Running a small business in Canada means keeping up with your tax obligations — and one of the most frequent ones is filing your GST/HST return.

Whether you’re registered federally under the Goods and Services Tax (GST) or provincially under the Harmonized Sales Tax (HST), the Canada Revenue Agency (CRA) expects you to file accurate and timely GST returns.

This guide walks you through exactly how to file, what to prepare, and how to avoid the most common mistakes business owners make.

What You Need Before Filing Your GST/HST Return

Before you begin the filing process, make sure you have the following ready:

CRA Business Number (BN) and GST/HST Account

Your Business Number (BN) is your universal identifier for the CRA.

When you register for GST/HST, you receive a program account number — for example, 123456789 RT0001.

Without this GST number, you can’t file GST returns or claim credits.

💡 If you’re not yet registered, you can sign up through Business Registration Online (BRO) on the CRA website.

Sales and Purchase Records

Keep detailed sales tax and purchase records for the reporting period.

These include:

- Invoices issued to clients (showing GST/HST charged)

- Receipts for business-related purchases

- Details for zero-rated goods, exempt goods, and zero-rated supplies

Accurate record-keeping ensures you report total taxable sales correctly and can claim Input Tax Credits (ITCs) without issues.

Input Tax Credits (ITCs) Documentation

ITCs let you recover the GST/HST paid on eligible business expenses.

To claim them, you must have proper documentation — invoices, receipts, or contracts — clearly showing the Goods and Services Tax or Harmonized Sales Tax paid.

Accounting Software or CRA My Business Account

You can file GST returns using:

- CRA’s My Business Account portal

- Accounting software like QuickBooks, Xero, or Wave (most are CRA-certified)

- Form GST34-2 (paper form) if you still prefer to file by mail

Online filing is faster and allows for direct payment or refund processing.

Step-by-Step Guide: Filing Your GST/HST Return Online

Step 1: Gather Documentation and Records

Organize all invoices, receipts, and financial records.

Ensure your total taxable sales, zero-rated supplies, and eligible ITCs are ready to enter.

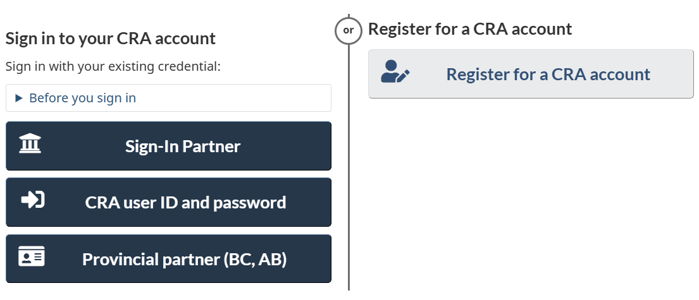

Step 2: Log into CRA My Business Account

- Go to the CRA website and sign into My Business Account.

- Use your CRA credentials or a Sign-In Partner (like your bank).

Note: If you manage multiple businesses, select the correct BN and GST/HST account.

Step 3: Select GST/HST Return to File

From your overview dashboard:

- Choose your RT account (your GST/HST program number)

- Click File a Return

You’ll now access your current reporting period.

Step 4: Select the Reporting Period

Pick the right filing period — monthly, quarterly, or annual — based on your business registration.

Incorrect periods cause rejected filings or late-filing penalties.

💡Filing deadlines vary depending on your assigned frequency.

Step 5: Enter Return Details

Fill in the following:

- Total sales (including GST/HST)

- Zero-rated supplies and exempt goods

- GST/HST collected

- GST/HST paid on eligible expenses (for ITCs)

If you had no activity, file a nil return with all zeros — still mandatory.

Step 6: Add Adjustments or Rebates (If Applicable)

Add any:

- Rebates or special adjustments

- Bad-debt write-offs

- Changes in use or capital property adjustments

- Provincial credits (where applicable, such as British Columbia or Quebec)

Step 7: Review, Confirm, and Submit

Double-check your figures before submitting.

The CRA system calculates your net tax — the difference between what you collected and what you can claim back.

