Are You Paying Taxes on Income You Haven’t Earned Yet?

If your business takes deposits or advance payments for projects or services (especially those delivered in another fiscal year), you might be paying taxes on money you haven’t earned yet. This happens when upfront payments are incorrectly logged as income. The result? Overstated revenue, higher taxes, and less cash flow.

This typically applies to:

- Construction Companies

- Design Studios

- Developers

- Any company that takes deposits

The fix is simple: deferred revenue tracking. Let’s break it down.

Deferred Revenue in Action

Lets say Precision Builders takes 30% deposits for projects, covering materials and planning. They take on a project in November that carries into the next year, but they made one critical mistake: they recorded deposits as income in the year they were received.

🚫 What went wrong?

- Bigger Big Tax Bill: They paid taxes on money that wasn’t earned until the next year.

- Cash Flow Confusion: Without tracking, they didn’t know how much money was for delivering current projects versus funding new growth.

✅ The Fix: Precision Builders can begin treating deposits as deferred revenue—a current liability on the books until the project was completed. This can help defer their tax liability, clarify their finances, and help them choose when to focus on delivery vs growth.

💙 The Lesson: This problem only happens if the work you’re paid for crosses into the next year. If your deposits and delivery happen in the same year, this won’t apply.

The Core Idea: Keep Deposits Out of Revenue Until the Job’s Done

Deferred Revenue is any unearned revenue that you've been paid but haven't delivered on yet.

To track it accurately - here's a simplified version what needs to happen:

- Mark Deposits as Liabilities: Until you fulfill the project, upfront payments don’t belong to you yet.

- Recognize Income Only When Earned: Move deposits into revenue only after delivering the product or service.

This process ensures you:

- Only pay taxes on earned income.

- Keep your cash flow clear.

- Focus on finishing current projects instead of chasing new ones.

SOP: Deferred Revenue Tracking in QuickBooks Online

So you know you have to track deferred revenue - but how do you actually do that in your accounting system?

Step 1: Create a “Customer Deposits” Liability Account

- In QBO, go to Chart of Accounts.

- Create a new account → Select Liability.

- Name it Customer Deposits.

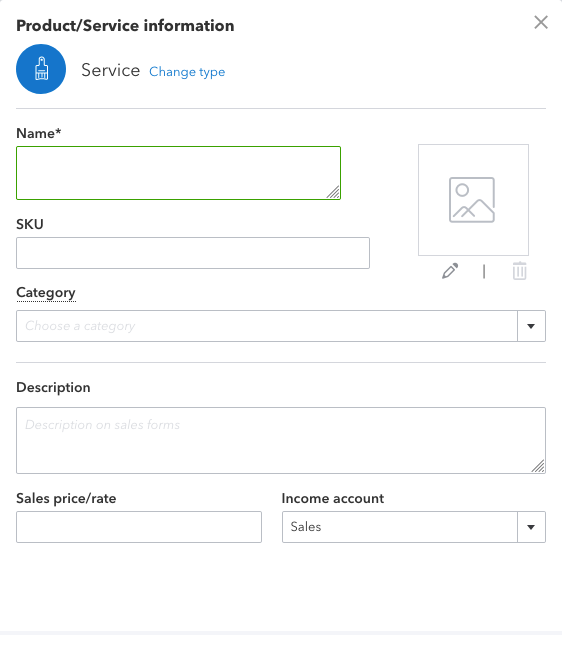

Step 2: Add a Product Called “Deposit” Linked to This Account

- Go to Products and Services.

- Create a product called Deposit.

- Link it to the “Customer Deposits” liability account.

- Use specific names like “Web Design - Deposit” for clarity.

Step 3: Invoice Deposits Correctly

- Add the “Deposit” product to your invoice.

- Verify it maps to the “Customer Deposits” account.

- Set Taxes to Out of Scope to keep deposits off your sales tax report.

Step 4: Recognize Income When Work Is Complete

- On the final invoice, list your actual service item as revenue.

- Add a line item to credit the deposit from “Customer Deposits.”

- Turn on Sales Tax for the final invoice if applicable.

The Gist

Deferred revenue tracking helps businesses with projects extending into the next year:

- Save on Taxes: Pay taxes only on money you’ve earned.

- Cash Flow Clarity: Separate funds for delivery from money available for growth.

- Operational Focus: Prioritize completing current projects over expanding prematurely.

FAQ

Q: Does this apply if I complete my projects in the same year as the deposit?

A: Its less of a problem if you complete your projects within the year - however tracking your differed revenue can still give you a clearer picture of your business.

Q: Why is deferred revenue a liability?

A: It represents an obligation to deliver services or products before the money is yours to keep.

Q: Can I implement this mid-year?

A: Yes, but you should consult an accountant to adjust past records properly and stay compliant.

.png)

.png)