What is a pay stub?

A pay stub (also called a wage statement, payslip, or earnings statement) is a document employers provide to employees each pay period. It outlines the employee’s earnings, deductions, and net pay.

For employers, pay stubs serve two main purposes:

- Legal compliance – Most Canadian provinces legally require employers to issue them.

- Transparency – Employees can clearly see how their wages were calculated and what deductions were taken.

Are employers required to provide pay stubs?

Yes, employers must provide pay stubs to employees every payday.

- Federal level: Employers must deduct and remit income tax, CPP/QPP, and EI contributions.

- Provincial level: Each province sets its own rules on what details a pay stub must include (see matrix below)

Employers who fail to provide pay stubs or omit required details risk penalties, audits, and disputes with employees.

What information does a pay stub have?

Every employer-issued pay stub must include specific details.

At minimum, employers should provide:

- Employee’s Name and Employer’s Name

- Work Period/Pay Period covered

- Pay Rate and applicable pay codes (regular, overtime pay, vacation pay, general holiday pay, commissions, bonuses)

- Gross Earnings before deductions

- Mandatory deductions: federal/provincial income tax, Canada Pension Plan, Employment Insurance, union dues

- Other deductions: group insurance, pension plan contributions, medical/health benefits

- Net Pay/Net Income after deductions

Employers may also include:

- Signature image for verification

- Cloud storage or digital access to payroll records

- Customer support or chat support contact details for payroll assistance

This ensures employees can review their employment income clearly and identify errors before filing their tax return.

Differences in pay stubs by province

Although federal rules apply nationwide, each province requires specific pay stub details:

- Ontario: Requires pay codes and pay rate per period, plus total gross pay, deductions, and net pay.

- British Columbia: Must show hours worked, pay rate, and any overtime pay or vacation pay.

- Quebec: Pay slips must be bilingual (French & English) and reflect collective agreement rules where applicable.

- Alberta: Employers must provide pay statements each pay period—digital or paper is allowed.

Employers should confirm details in their provincial employment standards legislation.

