Does it ever feel like you’re barely scraping by, even though your business is generating plenty of revenue? Maybe you’re juggling bills, scrambling to make loan repayments, or constantly asking yourself, “Where did all the money go?”

Here’s the thing: it’s not just about how much money you’re making—it’s about how you’re managing it. If your cash flow feels like a mystery, the root of the problem could lie in how your bank accounts are set up.

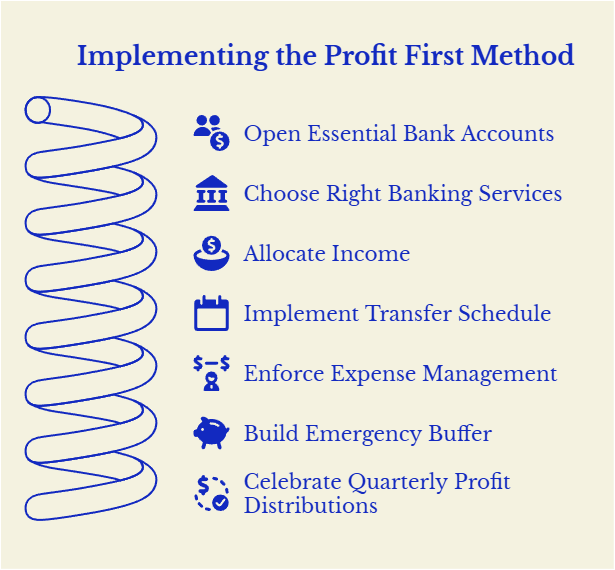

That’s where the Profit First Method comes in. By reorganizing your business finances and prioritizing profit from day one, you can finally take control of your cash flow, eliminate financial struggles, and build a profitable business. Let’s dive into the step-by-step guide to setting up your Profit First bank accounts.

Step-by-Step Guide: Setting Up Your Profit First Bank Accounts 🏦💰

The Profit First Method, developed by Mike Michalowicz, flips the traditional accounting formula on its head. Instead of thinking:

Income - Expenses = Profit,

this system works like this:

Income - Profit = Expenses.

This shift ensures you focus on PROFIT first. By managing cash flow using multiple, separate bank accounts, the method creates “small plates” of funds to control spending and encourage disciplined financial management. Here’s how you can implement it:

