If you're reading this you probably know you need to file taxes - and you probably also know when (if not check out our guide here).

Now you just need to know how to file your return without risking an audit.

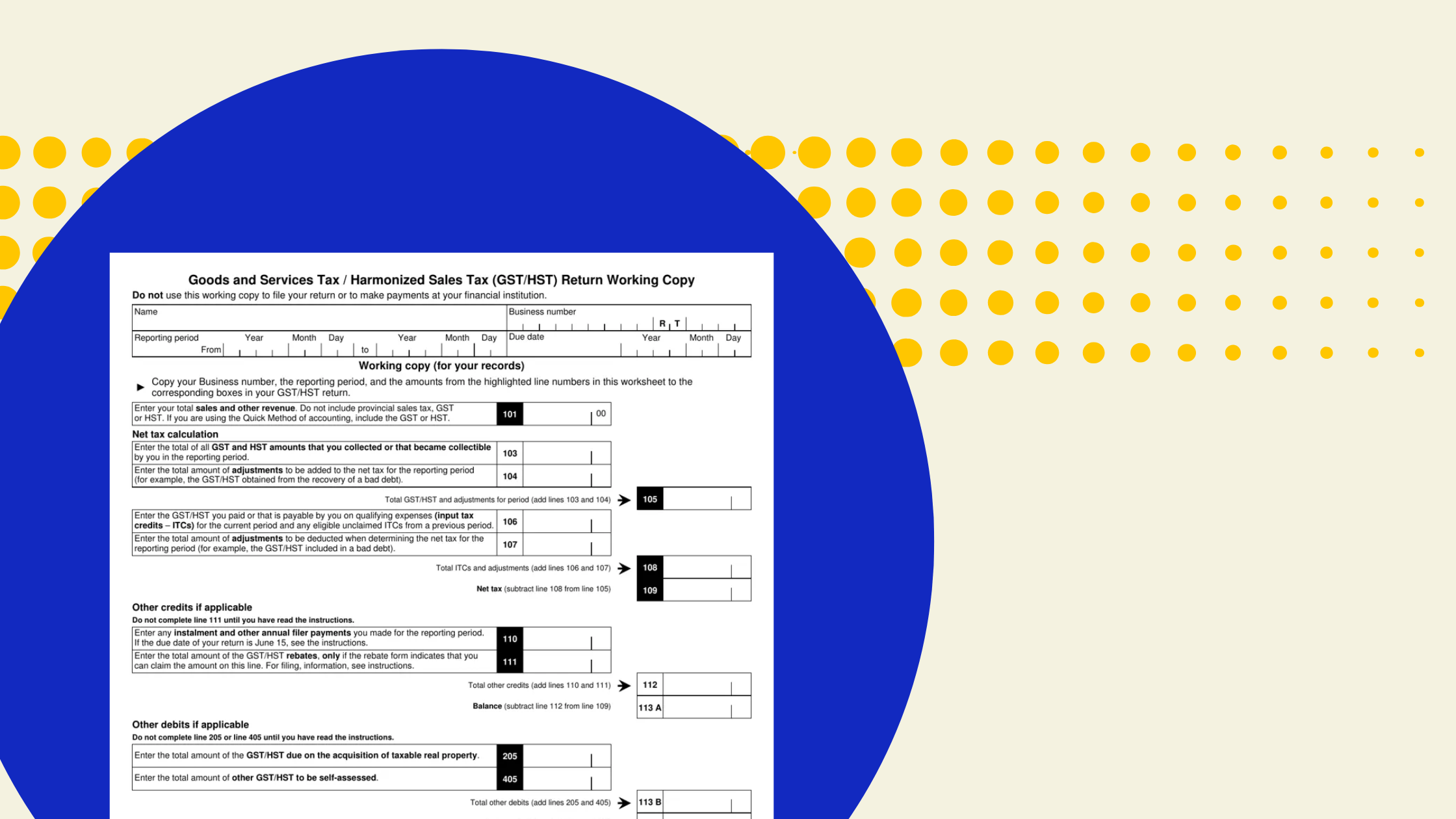

Good news - we've done this literally 1000s of times so here's a simple guide on how you can file your own GST/HST return.

