Late payments are more than just an annoyance—they’re a silent cash flow killer. Imagine trying to pay your team, manage day-to-day operations, restock inventory, or invest in growth while waiting weeks (or even months) for clients to settle their invoices. Without access to cash reserves, financial stress builds as bills pile up, and suddenly, you’re stuck in a cycle of juggling expenses and chasing payments.

For Canadian business owners, this scenario is all too familiar. Slow accounts receivable (AR) not only disrupts operations but can also affect your financial situation, strain business relationships, and derail progress toward financial goals. But what if there were simple, proven strategies to improve your billing cycle and reduce the amount of money tied up in unpaid invoices? By adopting modern solutions, you can transform AR management into a powerful tool for strong cash flow and financial security.

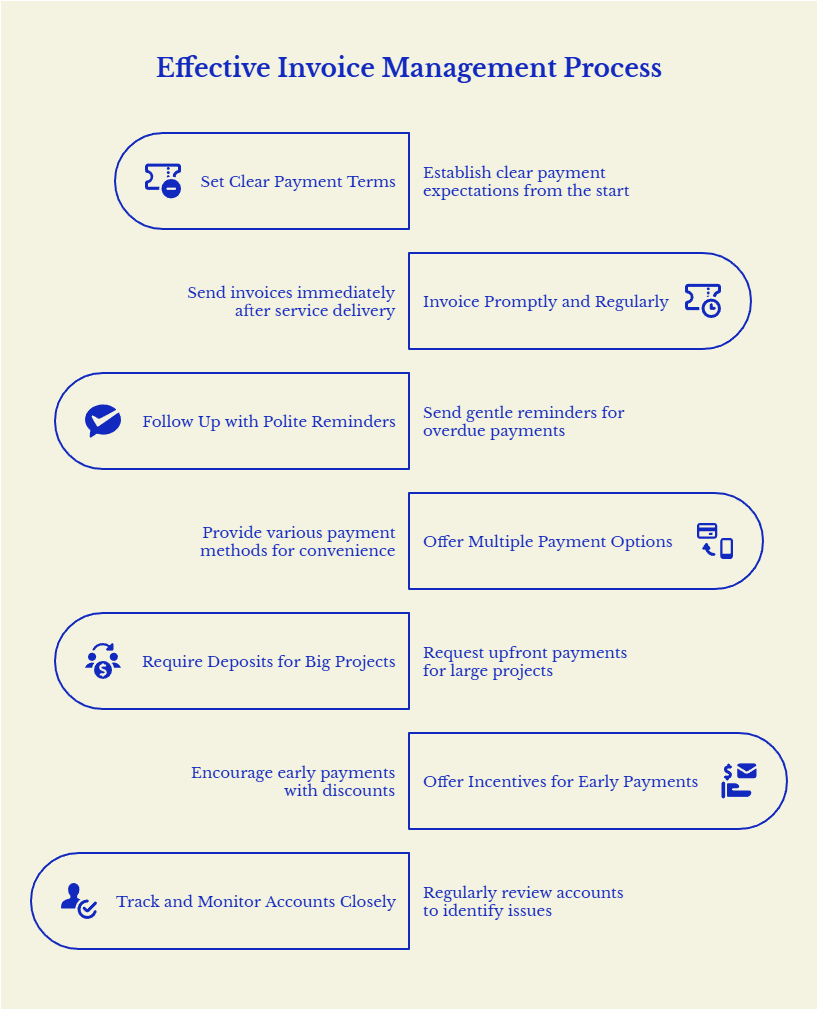

In this blog, we’ll show you 7 actionable tips to collect payments faster, strengthen your cash flow management, and reduce stress so you can focus on growing your business instead of chasing invoices. Let’s get started!

1. Set Clear Payment Terms from Day One

Confusion over payment terms is one of the top reasons invoices go unpaid. Be upfront about your expectations in your contracts by clearly stating:

- Payment deadlines

- Late fees

- Accepted payment methods

💡 Pro Tip: Use Net 15 or Net 30 payment terms instead of longer windows like Net 60 to encourage faster payments. Additionally, ensure your finance team monitors compliance with these terms to maintain visibility into payment statuses.

