You're crushing it on Shopify, but behind the scenes, your financial records might be telling a different story.

If your Shopify-QuickBooks integration isn’t syncing properly, even a wildly successful store can face hidden problems: duplicate transactions, inventory mismatches, inaccurate sales tax reporting, and unreliable financial reports.

And when your numbers lie, every business decision suffers. In ecommerce, accurate records aren’t a luxury — they're survival.

The good news? Most integration issues are completely preventable — if you know what to watch for. Here’s your step-by-step guide to spotting problems early and building a stable, error-free QuickBooks integration.

Common Shopify ➔ QuickBooks Integration Problems

1. Duplicate Transactions

Sales can get logged twice — once by Shopify, and again by your payment processors (like Stripe or PayPal).

Result? Inaccurate revenue, wrong tax reports, and hours wasted cleaning up duplicate records.

Pro tip: Monitor the connector logs inside your integration app to catch these errors fast.

2. Missing Fees and Payout Reconciliations

Shopify and payment gateways deduct fees before depositing your money. If your QuickBooks Connector doesn’t account for these adjustments, you’ll overstate your income — and understate your expenses.

Leading to... costly errors during tax season.

3. Wrong Tax Reporting

If Shopify’s tax settings (for GST, HST, PST, VAT, etc.) don't match your QuickBooks setup, you'll generate incorrect journal entries.

This can trigger tax compliance risks and expensive penalties later.

4. Inventory Mismatches

Managing inventory updates on both Shopify and QuickBooks? You're asking for trouble.

Discrepancies in stock levels lead to broken COGS tracking, bad financial reporting, and misinformed restocking decisions.

5. Faulty or Overcomplicated Connector Apps

Not all third-party integration apps are built equally.

Some connector apps, like QuickBooks Connector and Desktop Connector, struggle with multi-currency transactions, purchase orders, or stock updates, creating inaccurate records.

6. Sync Delays and Data Limits

Syncing isn’t always instant.

Editing a Shopify order after syncing? Prepare for out-of-sync records if your connector can’t handle retroactive changes.

How to Avoid These Shopify-QuickBooks Integration Nightmares

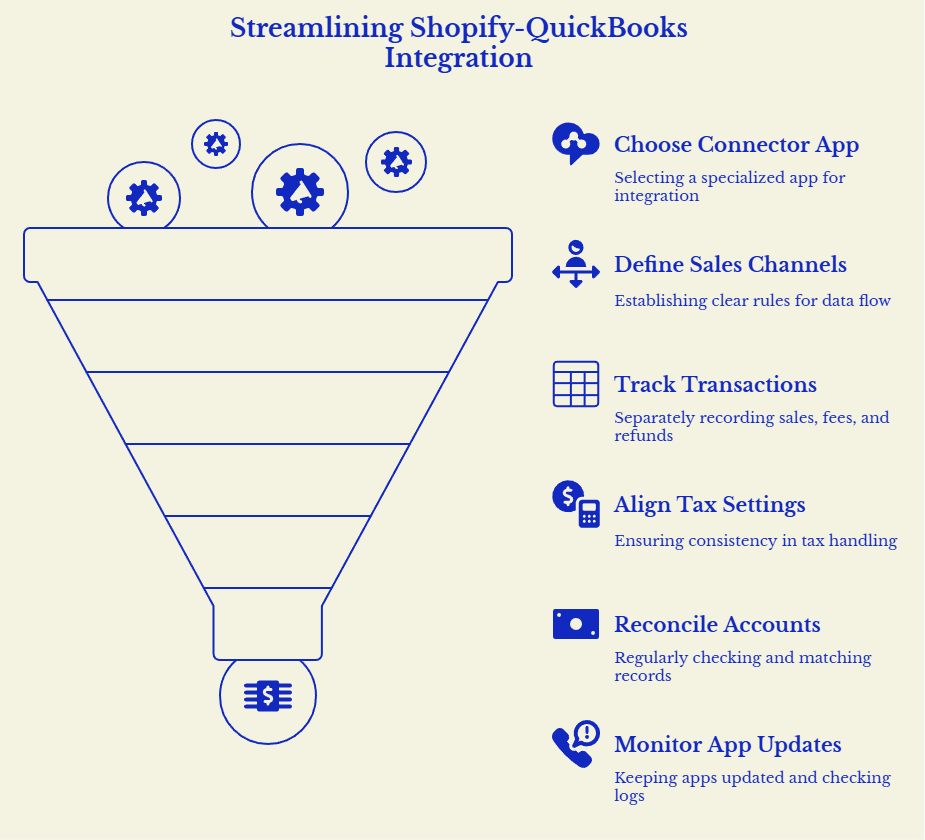

1. Choose the Right Connector (and Set It Up Properly)

Top-rated options like A2X, Bold Commerce, and AllowingQuickBooks Connector create structured journal entries for daily sales, refunds, fees, and taxes.

✅ Map transactions to the correct accounts

✅ Set up payment mappings properly

✅ Test your sync setup using a small batch before scaling

2. Establish a Master Record

Decide early:

- Will Shopify or QuickBooks own the “truth” of your data?

- Choosing the right integration settings prevents duplicate transactions and conflicting inventory updates.

3. Separate Gross Sales, Fees, and Net Deposits

The best advanced integration tools don't just lump deposits into one line item.

They track gross sales, refunds, gateway fees, and taxes separately for accurate financial operations and smooth tax reporting.

4. Align Your Tax Setup

In Canada, especially, misaligned tax rates between platforms can spell disaster.

Match Shopify’s settings to QuickBooks, and review them after any platform update or new product launch.

5. Reconcile Regularly

Even with automatic sync, monthly reconciliation is non-negotiable.

Compare Shopify payouts against bank deposits and QuickBooks Online records to spot errors before they snowball.

6. Monitor Sync Logs and App Updates

Connector mapping issues happen. Stay on top of your app’s update schedule and review sync logs regularly to catch problems early.

Bonus Tips for a Smooth Shopify-QuickBooks Integration

- Use Class Tracking: Assign sales by product line or marketing campaign to get better insights.

- Audit Inventory Monthly: Especially important if you offer gift cards or deal with overseas sales.

- Review Integration App Reviews: Avoid third-party apps with a history of sync failures or class action lawsuits.

- Work with an Accounting Expert: A professional can set up your integration of items, taxes, and advanced options properly, saving you hours of headaches.

Final Thoughts: Integration Should Make Business Easier — Not Harder

The right Shopify-QuickBooks integration process should:

✅ Eliminate manual data entry

✅ Improve financial reporting accuracy

✅ Boost the efficiency of commerce operations

✅ Reduce tax-time stress

✅ Help you focus on customer engagement and scaling your store

But poor setup — or ignoring integration issues — creates messy books, missed deductions, and risky compliance problems.

If you’re tired of chaotic books or struggling with syncing headaches, you’re not alone.

We've helped countless Canadian business owners streamline their financials, automate reporting, and grow their online sales without accounting headaches.

👉 Need help building a strong, stable Shopify-QuickBooks setup?

Talk to one of our experts, and turn your ecommerce financials into a real competitive advantage.

.png)