Are You Leaving Money on the Table? Here’s How to Get Up to $2,000 Per Apprentice

As a small business owner in Canada, you already know how expensive hiring and training new employees can be. But what if the federal government was willing to help cover some of those costs—would you take advantage?

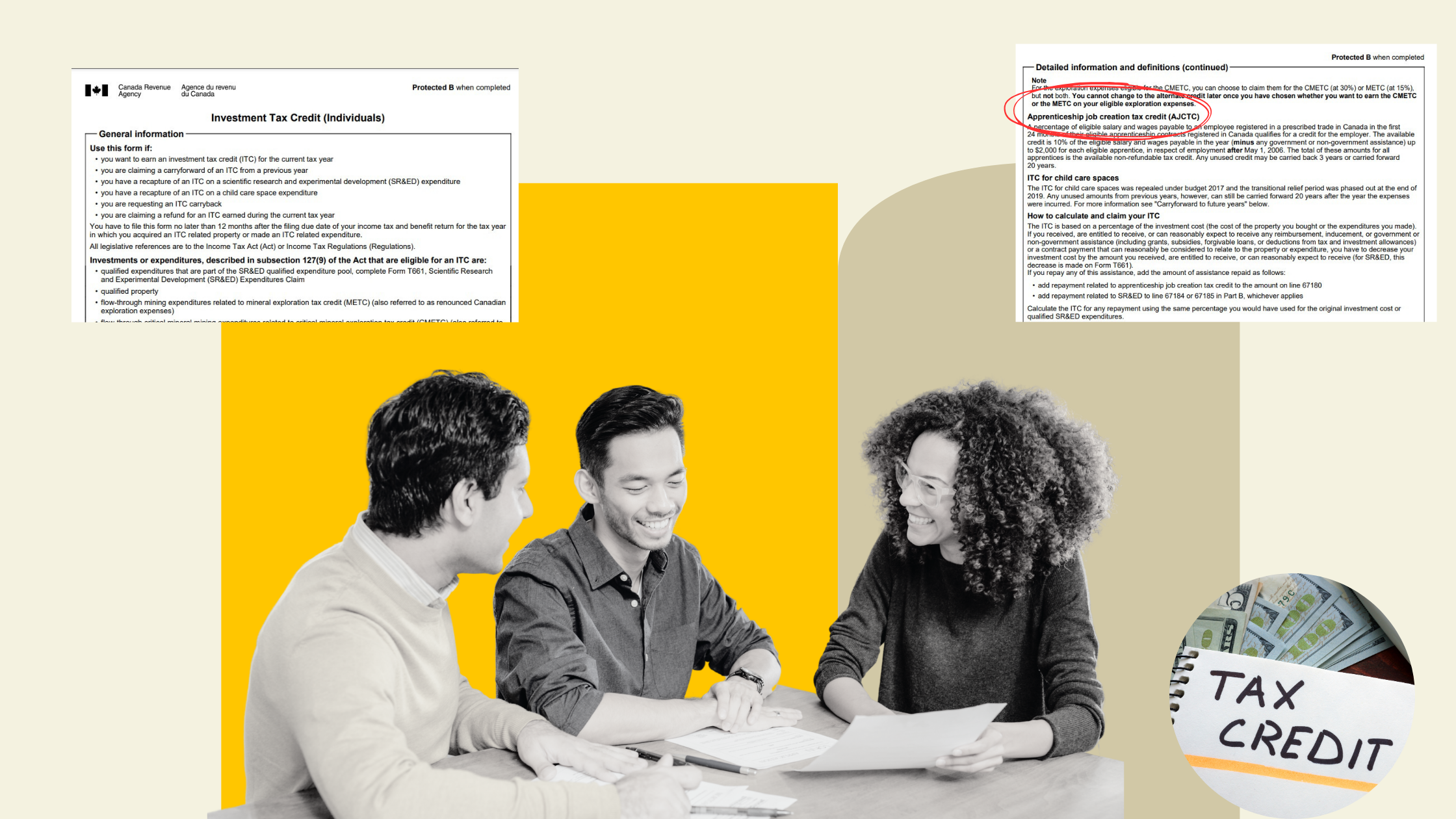

Many skilled trades employers miss out on thousands of dollars in non-refundable tax credits simply because they don’t know about them or don’t understand how to claim them. If you employ or are considering hiring eligible apprentices, the Apprenticeship Job Creation Tax Credit (AJCTC) can provide up to $2,000 per apprentice per year. This non-refundable investment tax credit helps reduce your income tax return burden while supporting the growth of trades in Canada.

