The Gift That Keeps on... Taxing?

You want to show appreciation for your team — a holiday bonus, a thoughtful gift, maybe even concert tickets.

But then the creeping thought hits you:

"Will this gift cost them — or me — at tax time?"

Unfortunately, what feels like a kind gesture can quickly become a taxable benefit in the CRA’s (Canada Revenue Agency's) eyes. If you're not careful, you might end up giving your employees a gift and a tax bill.

Let’s break it down simply so you can reward your team without any nasty surprises.

The Problem: Gifting Confusion = CRA Trouble

The CRA has clear—but—tricky rules about what counts as a taxable employment benefit.

Many business owners mistakenly assume that small gifts to employees are just nice gestures.

In reality, the wrong type of gift card, wrong form of payment, or wrong administrative policy could:

- Require payroll deductions from your employee’s income

- Increase your employee's taxable income

- Trigger compliance issues on your corporate tax return

Good intentions can quickly turn into costly mistakes.

The Solution: How to Gift Without the Tax Guilt

Here’s the good news:

The CRA allows some employee gifts to qualify as non-taxable benefits — but you must follow their rules carefully.

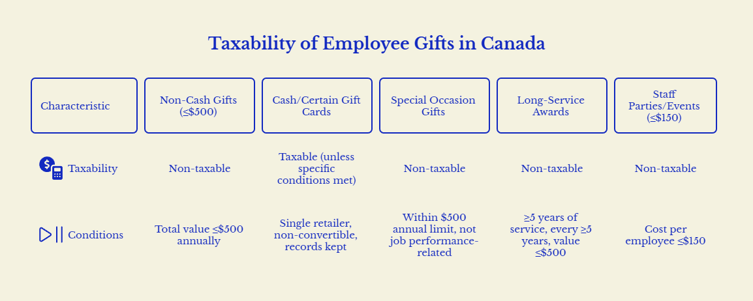

1. Non-Cash Gifts Are Usually Non-Taxable (Up to $500)

Non-cash gifts (like a watch, artwork, or event tickets) are not considered a benefit for employees if:

- Their combined fair market value does not exceed $500 per year

- The gifts are for special occasions (birthdays, holidays, weddings, etc.)

✅ Unlimited number of non-cash gifts

✅ Total value under $500 = non-taxable benefit

If the value goes over $500, only the excess amount is taxable.

Important: This applies only to arm’s-length employees (not family members or relatives in your business).

2. Cash and Gift Certificates Are (Usually) Taxable

Cash benefits and electronic gift cards that are redeemable broadly (e.g., Visa prepaid cards, digital currencies) are considered taxable income.

However, there’s a twist since 2022:

- A gift card usable only at a single store (like Amazon.ca) may be considered a non-cash benefit if proper records are kept.

Generic prepaid credit cards are still 100% taxable employment benefits.

When in doubt, assume gift cards are taxable unless CRA conditions are met.

3. Gifts for Special Occasions Are Non-Taxable (Within Limits)

Recognizing personal milestones? Good news:

- Religious holidays, birthdays, retirements, or weddings can qualify for non-taxable benefits.

- As long as total non-cash benefits stay under the $500 threshold, no tax issues arise.

Awards tied to outstanding service or sales targets are always taxable because they are considered recognition of job performance.

4. Over $500? Only the Excess Gets Taxed

If total non-cash gifts exceed $500 per year:

- Only the portion above $500 is considered a taxable benefit.

Example:

- $550 worth of gifts = $50 added to the employee’s employment income for income tax purposes.

5. Long-Service Awards: Different Rules

A long-service award (like a 5th anniversary) is non-taxable if:

- It recognizes five or more years of service

- It’s given no more frequently than every 5 years

- Its cost does not exceed $500

Follow the long-service awards policy carefully to avoid unintended taxable employment benefits.

6. Staff Parties and Social Events: Mind the $150 Limit

Hosting an event like a holiday party or virtual event?

- Reasonable expenses (party, meals, transportation expenses) are non-taxable if the cost per employee is $150 or less (including transportation and accommodation).

- If you exceed $150, the full amount becomes a taxable benefit.

This includes hospitality functions, social committees' events, and entertainment costs.

Bonus: Trivial Perks Are Always Non-Taxable 🎁

Small, low-cost items (de minimis benefits) like:

- Coffee mugs

- T-shirts

- Snacks

are not counted toward the $500 limit — no need for reporting, no impact on business income, no added Form 2848 or payroll paperwork!

3 Quick Questions to Avoid Gift Tax Mistakes:

✅ Is the type of gift non-cash and non-convertible to cash?

✅ Is the total value under $500 this year?

✅ Is it for a special occasion, not job performance?

If yes — you’re likely in the clear!

Real-World Example: Avoiding Gift Tax Traps

You give your employee:

- A $300 smartwatch (birthday)

- A $150 crystal plaque (5th anniversary)

✅ Total = $450, non-taxable benefit!

But then you add:

- A $100 prepaid Mastercard ➔ ❗ taxable benefit

Proper documentation about the type of gift card and the value is key.

Final Thoughts: Give Smarter, Not Harder

Employee gifts are a fantastic way to boost morale, strengthen teams, and show appreciation. But a misunderstood gift could trigger unwanted income tax, deductions, or worse — a CRA audit.

✅ Stick to non-cash gifts wherever possible

✅ Understand CRA's evolving rules for electronic gift cards

✅ Maintain detailed records for a form of remuneration and gift expense tracking

Smart planning ensures your gifts to employees create smiles — not compliance problems.

.png)