1. Open the Essential Profit First Bank Accounts 🏦✍️

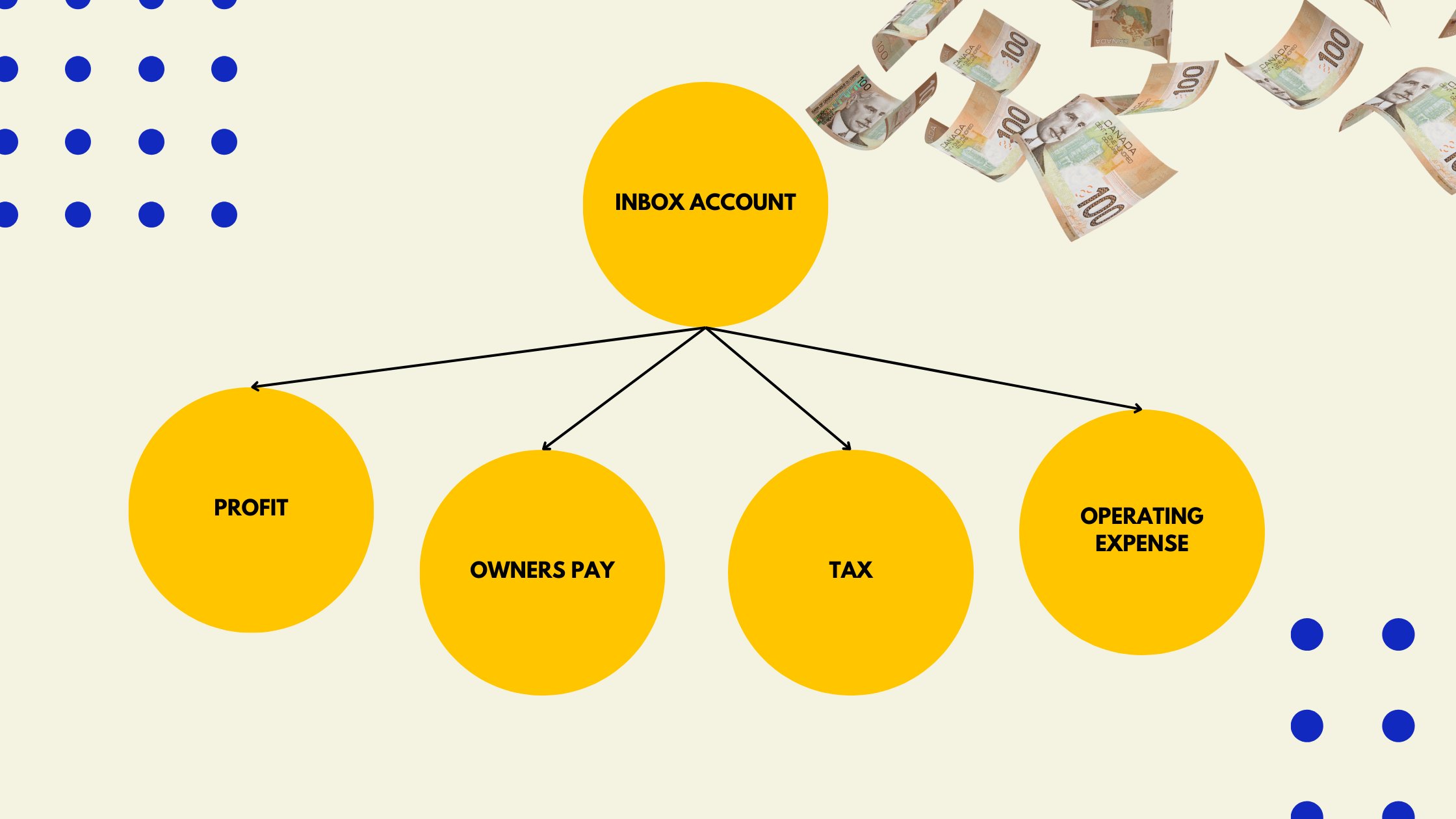

To allocate your income effectively, start by opening these five foundational accounts:

- Income Account 💸

- Purpose: The “inbox” for all deposits from sales and other revenue.

- Why It’s Important: Keeps incoming cash deposits separate from expenses and allocations, providing a clear picture of your business revenue.

- Profit Account 🎉

- Purpose: Reserve a percentage of revenue as profit.

- Why It’s Important: Ensures your business profit goals are prioritized and rewards you for your business’s success.

- Owner’s Pay Account 👩💰

- Purpose: Pay yourself a consistent salary.

- Why It’s Important: Guarantees fair compensation for you, the busy entrepreneur.

- Tax Account 🇽💵

- Purpose: Save for business tax requirements.

- Why It’s Important: Prepares you for tax obligations and prevents unexpected financial struggles.

- Operating Expenses Account 💳

- Purpose: Cover necessary costs like rent, software, and marketing.

- Why It’s Important: Encourages disciplined spending by limiting funds available for operational expenses.

.png?width=590&height=518&name=Struggling%20to%20Manage%20Your%20Cash%20Flow_%20The%20Problem%20Might%20Be%20in%20Your%20Bank%20Accounts%20-%20visual%20selection%20(1).png)

2. Set Up Your Accounts at the Right Bank 🏦✅

Choosing the right banking services can make a big difference in maintaining financial stability:

- Look for a business banking platform with low or no fees and features like easy transfers between accounts.

- Pro Tip: Open your Profit and Tax Accounts at a separate bank to reduce the temptation to dip into these funds.

- Consider platforms like Tangerine Business Savings or others tailored for Canadian entrepreneurs and small businesses.

3. Allocate Income Using “Small Plates” 🍽️

Much like portion control helps with healthy eating, allocation percentages ensure you’re spending within your means. Here’s a common target allocation percentage breakdown:

- Profit 🎉: 5%

- Owner’s Pay 💰: 50%

- Tax 💵: 15%

- Operating Expenses 💳: 30%

These percentages can vary depending on your business structure, annual revenue, and industry (e.g., retail or contractor businesses). Regularly review and adjust your allocation amounts to reflect your business’s evolving financial position.

4. Implement a Transfer Schedule 📅🔄

Create a consistent transfer schedule to ensure cash flow stability:

- Deposit all revenue into the Income Account.

- Distribute funds to the other accounts based on your Target Allocation Percentages.

- Stick to the schedule (weekly, biweekly, or monthly) to develop disciplined financial habits.

This process transforms your cash flow management, allowing you to make informed decisions with clarity.

5. Enforce Discipline with Expense Management 🛠️

Stay financially healthy by managing your cash outflows effectively:

- Use your Operating Expenses Account for business expenses only.

- Review your Profit and loss Statement (P&L) and Balance Sheet regularly to identify unnecessary expenses and ensure your cumulative sales support your financial goals.

- Example: Are your marketing expenses yielding a proportional return?

6. Build an Emergency Buffer and Celebrate Quarterly Profit Distributions 🎉🍾

- Emergency Buffer: To add financial stability, save at least three months’ worth of operating expenses in your Profit Account.

- Quarterly Rewards: Once your buffer is established, distribute 50% of your Profit Account balance as a reward and leave the other half to grow your safety net.

This balanced approach helps maintain cash flow stability while celebrating your business's success.

Take Action Today 🚀

Don’t let financial struggles dictate your business’s future. Start implementing the Profit First Method today:

- Open the five essential accounts for your business banking purposes.

- Allocate even a small percentage of revenue to each account.

- Commit to disciplined spending and celebrate your progress.

By using this accounting strategy and focusing on profit, you’ll transform your finances, reduce stress, and build a thriving, profitable company.

Need help setting up your accounts or refining your business plan?

Contact a Profit First Professional or accounting expert for personalized guidance!

.png)