2. Invoice Promptly and Regularly

Delays in sending invoices lead to delays in payment. If you aren’t prioritizing invoicing, why would your customer prioritize paying? Use agile accounting strategies to streamline the invoicing process. Make invoicing a priority by creating a consistent payment schedule. Ideally, invoices should be sent immediately after a product or service is delivered.

🔗 Bonus Tip: Leverage payment tracking software or advanced analytics tools to automate invoicing and send reminders for overdue payments. These tools also provide accurate cash flow projections to keep you ahead of potential issues.

3. Follow Up with Polite Reminders

Sometimes, clients just need a gentle nudge to pay their overdue invoices. A well-crafted email or a polite phone call can make all the difference in processing eligible payments.

Example Email Template:

Subject: Friendly Reminder: Invoice #1234 Due

Dear [Client's Name],

I hope this email finds you well! I’m reaching out as a friendly reminder that Invoice #1234, dated [Invoice Date], with an amount of [Invoice Amount], was due on [Due Date].

If you’ve already made the payment, thank you! Please disregard this message. If not, we’d appreciate it if you could arrange payment at your earliest convenience. Attached is the invoice for your reference.

Feel free to reach out if you have any questions or need assistance with the payment process. We're here to help! Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

[Your Position]

[Your Company]

[Your Contact Information]

💡Pro Tip: If the invoice remains unpaid after the first reminder, send follow-up calls or another email within a week. Keeping the tone professional and helpful can preserve the client relationship while emphasizing the urgency of payment.

4. Offer Multiple Payment Options

Make it easy for your clients to pay you by offering various payment methods like e-transfers, credit cards, and online payment platforms. Clients appreciate flexibility, and offering more options can also improve conversion rates and reduce churn rate.

5. Require Deposits for Big Projects

For larger projects, asking for a deposit upfront protects your cash flow and reduces the impact of late payments. A 25–50% deposit is common practice and shows clients you’re serious about timely payments.

🚀 Bonus Tip: Tie progress payments to project milestones for long-term work. This approach can act as a debt snowball method for your AR—prioritizing smaller, achievable payments while maintaining momentum.

6. Offer Incentives for Early Payments

Encouraging clients to pay early can improve cash flow and reduce the stress of overdue invoices. By offering small incentives, such as discounts or perks for early payments, you can motivate clients to prioritize settling their invoices.

Example: Offer a 2% discount on the invoice total if the client pays within 10 days instead of waiting until the standard Net 30 deadline.

💡 Pro Tip: Clearly outline these incentives in your payment terms and highlight them in your invoices. This can free up additional cash flow and ensure timely payments. Strong cash flow ensures you’re better prepared for unexpected life events or other financial operations.

7. Track and Monitor Accounts Closely

Staying on top of your accounts receivable is crucial for identifying potential issues that can impact your financial plan. Are certain clients consistently late? Are specific invoices frequently delayed? By identifying these patterns, you can adjust payment terms, request deposits, or focus on freeing up resources for high-priority tasks.

💡Pro Tip: Use the Aging AR Report in QuickBooks Online (QBO) to monitor overdue invoices. Here’s how to access it:

- Log in to QuickBooks Online.

- Navigate to the Reports menu in the left-hand sidebar.

- In the search bar, type "Accounts Receivable Aging Summary" or locate it under the “Who owes you” section.

- Click on the report to view a breakdown of outstanding invoices grouped by aging periods (e.g., current, 1–30 days overdue, 31–60 days overdue, etc.).

- Customize the date range or filters to focus on specific clients or periods as needed.

🔍 Pro Tip: Schedule this report to run weekly or biweekly so you can stay proactive about overdue invoices and avoid cash flow surprises. By regularly reviewing this report, you can develop a solid strategy for reducing unpaid invoices and managing high-interest debt.

Final Thoughts

Managing accounts receivable doesn’t have to be a constant headache. By implementing these tips, you can simplify the process, ensure prompt payment processing, and build peace of mind in your financial management practices. Whether you’re a service business owner or part of a larger team, these strategies can help you focus on growing your business, achieving your savings goals, and creating income for retirement rather than stressing over unpaid invoices.

Remember, strong cash flow is a cornerstone of financial security and an essential part of a comprehensive solution for long-term success.

.png)