What You Need Before Filing Your GST/HST Return

Before you start your Goods and Services Tax (GST) or Harmonized Sales Tax (HST) return, make sure you have everything the Canada Revenue Agency (CRA) requires to stay compliant. Proper preparation reduces your compliance effort and helps ensure you get every dollar of tax credits you’re entitled to.

CRA Business Number (BN) and GST/HST Account

You must have a CRA Business Number (BN) and a valid GST/HST account number (e.g., 123456789 RT0001). These are linked to your business registration and identify your business with Revenue Canada for tax purposes.

If you haven’t registered yet, you can do so through the Business Registration Online program (BRO).

Your business number is also used for income tax return forms, personal income tax returns, and remittance rate calculations under the standard method, quick method, or simplified method of accounting.

Sales and Purchase Records

Collect all records of sales to customers, sales tax reports, and invoices. Your sales and purchases data determine your GST/HST rate, tax rate, and overall tax return accuracy.

If you use QuickBooks, Wave, or another accounting method tool, you can easily extract reports showing sales, business activities, and eligible business expenses.

Input Tax Credits (ITCs) Documentation

Keep records for all eligible business expenses that include GST/HST — such as supplies, utilities, rent, and contractor payments. The GST/HST you pay on these purchases can be claimed back as Input Tax Credits (ITCs), which lower your net tax payable.

Pro Tip:

Organize receipts digitally using accounting software or cloud-based apps like Dext. The CRA allows digital records as long as they are legible and accessible for six years — a must during an audit or refund review.

Accounting Software or CRA My Business Account Access

You can file your HST return or GST returns directly using CRA My Business Account, your online business banking account, or certified accounting software.

If you still file by paper, mail it to the address indicated on your actual return form using Canada Post or at a Canada Post outlet. However, electronic filing is faster and safer.

Step-by-Step Guide: Filing Your GST/HST Return Online

Here’s how to complete your electronic return through CRA My Business Account.

Step 1: Gather Documentation and Records

Before you begin, ensure all invoices, receipts, and business registration details are ready. You’ll need totals for sales, purchases, and Input Tax Credits (ITCs). This ensures your tax credits are accurately calculated.

Step 2: Log into CRA My Business Account

Visit the CRA My Business Account portal and sign in using your CRA credentials or your bank (sign-in partner).

Ensure your business number and GST/HST account are linked.

If you file for clients, use the Represent a Client feature (requires CRA authorization).

Step 3: Select GST/HST Return to File

Select your business number and find the “GST/HST” section.

Click on your RT number (e.g., RT0001) and choose “File a Return.”

This opens your actual tax return form for submission.

Step 4: Select the Appropriate Reporting Period

Choose your filing frequency (monthly, quarterly, or annually).

Make sure the reporting period matches your registration threshold and business structure.

Late or incorrect period filings can lead to late filing penalty guidelines being applied.

Step 5: Enter Return Details (Sales, Tax Collected, ITCs)

Enter your:

- Total taxable sales

- Zero-rated and exempt sales

- GST/HST collected

Then, report the Input Tax Credits (ITCs) from your eligible business expenses.

If you had no sales or expenses, file a nil return (all zeros). This prevents your account from being flagged as outstanding.

Step 6: Add Rebates, Adjustments, or Special Items (If Applicable)

Some businesses qualify for rebates or use the quick method, which affects their remittance rate.

If you’ve had bad debt adjustments or made sales outside of Canada, you’ll need to complete the additional schedules on your actual return form.

Step 7: Review, Confirm, and Submit

Review your tax return carefully. The CRA system calculates your net tax payable or refund automatically.

Check the certification box and submit your return with ease.

