Sole Proprietorship to Corporation: What You Need to Know

Learn the pros and cons of transitioning from a sole proprietorship to a corporation, including liability protection, tax...

OUR BLOG

Add a little bit of spice to your inbox.

.png)

January 02, 2026

Learn the pros and cons of transitioning from a sole proprietorship to a corporation, including liability protection, tax...

December 31, 2025

Learn how a structured QuickBooks Online workflow helps business owners avoid common mistakes and keep books accurate and...

December 29, 2025

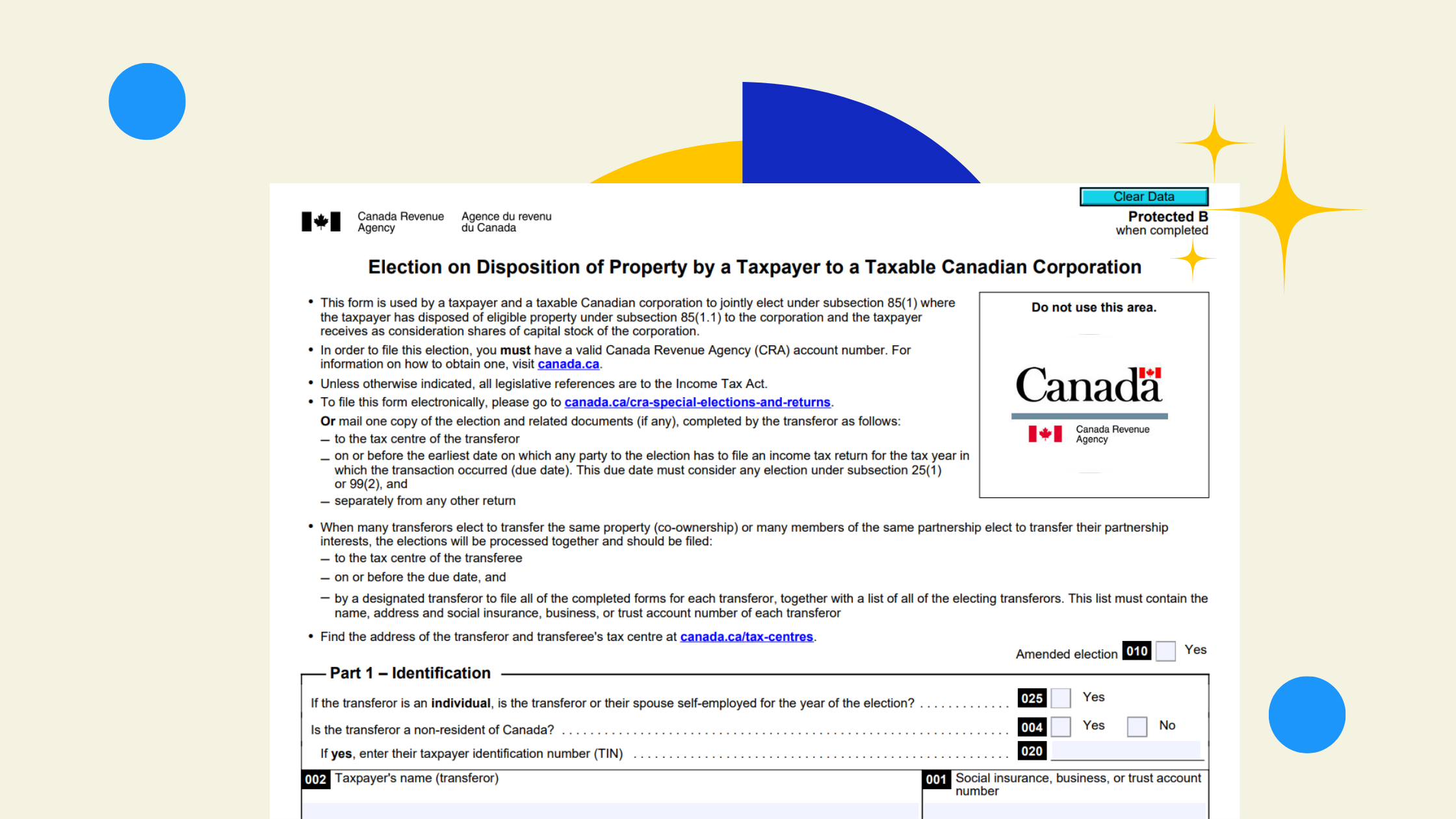

Learn how Section 85 rollover allows Canadian business owners to transfer assets to a corporation without immediate tax...

-1.png)

December 26, 2025

Learn the risks of putting your car in the company, from tax to insurance considerations, and discover when it makes sense for...

-1.png)

December 24, 2025

Learn why clinging to Excel for bookkeeping can hinder growth, increase errors, and limit efficiency, and how modern accounting...

December 22, 2025

Discover what bookkeeping services include: transaction recording, categorizing income and expenses, reconciliation, accounts...

.png)

December 19, 2025

Learn how dividend income is taxed in Canada, including differences between eligible and noneligible dividends, and how to...

.png)

December 18, 2025

Learn how to set up QuickBooks Online for your eCommerce business to streamline accounting, manage inventory, and ensure tax...

December 12, 2025

Discover when it's time to hire a bookkeeper to transform your financial management, improve accuracy, and free up your valuable...

December 10, 2025

Understand the crucial differences between cash flow and profit to make smarter financial decisions and avoid common pitfalls for...