As a business owner, keeping track of your finances can feel overwhelming. You’re juggling sales, operations, and growth—all while ensuring your books are in order. That’s where full-cycle accounting comes in. It’s a structured approach that ensures your financial records are accurate, up-to-date, and compliant with regulatory requirements, allowing you to focus on confidently running your business.

What Is Full-Cycle Accounting?

Full-cycle accounting refers to a company's entire accounting process to track, record, and report financial transactions. It includes everything from the initial recording of daily transactions to the preparation of financial statements and the closing of the books at the end of each fiscal period.

This comprehensive accounting process ensures that your business finances are well-managed, tax-ready, and optimized for informed business decisions.

What Does Full-Cycle Accounting Include?

Understanding the cycle accounting process can help you grasp how financial data moves through your business. Here are the key accounting cycle steps that a cycle accounting services firm would usually take care of for you:

1. Transaction Recording

Every business transaction—whether it’s a sale, purchase, accounts payable, or revenue—needs to be accurately recorded in your ledger accounts. This typically includes:

- Supplier invoices and invoice processing

- Bills received from vendors

- Payroll transactions

- Ongoing transactions such as bank deposits and withdrawals

- Temporary accounts related to business expenses

2. Journal Entries & Adjustments

Some transactions require additional work to ensure they are categorized accurately and that you receive the full tax benefits you qualify for. These adjustments are typically made for:

Accruals and Prepayments

- Accruals: These adjustments account for expenses and revenues that have been incurred but not yet recorded.

- Example: Salaries earned by employees in December but not paid until January.

- Example: A company provides consulting services in December but doesn't invoice the client until January.

- Prepayments: These represent payments made in advance for expenses that will be recognized over time.

- Example: An annual software subscription is paid upfront in January, but the service is used throughout the year.

- Example: A business receives a customer deposit for a project that will be completed in a later period.

Depreciation of Assets

- Depreciation adjustments allocate the cost of long-term assets over their useful life.

- Example: A business purchases office furniture that will be used for five years, and a portion of its cost is expensed each year.

- Example: A company buys a delivery van, and its value decreases over time due to wear and tear.

Allowance for Doubtful Accounts

- Adjustments for expected bad debts help businesses anticipate potential losses from customers who may not pay their invoices.

- Example: A business reviews its outstanding receivables and estimates that a percentage of customers will likely default on their payments.

- Example: A customer with a long-overdue balance is confirmed as bankrupt, requiring the removal of their unpaid invoice from accounts receivable.

3. Reconciliation

Regular reconciliation ensures that your records match your unadjusted trial balance report, bank statements, and credit column entries. This step helps identify potential issues, prevent fraud, and keep accounts up to date so the year-end accounting close process is smoother.