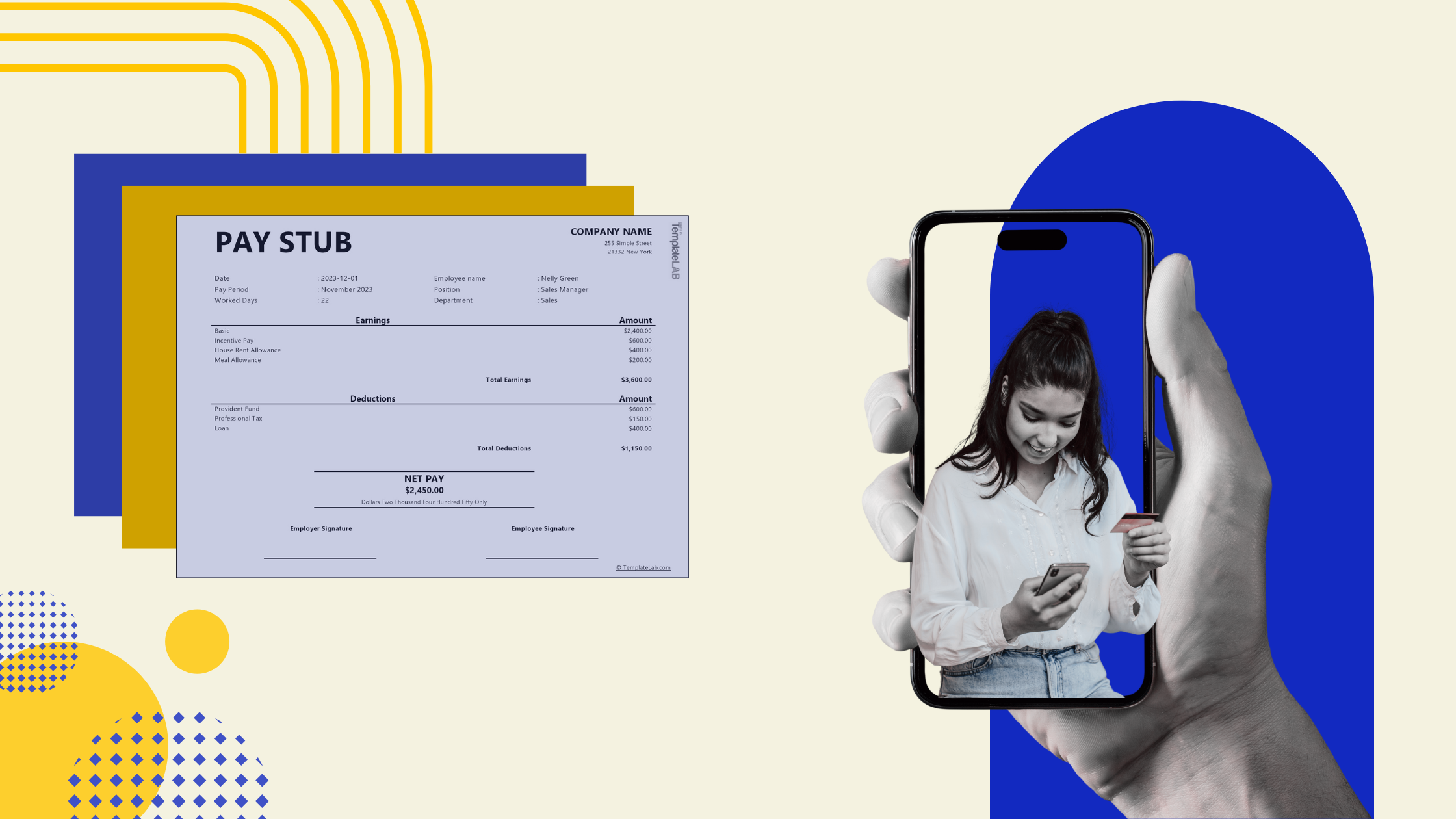

Examples of pay stubs

Here are some pay stub examples Canada employers can reference when creating payroll documents:

Example 1: Hourly Pay Stub

- Employee Information: Employee’s name, employer’s name, work period

- Salary Information: Hours worked, hourly pay rate

- Gross pay: Regular + overtime hours

- Deductions: Income tax, EI, CPP, union dues

- Net pay: Amount deposited after deductions

Example 2: Salaried Pay Stub

- Fixed salary per pay period

- Pay codes and abbreviations for pension plan and group insurance

- Gross earnings remain the same each period

- Deductions: income tax, CPP, EI, medical and health benefits deductions

- Net income shown after mandatory and voluntary deductions

Example 3: Commission-Based Employee Pay Stub

- Base salary + commission earnings

- Pay system applies appropriate income tax and CPP/QPP deductions

- Net pay varies based on sales performance

- Useful for industries like real estate, insurance, or sales-based employment

Example 4: Overtime and Bonus Pay Stub

- Regular earnings + overtime pay calculated by pay codes

- Vacation pay and general holiday pay shown if applicable

- Bonus taxed at federal income tax brackets

- Deductions include employment insurance, Canada Pension Plan, and union dues

- Final net income deposited into the employee’s bank account

How to create a paystub

Employers can create pay stubs using several methods:

- Payroll Software

- Automated systems like ADP Canada, QuickBooks Payroll, or Ceridian generate accurate pay stubs with integrated CRA tax rates.

- Features like cloud storage, digital camera upload (signature images), and personalized assistance via chat support simplify payroll management.

- Instant Mobile Pay Stub Maker

- Online tools like Create Your Stub allow employers to instantly generate pay stubs on mobile or desktop.

- Employers just input Employee Information, Salary Information, and Email Information, and the system creates a professional pay slip.

- Manual Pay System

- Employers can design pay statements in Excel or Word.

- Riskier, since errors in applying income tax system, federal income tax brackets, or tax exemptions can lead to CRA audits.

✅ Best practice for employers: Use payroll software or Instant Mobile Pay Stub Makers to remain compliant, reduce manual errors, and streamline the payroll process.

Conclusion

For employers, providing accurate pay statements isn’t optional—it’s a legal responsibility under Canadian employment standards. By ensuring each pay slip shows gross pay, deductions, net pay, employment earnings, vacation pay, pension contributions, and overtime pay, businesses remain compliant while supporting employees in their financial planning.

Whether you choose payroll software, a mobile pay stub maker, or manual systems, ensuring compliance with the Canada Revenue Agency and Gouvernement du Canada should always be the top priority.

Frequently Asked Questions for Employers About Pay Stubs

1. Do all employers in Canada need to provide pay stubs?

Yes, most provinces require employers to issue pay stubs every payday.

2. Can I give digital-only pay stubs?

Yes, as long as employees can access and print them if needed.

3. What happens if I miscalculate deductions?

Employers may face CRA penalties and employee disputes. Always verify payroll accuracy.

4. Are employer CPP and EI contributions shown on pay stubs?

It’s not mandatory, but many employers include them for transparency.

5. How long do I need to keep payroll records?

At least three years in most provinces.

6. Where can I get free pay stub templates for my business?

The Government of Canada payroll resources and payroll software providers offer templates.

.png)