Don’t let this opportunity slip through your fingers. Here’s everything you need to know to claim your credit and maximize your savings.

What is the Apprenticeship Job Creation Tax Credit?

The AJCTC is a non-refundable credit for employers hiring apprentices in respect of employment in designated trades. Eligible employers can claim 10% of the wages paid to qualifying apprentices, up to a maximum credit of $2,000 per apprentice per year.

This tax credit completion tax program supports the development of skilled employees while providing financial support for businesses investing in employee training. Even better, unused credits for employers can be carried back three years or forward 20 years, ensuring access to tax credits when needed.

Who is Eligible?

Your business may be eligible for the AJCTC if:

- You employ apprentices registered in a Red Seal trade.

The Red Seal Program standardizes trades across Canada, ensuring that certified tradespeople meet consistent national standards. As of now, there are 54 designated Red Seal trades, including :

Construction Trades:

-

- Carpenter

- Bricklayer

- Construction Electrician

- Plumber

Industrial/Manufacturing Trades:

-

- Industrial Mechanic

- Machinist

- Welder

Motive Power Trades:

-

- Heavy Duty Equipment Technician

- Truck and Transport Mechanic

- Automotive Service Technician

Service Trades:

-

- Cook

- Hairstylist

- Landscape Horticulturist

- The apprentice is working toward trade certification under an eligible training program approved by provincial or territorial governments.

- Your business is subject to Canadian income tax (including corporations, sole proprietors, and partnerships).

-png-1.png?width=698&height=485&name=_-%20visual%20selection%20(2)-png-1.png)

📌 Important: If multiple related employers hire the same apprentice, special rules apply to ensure that the $2,000 annual tax credit level is not claimed multiple times for the same apprentice.

How to Claim the Credit

-png.png?width=698&height=626&name=_-%20visual%20selection%20(3)-png.png)

Claiming the AJCTC is a straightforward process, but proper required documentation is crucial. Follow these steps:

Hire and Register the Apprentice

✅ Ensure the apprentice is enrolled in an eligible apprentice program under a provincial or territorial apprenticeship program.

✅ Maintain records proving certification tax credit completion requirements have been met.

Track Eligible Wages

✅ The basic tax credit applies to the first two years of an apprentice’s employment.

✅ Maintain payroll records detailing employment income, taxable benefits, and proof of entitlement to the credit.

File Your Tax Return

✅ Use Form T2038 (IND) for individuals or Schedule 31 (T2) for corporations to claim the AJCTC.

✅ Submit the form with your business’s annual tax return before the strict deadline.

Additional Benefits & Stacking Credits

While the AJCTC is a federal apprenticeship tax credit, some provinces offer their alternative support measures, such as:

- British Columbia Training Tax Credit – Includes enhanced tax credit amounts for persons with disabilities and other eligible persons.

- Ontario Apprenticeship Training Tax Credit – Provides additional financial support for eligible training programs.

- Alberta Apprenticeship Job Creation Incentive – Covers a portion of eligible apprentice wages.

These credits for employers hiring apprentices may be combined with the AJCTC to further reduce training costs. Some programs even offer completion credits based on work-based hours. For example, non-Red Seal program completion credit may be available for apprentices completing required work-based hours, such as 1,800 work-based hours or 5,400 work-based hours.

Why Your Small Business Should Take Advantage of the AJCTC

Hiring apprentices not only helps fill labor shortages but also ensures that your employees are trained according to your company’s needs. The AJCTC and similar credits, such as the completion training tax credit and investment tax credit, reduce the financial burden, making it easier for businesses to invest in workforce development.

By leveraging this credit per level completed, you can save money, develop a skilled team, and contribute to the growth of trades in Canada. Programs like Mentor Development Programs and Careers in Trades further support businesses training employees in high-demand trades.

Final Thoughts

The Apprenticeship Job Creation Tax Credit is a valuable opportunity to invest in skilled labor while lowering your tax burden. Even if you don’t use the credit immediately, you can carry it forward for up to 20 years!

💡 Have questions about tax credit claims or program eligibility? Contact MESA CPA today or reach out to the Canada Revenue Agency for guidance. You can also email ITBTaxQuestions@gov.bc.ca for questions about program eligibility, tax credit completion tax amounts, or the federal incentive program.

📌 Don’t leave money on the table! Ensure you're maximizing your tax credits and taking full advantage of all available financial supports for your business.

Contact us to learn more about using the Apprentice Job Creation Tax Credit.

.png)