Once satisfied, click Submit and record the confirmation number shown on screen.

Step 8: Save Confirmation and Records

Download the PDF summary and CRA confirmation page.

Keep these along with your sales and expense documentation for at least six years, as required by law.

Step 9: Payment or Refund

If you owe taxes:

- Use CRA’s My Payment system

- Pay through your financial institution

- Send via online banking (use “Federal – GST/HST Payment” as the payee)

If you’re due a refund, ensure your direct deposit information is current.

Tips and Reminders for Filing

✅ File on time to avoid late-filing penalties and interest.

✅ Track your GST/HST rate changes (especially if you operate across provinces with Provincial Sales Taxes).

✅ Back up all receipts digitally — CRA accepts digital records as long as they’re legible.

✅ When in doubt, consult your bookkeeper or accountant before submitting.

Common Mistakes to Avoid

1. Not Claiming Input Tax Credits (ITCs)

Failing to claim eligible ITCs means leaving money on the table.

Keep all GST/HST-bearing invoices organized — even small expenses like office supplies add up.

Pro Tip:

Apps like Dext, Hubdoc, or QuickBooks can automate this.

2. Forgetting to File During Zero-Sales Periods

Even if you didn’t sell anything, you still must file GST returns.

A “nil” return tells the CRA your account is active and compliant.

3. Requesting Refunds Without Documentation

If your ITCs exceed what you collected, the CRA may issue a refund — but they often verify your claim first.

Missing documentation can delay refunds or trigger audits.

Other Filing Methods

Not everyone files online. The CRA also allows:

- Paper filing using Form GST34-2 (for those without internet access)

- File GST returns via authorized third-party accounting software

- Quick Method of Accounting (a simplified approach for small businesses)

About the Quick Method

The Quick Method is designed for small businesses with annual revenues under $400,000.

Instead of tracking every ITC, you remit a set percentage of your sales to the CRA — a shortcut that simplifies record-keeping and cash-flow management.

Ask your accountant if it’s right for your business, especially if you operate in service-based industries or across multiple provinces like British Columbia or Ontario.

When to Consider Professional Help

If your business earns more than $100K/year, or deals with multiple tax jurisdictions, zero-rated goods, or exempt supplies, you might be better off outsourcing this task.

You don’t need a $250/hour accountant — many qualified bookkeepers can handle your GST/HST returns accurately and on time.

At Mesa CPA for example, we specialize in small-business tax filing and can handle CRA compliance from start to finish — so you never miss a deadline or refund opportunity.

FAQs

1. Do I have to file even if I had no sales this period?

Yes. You must file a nil return each reporting period to stay compliant.

2. What happens if I file late?

You’ll face penalties and daily interest on unpaid balances.

3. Can I claim back the GST/HST I paid on business expenses?

Yes, through Input Tax Credits (ITCs) — provided the expenses are business-related.

4. How often do I need to file?

It depends on your revenue: monthly, quarterly, or annually, as assigned by the CRA.

5. What are the filing methods?

Online via My Business Account, through accounting software, or by mail using Form GST34-2.

6. How do I pay what I owe?

Pay online via banking, CRA’s My Payment, or at your financial institution.

7. What if I overpaid or my ITCs exceed what I collected?

You’ll receive a refund or credit on your next return.

8. Do I need to keep all receipts?

Yes — CRA requires all records to be kept for at least six years.

9. What if I made a mistake after submitting?

You can amend returns online through My Business Account or contact the CRA directly.

10. What if my business sells only outside Canada?

Those are zero-rated supplies — you typically don’t charge GST/HST, but you must still file and report those transactions.

Final Thoughts

Filing your GST/HST return isn’t just a compliance task — it’s part of running a financially healthy, audit-ready business.

When done right, it protects you from penalties, helps you recover taxes through ITCs, and builds a record of responsible tax behavior with the Canada Revenue Agency.

If you want help setting up your GST/HST filing system or exploring whether the Quick Method could save you money, Mesa CPA can guide you step by step.

.png)