If successful, you’ll receive a six-digit confirmation number — save this immediately.

Step 8: Save Confirmation and Download Proof

Download and save your confirmation PDF for your records. CRA requires you to keep all return documents for six years.

Keep digital copies in a secure cloud system or with your bookkeeping software.

Step 9: Payment or Refund

If you owe money:

- Pay through My Business Account,

- Use Online Business Banking,

- Or pay at a credit union, Canada Post outlet, or financial institution.

If expecting a refund, ensure your direct deposit information is current under Payment History.

Check your Payment Date, outstanding payments, and Tax Payments section regularly.

Tips and Reminders

- File on time to avoid penalty fees and interest.

- Double-check all amounts before submission.

- Keep all sales tax reports and ITC documentation for audit purposes.

- Call the CRA Business Information Line if you need clarification on your business registration online program or accounting method.

Common Mistakes (Based on Real Experience)

Even compliant businesses make these common GST/HST filing errors:

1. Not Claiming Input Tax Credits (ITCs) Due to Poor Receipt Management

Many small businesses lose hundreds of dollars by not claiming ITCs simply because receipts were misplaced or unreadable.

You can’t claim tax credits without proof of payment — and the CRA will deny unverified claims.

Pro Tip:

Use cloud accounting tools to digitize receipts. CRA doesn’t need paper copies, but your electronic return must be backed by legible documentation.

2. Forgetting to File for Zero-Sales Periods

Even if your business had no activity, you still need to file a nil GST/HST return.

Failure to do so can trigger penalty fees, CRA letters, and potential account restrictions.

3. Requesting a Refund Without Proper Supporting Documentation

If you’re expecting a refund, the Canada Revenue Agency will likely request supporting documentation.

Refund requests are where CRA scrutiny is highest. If your Input Tax Credits aren’t backed by valid invoices or receipts, your refund can be delayed, denied, or audited.

Pro Tip:

When expecting a refund, ensure every ITC claim has clear evidence — invoices, receipts, or bank statements.

Other Options: Should You File Yourself or Get Help?

If your business earns $100,000/year or more, filing your own GST/HST returns might not be worth the risk.

Mistakes in your tax return or missed ITCs can easily exceed the cost of hiring help.

Good news is you probably don't need an accountant at $250/hour to file for you as most bookkeepers can take care of the return.

If you want an extra stellar experience - speak to our team here to get a quote ;)

FAQs: Your GST/HST Filing Questions Answered

- Do I have to file even if I had no sales this period?

Yes, file a nil return every period to avoid CRA penalties. - What happens if I file late?

You may face late filing penalty guidelines and interest charges. - Can I claim back the GST/HST I paid on business expenses?

Yes, claim them as Input Tax Credits (ITCs) for eligible business expenses. - How often do I need to file?

Depends on your business structure and annual revenue — monthly, quarterly, or annually. - How do I actually file?

File online using CRA My Business Account, by mail through Canada Post, or via accounting software. - How do I pay the amount I owe?

Pay through Online Business Banking, CRA’s My Payment, or at a credit union or Canada Post outlet. - What if I overpaid or my ITCs are higher than what I collected?

You may receive a refund or credit for your next actual tax return form. - Do I need to keep all my receipts?

Yes — CRA requires all supporting documents for six years minimum. - What if I made a mistake on a return I already filed?

You can amend your electronic return through My Business Account or contact the CRA directly. - What if my business only does sales outside of Canada?

You may be exempt from charging Harmonized Sales Tax (HST), but you must still report your business activities.

Final Thoughts: File Your HST Return with Confidence

Filing your GST/HST return may seem daunting, but with the right tools and preparation, you can file your tax return with ease.

Using CRA My Business Account, the Business Registration Online program, and organized bookkeeping habits makes compliance simple and stress-free.

Whether you file yourself or hire a professional, stay proactive — accurate filing protects your refunds, tax credits, and your relationship with the Canada Revenue Agency.

.png)