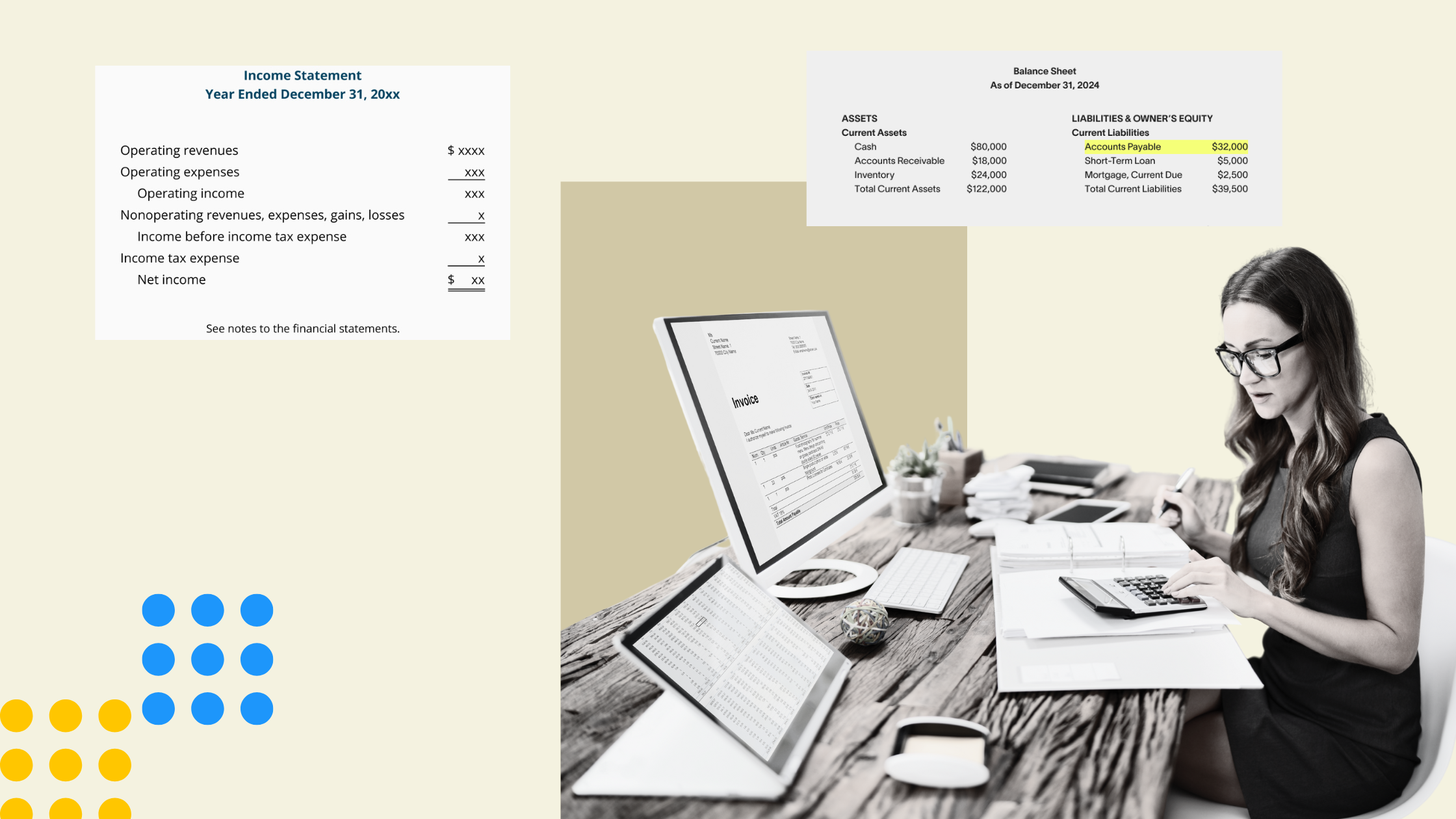

4. Financial Reporting

At the end of each reporting period (monthly, quarterly, or annually), financial statements are prepared, including:

- Income Statement Temporary Accounts (Profit & Loss Statement): This shows revenue and expenses.

- Balance Sheet Accounts: Displays assets, liabilities, and equity.

- Cash Flow Statement: Tracks cash inflows and outflows for better financial management.

5. Tax Compliance & Filing

Tax season is smoother when books are properly maintained throughout the entire process. A full-cycle accountant ensures:

- Sales tax is accurately reported and remitted.

- Corporate income tax filings are prepared.

- Payroll taxes are submitted correctly and on time.

- Cycle accounts payable start with proper documentation.

6. Closing the Books

At the end of the monthly accounting period, the books are closed by ensuring all accounting activities have been recorded, reconciliations are complete, and financial statements are finalized. This process includes:

- Closing entry adjustments

- Post-closing trial balance report generation

- Verification of debit and credit balances

Why Full-Cycle Accounting Matters

A structured accounting control process offers several benefits:

✅ Financial Clarity: Business owners can make informed decisions based on accurate financial reports.

✅ Regulatory Compliance: Avoid penalties by staying on top of public companies' reporting requirements.

✅ Improved Cash Flow Management: Understanding business activity ensures financial stability.

✅ Business Growth: With clear financial insights, businesses can identify opportunities for cost savings and efficiency improvements.

How MESA CPA Can Help

At MESA CPA, we specialize in full-cycle accounts to help business owners save time, reduce stress, and gain a complete picture of their financial health. Our expert accounting department ensures your books are always accurate, reconciled, and tax-ready—so you can focus on growing your business with confidence.

If you’re ready to streamline your finances with accounting automation software, let’s talk!

.png)