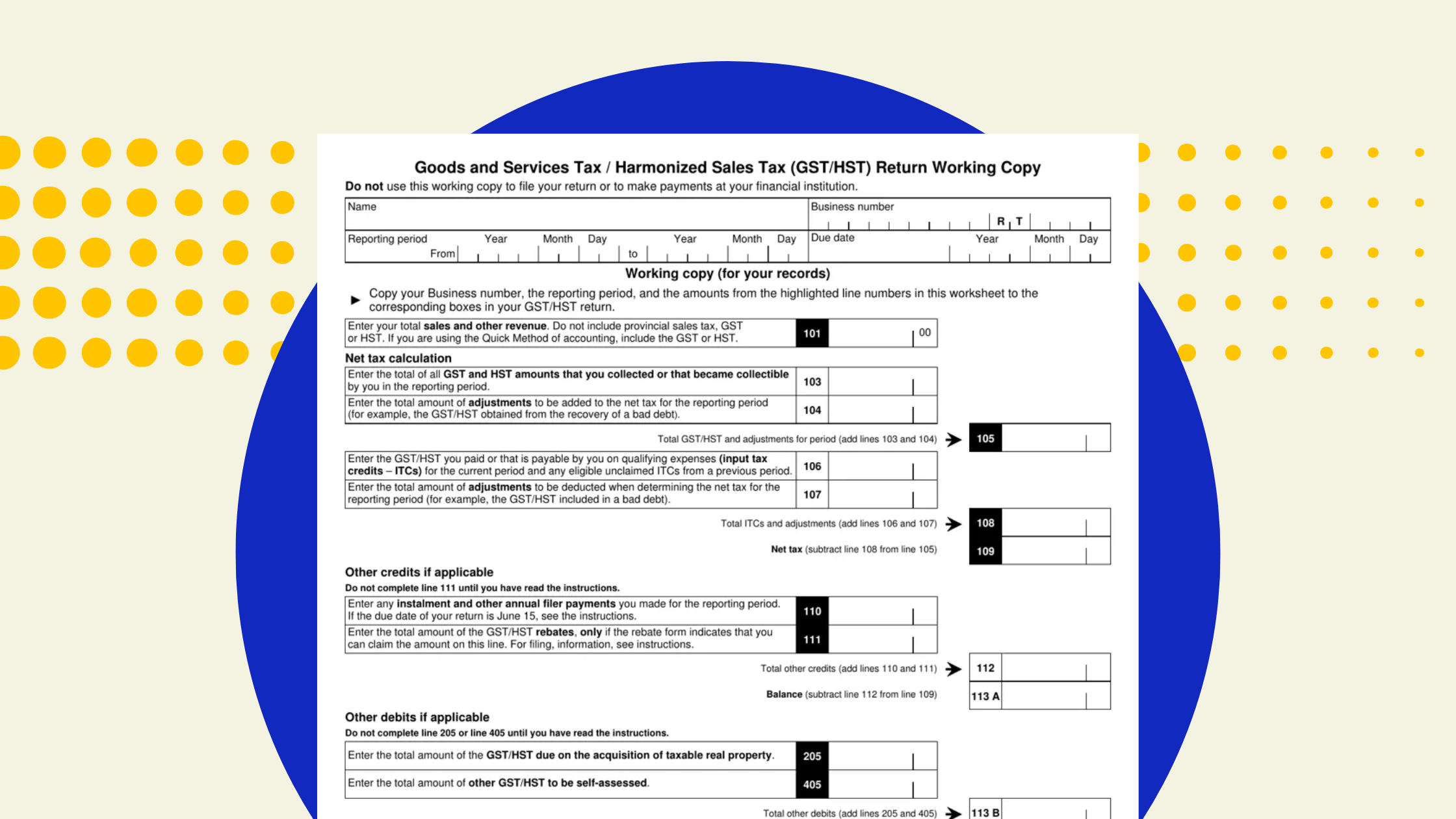

Learn what GST/HST is, how to file GST/HST returns, avoid penalties, and keep your cash flow predictable with expert guidance from...