One of the biggest questions business owners have when considering professional accounting services is: How much does an accountant charge? The answer depends on several factors, including the type of services you need, the complexity of your financial transactions, and how often you require assistance.

Accounting services for a small business can range from $250-$500/hour and $450-$2000/month.

In this guide, we’ll discuss the costs of hiring a Chartered Professional Accountant (CPA) and what you should expect to pay for different services.

Factors That Affect Accounting Fees

The cost of hiring a professional accountant can vary based on:

- Services Required – Are you seeking basic financial accounting, tax accounting, managerial accounting, or full-service financial management?

- Business Size & Complexity – A solo entrepreneur with simple accounting records will pay much less than larger companies with complex financial activities.

- Billing Structure – Some accountants charge by the hour, while others offer fixed pricing or monthly retainers.

- Location – Accounting rates can vary depending on the region and cost of living in that area.

- Expertise & Experience – A public accountant may charge less, whereas an experienced financial analyst or tax expert typically commands higher rates.

Common Accounting Fees by Service Type

1. Bookkeeping Services

- What it includes: Organizing accounting records, recording journal entries, reconciling bank accounts, and tracking expenses. This also includes preparing income statements, cash flow statements, and financial statements to assess financial health.

- Cost: $450 – $1,500/month, depending on transaction volume and complexity.

2. Tax Preparation & Filing

- What it Includes: Preparing and filing annual tax returns for businesses and individuals, ensuring compliance with CRA regulations.

- Cost: $500 – $5,000+, depending on business transactions and tax complexity.

3. Payroll Processing

- What it includes: Managing employee salaries, tax deductions, and compliance with employee benefit plans.

- Cost: $50 – $250/month + per-employee fees.

- Hack: You can use business accounting software like WagePoint to do this instead and keep costs low.

4. CFO & Advisory Services

- What it includes: Strategic financial planning, business analytics, cost accounting, and growth planning.

- Cost: $2,000 – $10,000/month for fractional CFO services.

How Do Accountants Charge for Their Services?

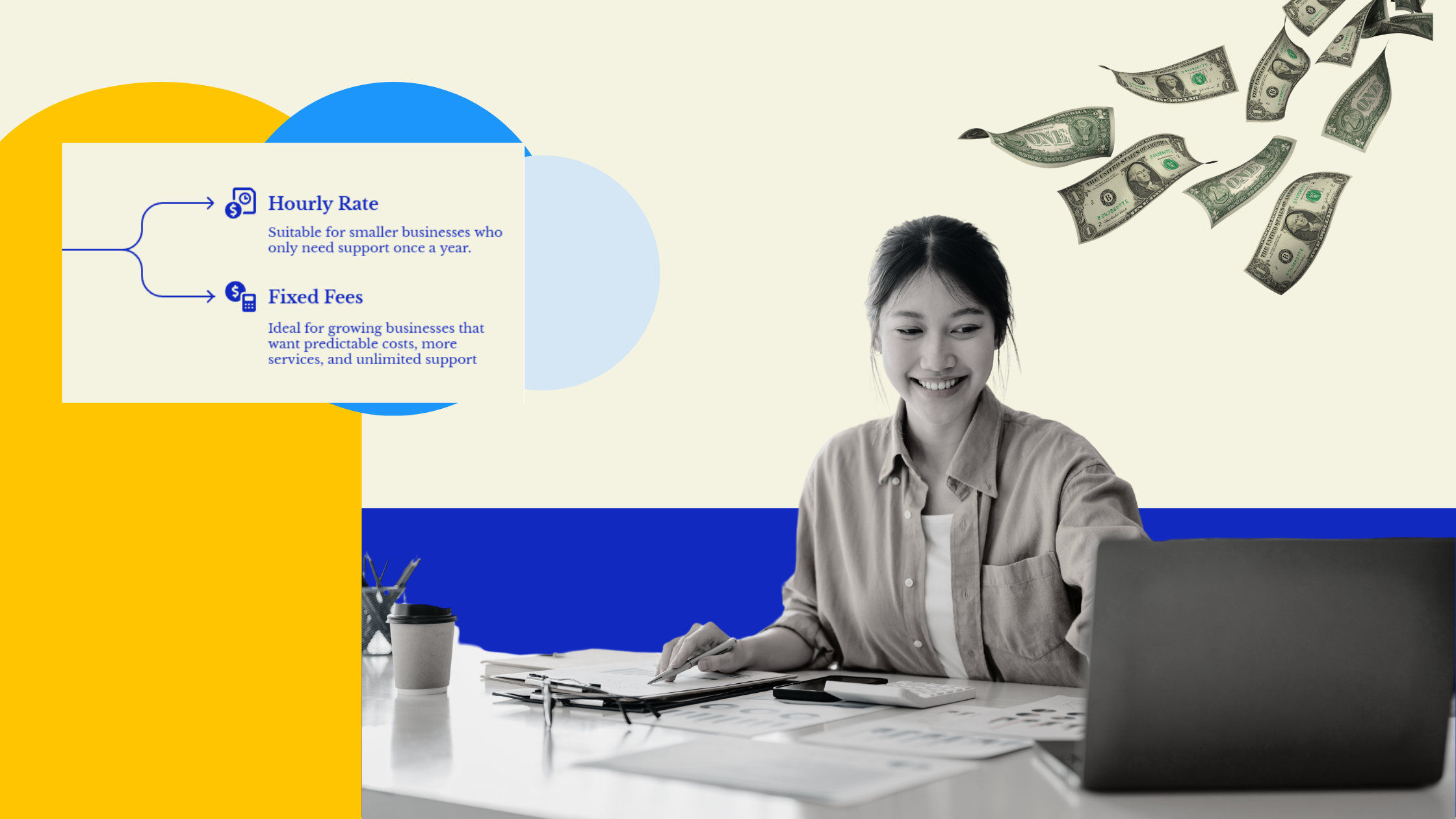

Accountants typically use one of these pricing structures:

- Hourly Rate: $250 – $500 per hour, depending on expertise.

- Fixed Fees: Set monthly prices for a group of services like financial accounting, tax filings, and support.

For growing businesses, a monthly fixed-fee accounting package is often the best choice. It ensures predictable costs while covering essential financial needs.

How Much Should Your Business Budget for Accounting?

A good rule of thumb: Expect to spend 1-3% of your annual revenue on accounting services.

For example:

- A business earning $500,000/year might spend $5,000 – $15,000 annually on accounting.

- A business making $2M/year may invest $20,000 – $60,000 for full financial support.

Investing in management accountants isn’t just about compliance—it helps you make better business decisions, avoid costly mistakes, and grow profitably.

Final Thoughts: What’s the Right Accounting Service for You?

The cost of an accountant varies widely, but what’s most important is finding a service that matches your needs and budget.

If you’re a business owner looking for responsive, full-service accounting with fixed pricing, MESA CPA can help. We handle basic accounting, double-entry accounting, statements of cash flows, and financial strategy so you can focus on growing your business.

.png)